August has been a hot one for tech.

The Nasdaq has stampeded 11% higher from its August 5 lows.

The Invesco QQQ ETF (ETF) topped $480 once again.

And the mid-July pullback that had so many investors around the globe chewing on their fingernails is all but forgotten.

Last month’s lackluster jobs report has been usurped by fresh rounds of resiliency, and markets have been further buoyed by the Federal Reserve telegraphing that a time for a policy shift has arrived.

It appears we have nothing but blue skies ahead. Particularly, as we race headlong to the all-important holiday shopping season.

But I’m here to warn of some possible torrential rains… as this is the bull trap we too often see.

The Election Year Fool’s Rally

Since 2000, Triple-Qs - the proxy for the Nasdaq 100 - is averaging a 0.59% gain in August. That earns it the title of the sixth-best month for tech…. or dead center, middle of the pack.

And large-cap tech has ended August in the red 11 times over the past 24 years. That translates to a 54% success rate.

But here’s the deal… in U.S. presidential election years, August can trick investors into falling into a deadly trap…

Now, as I always say, “There’s never a summer lull in tech.” And this is true even in election years.

I’ve previously written that July is traditionally one of the strongest months for tech. Until this year, the QQQ ended the month with a gain for 16 consecutive years. Well, what we see in election years is that historic July strength tends to be followed by what I call a “fool’s rally” in August…

Big tech is averaging a 4.7% gain in the month during U.S. presidential election years.

In August 2020, we saw the QQQ surge 10%... 4.4% in 2012… and even 13% in 2000…

At the moment, the QQQ is up roughly 1.4% in the month. But has charged double digits from its early month lows.

But let’s focus on what tends to follow.

Because all those gains – and those from the months before – are often brutally wiped out.

Tech’s Cold Front

Every rally comes to an end.

And quite often, not with a whimper, but the sound of crunching metal and shattered glass.

There’s a rhythm to life.

And there’s a rhythm to the markets as well.

For investors, the downbeat is September.

It goes by many names.

The September Swoon… the September Spoiler… the September Sell-Off… the September Effect…

But they all mean the same thing… September is the worst month for stocks.

And not just for sectors like tech, but also cryptocurrencies.

The data speaks for itself. So, I’ll let it have the floor…

The QQQ has ended the month of September lower six out of the last seven years. Not to mention four consecutive years where the Nasdaq has tumbled 5.8% or more in the month.

And it’s averaging a 2.56% loss in the month since 2000.

That’s by far the worst month of the year for tech.

There’s nothing on the calendar as remotely precarious.

Tech’s summer run comes swiftly to an end with September’s cold front.

A Spoiler? A Swoon? An Opportunity?

September has rightfully earned a reputation for being a month full of declines.

And most years that’s fine.

That’s because typically two of the best months for tech – October and November – are on the horizon.

So, September can be a time to start compiling your wish list. To think of that September selloff as an early holiday present to yourself. Because it’s the perfect opportunity to add shares of great companies at a discount.

