Well, one of the great streaks on Wall Street has finally ended…

For the first time since 2007, the Invesco QQQ ETF (QQQ) closed the month of July with a loss.

That shut the books on a 16-year streak of wins for tech in the month.

But the pullback wasn’t universal.

Sure, marquee names like Alphabet (GOOGL), Amazon (AMZN) and Netflix (NFLX) struggled in July.

They weren’t the problem though. Semiconductors were responsible for much of the damage. Fears over the future of artificial intelligence (AI) and our robot overlords weighed on the crowded trade, mixed with some geopolitical unease over whether the U.S. would lend a hand if Taiwan were invaded by China at some unspecified date in the future.

But it wasn’t all bad news for tech. In fact, the next member of the “Magnificent 7” to report earnings tonight kept its streak alive in July… But will it continue?

The July Stronghold Holds

Back in May, I wrote there’s only one time of the year when no one wants Apple (AAPL) products… And that’s the summer.

Despite the high temperatures, it's an annual chilly stretch for the iPhone maker.

Now, consumers have money burning holes in their pockets. But they’re splurging on vacations, cruises, food, drink, and tickets to see Taylor Swift or Deadpool and Wolverine.

They’re not dishing out hundreds of dollars for the latest piece of tech.

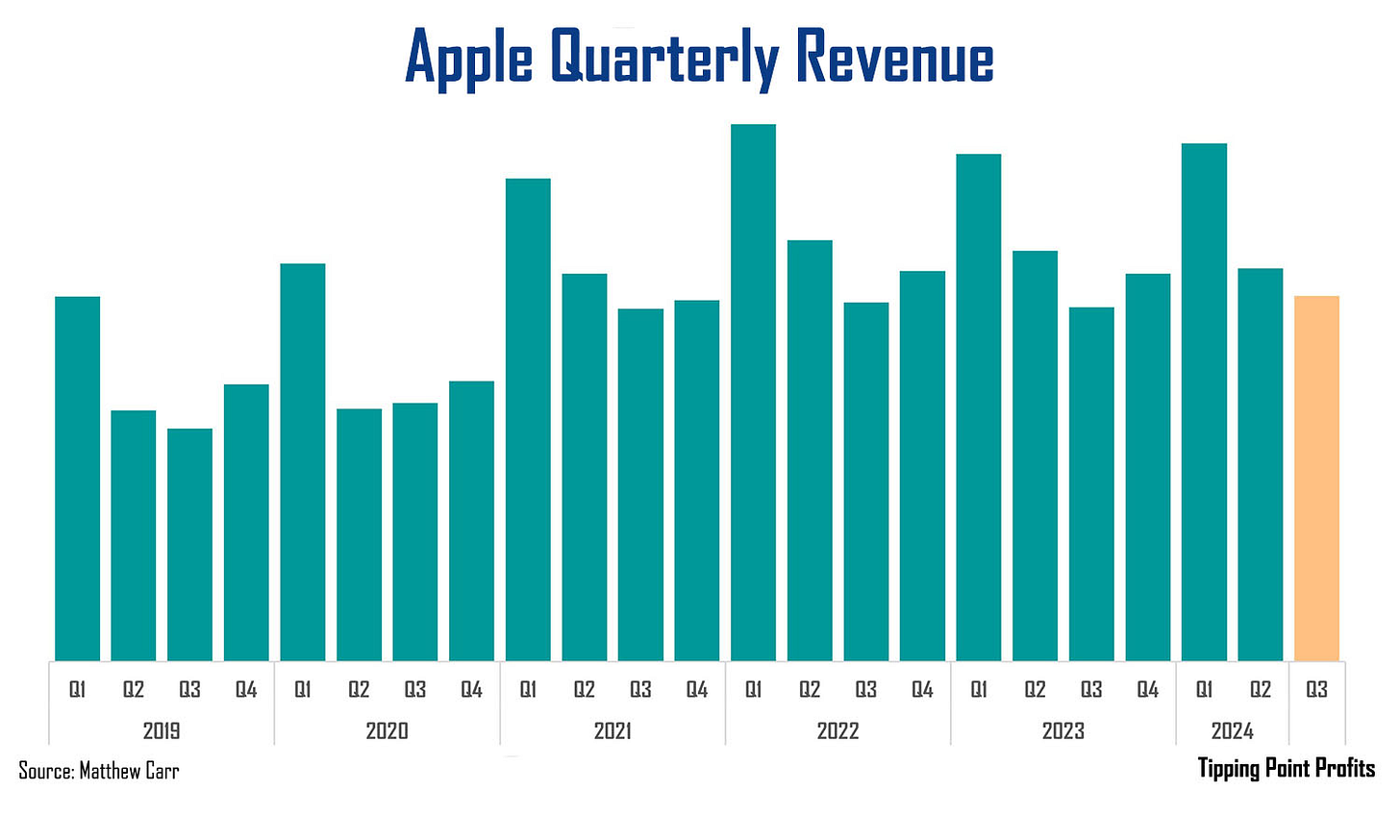

If we take a peek at Apple’s quarterly revenue, we see that telltale “sawtooth” pattern…

Each year, the tech giant’s busiest stretch of the year is its fiscal first quarter, which includes the holiday shopping season. In its fiscal year second quarter, we see a step down in terms of sales.

For example, in the first quarter, Apple reported $119.6 billion in revenue. In the second quarter, this slowed to $90.8 billion. And we can see for its fiscal year third quarter – which the company reports after the bell tonight – sales are projected to slide even further.

This quarter is always its worst quarter of the year for sales! But more on that in a moment…

What’s important to understand is that even though Apple faces these fundamental headwinds, shares tend to weather the summer storms quite well.

For instance, Apple shares have put together three straight months of gains. And the iPhone maker shares ended July with a 4.7% gain… They’re ninth consecutive gain in the month, and their 20th in the past 22 years.

Up ahead, we have August. And since 1985, this has been the second-best month of the year for shares.

With that in mind, let’s dive into what to expect from earnings…

When Worst is Best

