“Imitation is the sincerest form of flattery.”

That’s the Oscar Wilde quote that the unimaginative love to lean on.

But too often we forget the full quote is: “Imitation is the sincerest form of flattery mediocrity can pay to greatness.”

It’s one of Wilde’s finely crafted insults to the copycats, wannabes, and plagiarists.

Now, throughout my career, several have tried to imitate my strategies. Some, obviously, more blatantly than others (as the current faux cycle/trend strategist du jour is doing). But they can’t replicate the success. That’s because they don’t understand how the trading style actually functions... They haven’t spent decades building the systems.

So, buyer beware.

But the one thing these wannabes give by mimicking me - nearly word for word! - is credence to the knowledge and expertise I’ve cultivated and share here.

And of course, some trends are so clear that even the fakes can spot them (or read about them in these pages).

Let’s take July for example…

As I’ve often said, it is one of my favorite months of the year.

Not because it's National Ice Cream Month or National Hot Dog Month.

But because, as a trend investor and strategist, July is arguably the most perfect-est month there is.

16-for-16

You’ve heard me say it (and write it) time and time again: “The trend is your friend.”

And that I’m always on the lookout for the friendliest of trends. To identify those tipping point moments for profits.

Well, there’s are no friendlier month for tech stocks (and Bitcoin) than July!

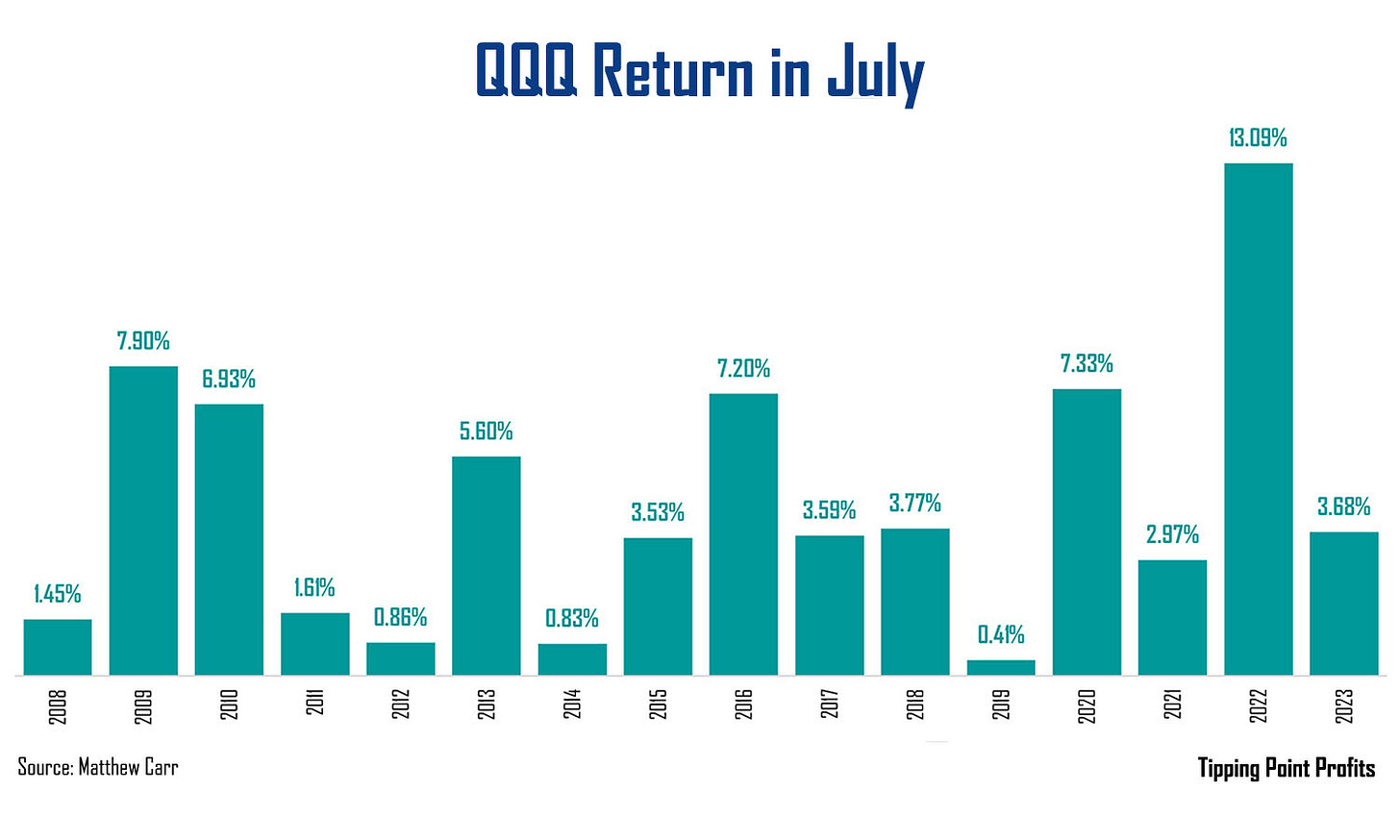

In fact, the last time the Invesco QQQ ETF (QQQ) ended July with a loss, George W. Bush was president…

That’s a 100% success rate over not five years… or 10 years… but the past 16 years. And the QQQ offers a 75% chance of a gain in the month since 2000.

No other month on the calendar sports such consistency… not even close.

You’ve heard me write here that, there is no Summer Lull in tech. And July is the tentpole.

Because the reality is, the QQQ has gained in July during a global financial crisis… It gained during a downgrade of U.S. debt… It moved higher despite a European debt crisis, multiple trade wars with China, a global pandemic, and the Federal Reserve hiking rates at the fastest pace in decades.

None of that mattered... at least not in July.

But once again, this is no ordinary year. This is a U.S. Presidential Election year! And we just suffered through one of the most embarrassing televised debates ever.

So, let’s take a closer look at this trend inside a trend…

A Presidential Bid

Obviously, tech has had some infamous issues in the past.

The start of the millennium was a trying period after the dot-com bubble burst.

And some are wondering if we’re about to see history repeat itself once again with the artificial intelligence boom.

Now, we know that the Nasdaq collapsed into bear markets during the financial crisis, the pandemic, as well as the bear market in 2022.

And the QQQ suffered sizable losses in June, August, and September over the past couple of decades.

But regardless of the financial and political climate, July has been a shelter from the storms.

Yes, even during election years…

We can see that tech stocks haven’t tumbled in this month during an election year since 2004. That’s four consecutive election years of gains. And includes the terms of George W. Bush, Barack Obama, Donald Trump, and Joe Biden… two Democrats and two Republicans.

Over the last 16 years, the average gain of the QQQ in July is 4.42%. But that average during election years comes down to 0.86%. Though, we do see 7%+ gains in the last two elections.

So, keep in mind, July is not only a month for summer fun… It’s also home to one of the friendliest trends for tech.

If you can, look to take advantage of dips. And feel secure knowing that the QQQ has ended this month higher for 16 consecutive years… a streak unparalleled on any calendar. Mine or those desperate to copy me.

May karma always be in your favor,

Matthew

When Matt talks, I listen.