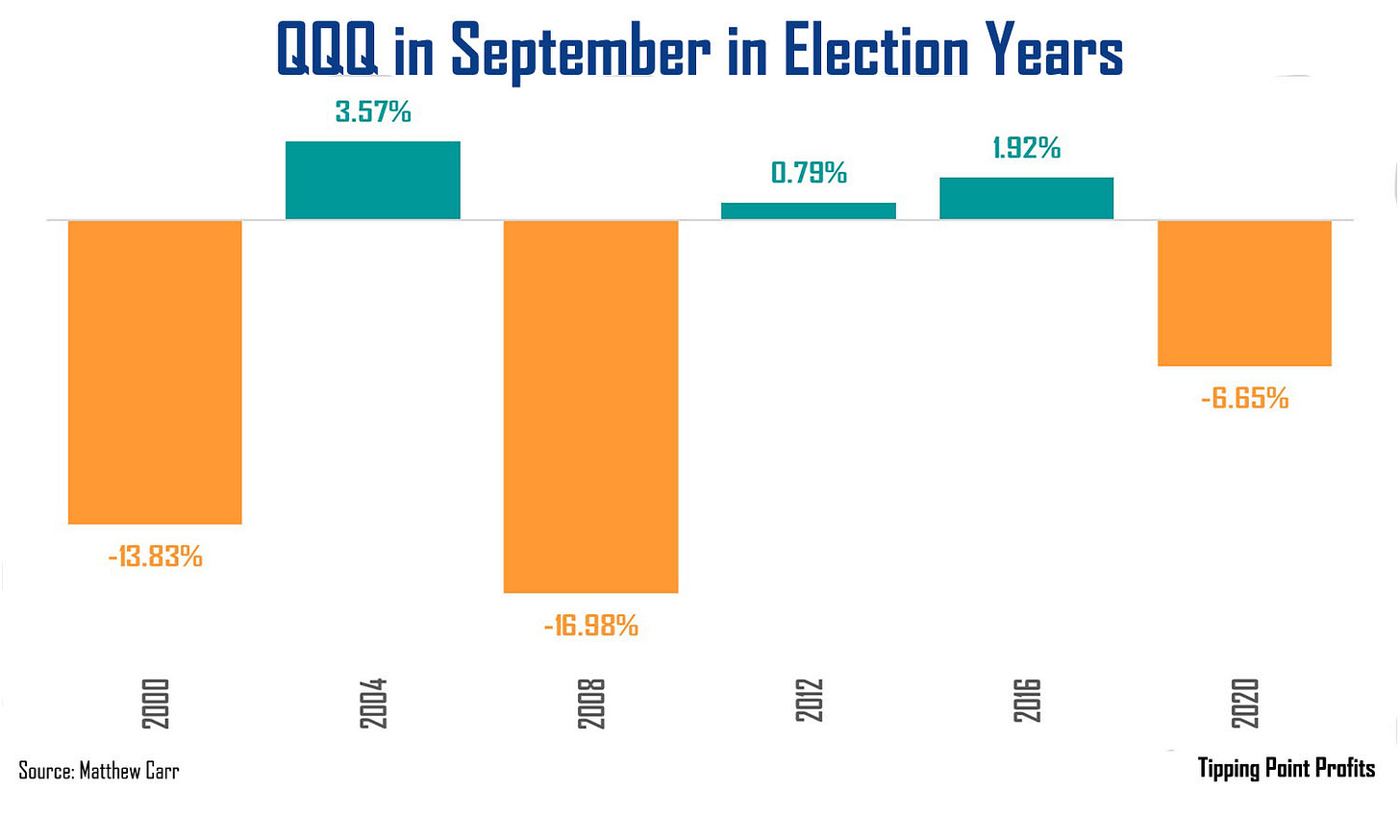

But in U.S. presidential election years, big tech tends to fall hard during the month…

The QQQ is averaging a loss of more than 5% in September during these years.

The reason?

Tensions in the U.S. are heightened as we get closer to election day in November. And fears start to creep in.

But worst of all, that September’s sprung leak is only the beginning…

You see, the QQQ has ended October lower in five of the last six U.S. presidential election years. And is averaging a loss of 5.36% during the month!

Historically, we’re almost guaranteed another correction in tech between now and Election Day.

Now, we could argue that the U.S. presidential election year selloff has already taken place from mid-July to the early days of August. And that could be true.

But I’d also keep wary because these losses in September and October are consistent.

In fact, when the QQQ rallies hard in August during U.S. presidential election years, it’s been a surefire signal to load up on puts. These will be cheap… but that works in our favor!

So, use any August rally as a time to tighten trailing and hard stops, and prepare to buckle up. Summer’s end is swift. Soon September will be here. And its a month of red.

Prepping now for Summer’s end,

Matthew

Thanks Matt, very useful information! question - given all the data you shared above, historically how does the rate cuts effecting the market /QQQ this month