We’re wading deeper into first quarter earnings season.

And sure, some names steal headlines each day. Winners, such as Carvana (CVNA), Emergent BioSolutions (EBS), Pinterest (PINS), and Snap (SNAP). And losers, like Advanced Micro Devices (AMD), CVS (CVS), Etsy (ETSY), Fastly (FSLY), and Super Micro Computer (SMCI).

But Wall Street’s real focus is on the “Magnificent 7” – Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA).

These companies powered the markets to gains in 2023 and 2024. And they’re the most heavily weighted components of indexes like the S&P 500 and Nasdaq 100.

So, often where these companies go, so goes the markets.

All but Apple and Nvidia have yet to report results.

Well, the artificial intelligence (AI) and crypto chip maker, Nvidia won’t report until later this month.

But the countdown clock has started for Apple. It reports this evening after the closing bell. So, let’s take a peek at what to expect.

The Only Time People Don’t Want an iPhone

The summer months tend to be a cool stretch for the iPhone maker.

Most consumers are busy blowing their birthday money and paychecks on trips to the amusement park, the beach, the lake, Europe, or taking part in one of the many vibrant protests that are readily available.

They’re indulging in food, drink, and a variety hefty criminal penalties… But not so much gorging themselves on the latest tech.

And, as I’ve covered in the past, for consumer gadget giants, like Apple, that translates into softer sales.

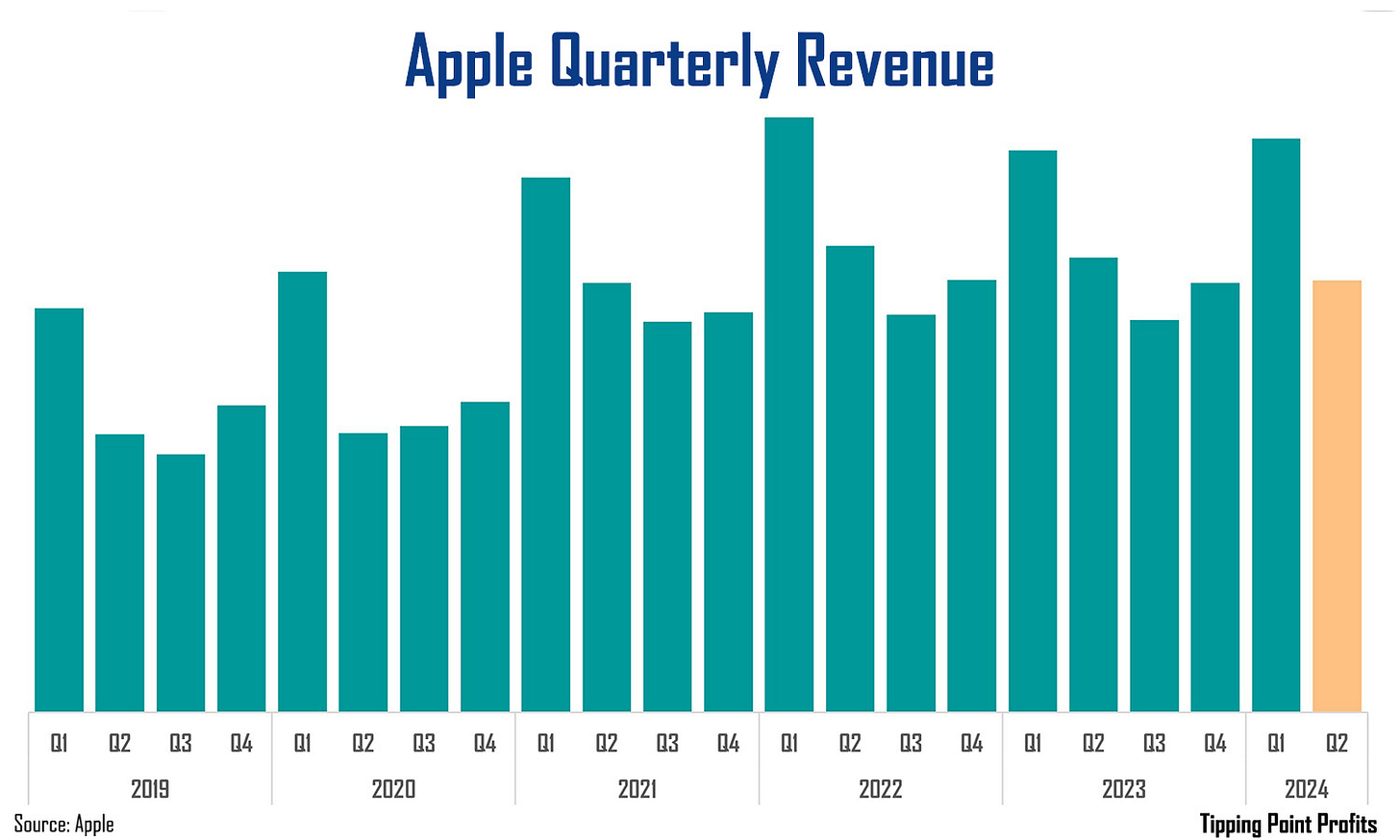

For instance, Apple will be reporting fiscal year second quarter results this evening. Expectations are for $90.01 billion in revenue, a decline of 5.1% from a year ago.

But most importantly, this is a significant step down from the $119.6 billion the company reported in the first quarter.

Many investors fail to realize that Apple’s revenue has the “sawtooth” pattern I so often like to exploit…

Apple’s first quarter – which spans the holiday shopping season – is by far its largest of the year. We see each of these “teeth” towering over the rest.

And up ahead, we see we’re in store for Apple’s third quarter – which is always its worst quarter for sales every year.

Consumers are out buying ice cream cones, baking in the sun at the baseball park, or plopping down $3,525 to partake in Taylor Swift’s Eras Tour.

In turn, the reaction to Apple’s fiscal year second quarter results can be just as divisive as the release of The Tortured Poets Department.

Four Month Fast

Shares of Apple have been on a diet, notching four consecutive months of declines.

And they’re currently trading 14% below their 52-week high of $199.62 which was set back in December.

Well, heading into second quarter results tonight, it’s worth noting that shares have fallen on this report seven times over the last 13 years. But the bright side is, most of the declines have been marginal…

The average one-day move from Apple’s shares on second quarter results since 2011 is actually a gain of 1.54%. That’s because when the iPhone maker’s shares do jump, it’s most often for a gain of 4.4% or more.

The current expected move on Apple is +/- 3.6%. That represents a move up to $178.16 or a decline to $165.71.

Now, I do want to note that the response from the “Magnificent 7” this year has broken from some earnings trends.

For example…

· Meta shares tumbled 10.5% on first quarter results… after six consecutive years of gains on this report.

· Tesla shares shot up 12%, breaking from the trend of seven declines over the previous eight first quarter reports.

· Amazon shares rose 2.29% on first quarter results, following four consecutive years of losses on this release.

· Alphabet shares rocketed more than 10% higher on first quarter results after three losses over the previous five.

· Meanwhile, Microsoft shares rose on its fiscal year third quarter results for the seventh time in the last eight years, as well as the 11th over the last 13 years.

And it’s also interesting that five of the six “Magnificent 7” have rallied on earnings this quarter. We’ll see if Apple can keep that trend alive.

Historically, the tech giant has slipped on this report more times than it has gained. But the moves lower have largely been modest, while the gains have been real market movers. And Apple investors are looking for shares to break their four-month streak of declines.

Watching this Apple today,

Matthew