For many, Wall Street feels more like Elm Street today.

This was a vital week for investors as five of the Magnificent 7 were on deck to report earnings.

And Halloween has arrived with a nightmarish start as two of that $12 trillion crew are dragging indexes lower today.

But is this spooky session a sign of something more ominous… or is it merely a jump scare investors should have expected?

Let me explain…

Bloody Streets in October

Microsoft (MSFT) and Meta Platforms (META) reported earnings after the closing bell yesterday.

And I’ll let you in on a little secret… much of what we’re seeing today is nothing new.

Now, Meta beat expectations. The social media giant’s fourth quarter outlook of $46.5 billion nudged out the consensus of $46.09 billion.

What’s sending shares down roughly 3% are these lines from CFO Susan Li:

“We anticipate our full year 2024 capital expenditures will be in the range of $38-40 billion, updated from our prior range of $37-40 billion. We continue to expect significant capital expenditures growth in 2025. Given this, along with the back-end weighted nature of our 2024 capex, we expect a significant acceleration in infrastructure expense growth next year as we recognize higher growth in depreciation and operating expenses of our expanded infrastructure fleet…”

Meta’s Reality Labs and overall spending have haunted investors for years… especially on this year.

For Microsoft, the story is much the same. The tech megacap’s earnings topped expectations. And its AI business is on track to top $10 billion in revenue next quarter.

But capex is a curse… The surge in spending to $20 billion in the quarter was a bit much. And the outlook that AI spending will increase sequentially is dragging shares nearly 6% lower today.

So, here’s the deal…

I’ve covered before that Meta shares stink on third quarter results.

This is the report to always buy puts on! (Remember that for next year!)

Since going public, shares have only risen on this report five times. And if they finish today lower, that will mark the fifth consecutive year they’ve dropped on its Q3 release. Not to mention, it would be the seventh decline in the last 10 years.

For Microsoft, fiscal year first quarter results have become a sore spot in recent years. If shares end down more than 5% today, it’ll mark the fourth consecutive year with a move of 4.2% or more… and three of those are declines.

This is a departure from the long-term success we’ve previously seen on this release. But we’ve been witnessing this shift in sentiment 2021.

The takeaway: today’s bloody street is nothing new.

But there are two more of the Mag 7 on deck tonight… What does the trend Ouija board tell us?