When I talk about “sawtooth” patterns in revenue, it’s key to understand that a company’s worst quarter for sales doesn’t mean it’s the worst quarter for shares.

In many cases, the opposite is true.

And Apple is a perfect example.

Wall Street is looking for the iPhone maker to report $84.4 billion in revenue with earnings of $1.35 per share. As I mentioned above, this is a step down from the $90.8 billion in revenue with $1.53 per share reported in the second quarter.

I also showed you that this is traditionally Apple’s worst time of the year in terms sales and earnings. But it’s the best-received quarter for shares. They’ve risen on this report 9 times over the last 13 years…

That’s a 69% success rate!

And the average one-day move from Apple’s shares on third quarter results since 2011 is a gain of 2.15%. That’s because when the iPhone maker’s shares do jump, it’s most often for 3.3% or more.

The current expected move on Apple is +/- 3.8%. That represents a move up to $228 or a decline to $211.

The main data item to watch tonight are sales in China (and of course any update or mention of AI… because that’s all anyone cares about).

Now, the reality is, Apple is facing some tough competition in China. But it’s a race to the bottom as rivals are offering discounts galore.

In the second quarter (not Apple’s fiscal year second quarter), the company’s iPhone shipments to China reportedly fell 3.1%. Meanwhile, Android phone sales rose 11.1% in the region. And for the first time ever, the top five smartphone vendors in the country are domestic, the likes of Huawei, vivo and Xiaomi.

Because of this, Apple’s market share in China has slipped 2% over the past year. But it still holds 14% of the market.

That’s the bad news.

The good news is the declines in China are expected to have bottomed up. So, analysts are looking for any optimistic commentary that we’re now on the upswing.

Next, the iPhone 16 will be unveiled in September. Excitement is building for this launch. (Though, I will revisit this in September because there is an important trend to know here.)

And then we’re into the holiday shopping season, the company’s best quarter of the year.

At the moment, Apple shares are roughly 7% below their 52-week high, which was set back in mid-July.

Historically, Apple’s fiscal year third quarter is its best-received of the year because there’s often only good news ahead. And the moves higher on this report are traditionally quite strong for a company of its size. The rotten spot hiding in this apple though is any news that the situation in China has gotten worse not better.

All eyes on China and AI,

Matthew