I’m an October defender.

But only in odd-numbered years.

You see, the month often stands out in investors’ minds as a particularly dangerous one.

And that’s not without reason.

A half dozen of the worst declines in market history have unfolded in the bewitching month.

There were two catastrophic “Black Mondays” in October, one in 1929 and the other in 1987. Not to mention the fright of “Black Tuesday” and “Black Thursday” in the month.

We also have the infamous October 2008 when the S&P 500 collapsed 17% as the global financial system gave way.

But here’s the reality…

Statistically, October is one of the best months for stocks.

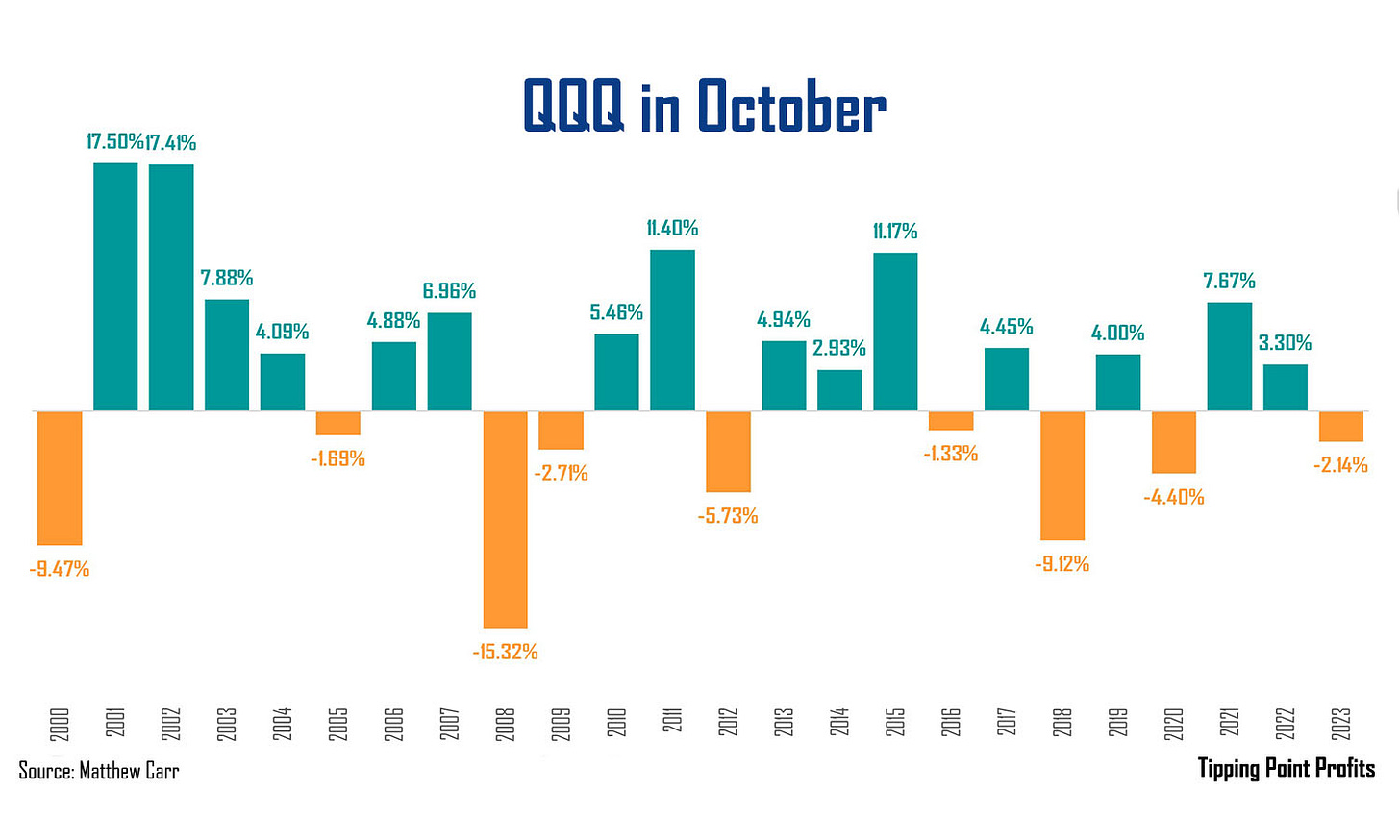

Since 2000 – which spans the release of four installments of the Halloween movie franchise – the Nasdaq 100 has weathered October fairly well.