61% Chance of… A Letdown

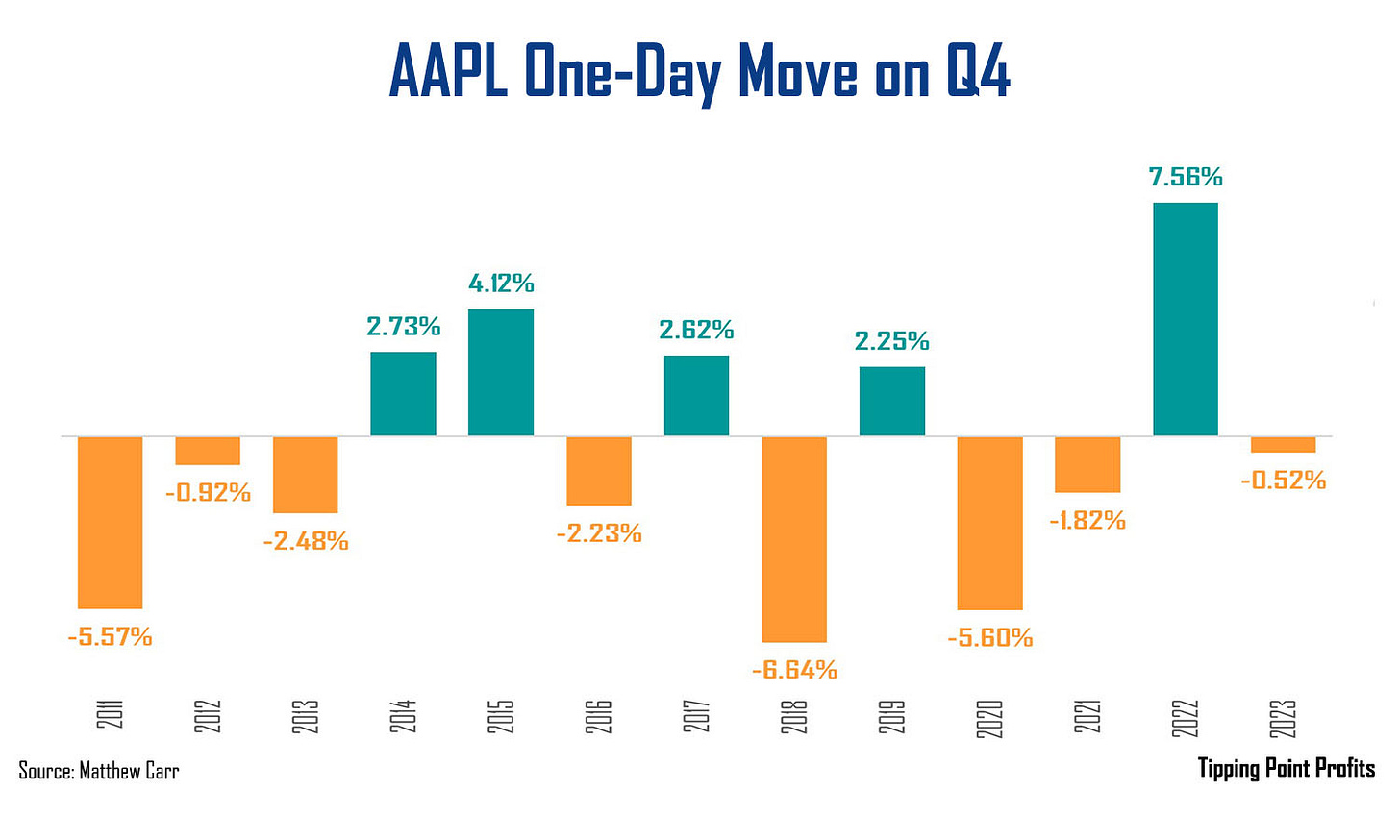

Let’s start with iPhone maker, Apple (AAPL).

I’ve outlined before that Apple’s worst quarter in terms of revenue (its third quarter) tends to be its best-received. That’s in large part due to forward guidance.

Well, tonight, the company will unveil fourth quarter results. This is when we begin to see Apple’s revenue tick higher as we speed headlong into the all-important holiday shopping season.

Expectations are for $94.58 billion in revenue with earnings of $1.60 per share. And looking ahead to the company’s fiscal year first quarter, analysts are expecting $127.53 billion in sales with earnings of $2.38 per share.

Unfortunately, for investors, tonight’s report tends to be a dud…

Since 2011, shares have dipped on this earnings release eight times. That’s a 61% chance for a decline.

Though, our average move during that span is only a one-day loss of 0.50%.

The options market is currently forecasting a move of +/- 3.6%. That means shares could potentially skip up to $235 or down to $219.

All eyes are going to be on China… once again. If consumers here have returned to snapping up iPhones, Apple shares could have a nice day. Especially after today’s pullback. But China has been a thorn here for several quarters.

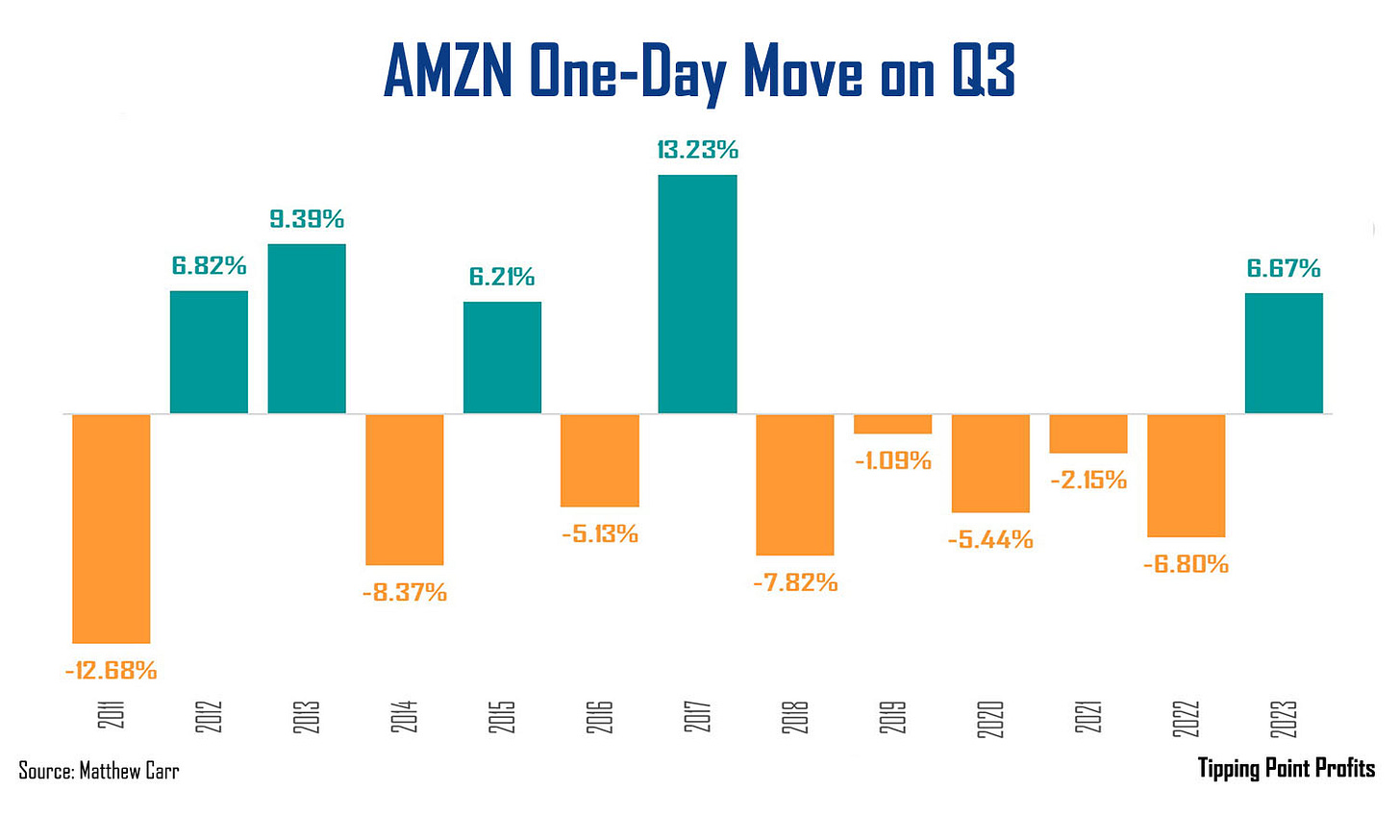

When we look at Amazon (AMZN), we spy a similar tale...

The e-commerce retail and cloud monolith is expected to report $157.2 billion in revenue with earnings of $1.14 per share. And looking ahead to the fourth quarter, analysts want to see $186.16 billion in revenue with earnings rising to $1.34 per share.

For Amazon, its second quarter results, reported in late July or early August, tend to be its best received.

Unfortunately, the company’s third quarter results (on deck tonight) are often its worst…

Since 2011, shares have only gained on this report five times. And if we remember our math from above, that’s a 61% chance for a decline.

Now, Amazon is prone to some large moves on this report, as we can see from the chart. But they all cancel themselves out to an average one-day loss of 0.50%.

The options market is forecasting a move of +/- 6.1%... which is well within historical norms. That means shares could potentially leap higher to $198 or drop down to $175.

It’s a difficult day for Wall Street today. Scary spending on AI has spooked investors. And they don’t need much reason to search for a safe space with Election Day coming up on Tuesday. But the reality is, none of this is outside the norm. And if those deep-pocketed Mag 7 are ramping up spending on AI, it might be a good day or two to start snatching up some names you may have missed.

Shopping for treats today,

Matthew