In fact, during that stretch, the Invesco QQQ ETF (QQQ) has only ended the month lower nine times…

That’s a success rate of 62.5%.

Now, that may not sound like a sure thing. And it isn’t. But it does represent a tremendously strong opportunity for gains. Especially when you understand the nuances at play.

For instance, the only months with better success rates for the Qs than October are July and November.

But there’s a particularly important element to understand about volatility and October…

That’s about what unfolds in election years.

Election Year Blues

Since this is an election year, there’s an asterisk for October returns.

Betting on a rally in equities during mid-term and presidential election years in October is extremely dangerous.

In fact, my near-automatic recommendation in October with these catalysts on the horizon is to protect your portfolio with puts or inverse ETFs. The data here is pretty definitive for the Nasdaq 100…

Only three of the QQQ’s losses in October over the last two decades-plus weren’t U.S. presidential election years – 2005, 2009 and 2018.

On top of that, we’ve seen drops on the Dow Jones Industrial Average in the month in 1992, 2004, 2008, 2012, 2016, 2018 and 2020.

That’s practically every U.S. Presidential election year in the past three decades!

And of the last 10 drops on the Dow in October, seven have occurred during mid-term or presidential election years.

There’s a tremendous amount of anxiety before Election Day in November. And that uncertainty – as the political divide has widened – has been on the rise in recent years.

But there’s one other thing we must keep in mind. An American tradition that goes back centuries…

The “October Surprise” Surprise

Election years in the U.S. are full of drama.

The campaigns are long and expensive. The rhetoric is divisive… becoming even more so over the past two decades.

And we know most years a bombshell will drop. One that will suddenly turn the tide in the election. This event even has its own name… The October Surprise.

For more than 200 years, it’s been a tradition in American politics.

From a fake letter published by The New York Truth in October 1880 by Republican candidate James Garfield to the assassination attempt of Theodore Roosevelt on October 14, 1912, to the indictment of former Defense Secretary Casper Weinberger in October 1992, to the release of the “Trump Tapes” AND the announcement of an investigation into Hillary Clinton in 2016.

These moved markets.

Every U.S. presidential election year, we know there’s going to be drama.

And it’s either going to be self-inflicted, opposition planned or an act of Mother Nature (like Super Storm Sandy in October 2012 turning the tide of the election).

Well, in 2024, there’s a question of how much more drama can we take?

I mean, already the incumbent candidate has stepped down. And there has been not one, but two assassination attempts on the former president running for re-election.

All of this occurred months earlier than October.

I’m not sure what “October Surprise” is in store this year. But if there is one, the upside is, I don’t think it can be more dramatic than what we’ve already seen.

There are only 35 days until Americans head to the ballot boxes in November.

I’ve been more cautious the last couple of months than I’m normally known for. That’s simply due to the trends we see in election years. But I’ll also admit, that we’ve witnessed the 16-year tech trend in July come to an end, as well as the “September Swoon” fizzle out.

It’s possible there’s no “October Surprise” and the markets truck along without an any anxiety toward election day. And I’ll be fine with that. But I also believe in knowing the trends and adding some portfolio protection just in case there’s one last moment of mayhem before November.

Waiting for the storm to pass, but keeping an umbrella handy,

Matthew

Diversification and patience are my only hedges. Who wouldn't love a good washout?

Hey Matthew. Always enjoy your words of wisdom. Miss your recommendations. Hope all is well