It’s over.

After years of hype, mudslinging, investigations, insults, and spending billions of dollars on campaign ads… it’s over.

Just like that.

The 2024 U.S. Presidential Election didn’t end in controversy.

There were no last-minute appeals or demands for recounts (as we’ve had over the years).

The victory was decisive…

Making all those hysterical calls and frothy headlines about “the tightest election in decades” laughably incorrect.

Donald J. Trump is now the 47th President of the United States.

And the markets celebrated the lack of drama.

Already, Trump’s win has spurred $20 billion that had been sitting on the sidelines to flow into equities. And the Wednesday after the election, the Dow Jones Industrial Average soared 1,500 points.

In fact, all three major U.S. indexes – the Dow, Nasdaq, and S&P 500 – rallied to new all-time highs on the news.

And that’s not all… Bitcoin soared to new all-time highs as well!

Of course, these were moments we’ve been preparing for here.

So, is it merely a sugar rush? Or is this only the beginning of the next uptrend?

Looking Back at “Uptober”

I’ve already outlined what to expect from the broader markets post-election. So, today let’s focus on one of my favorite alternative assets… Crypto.

There’s one month that’s notorious among cryptocurrency investors.

It delivers gains time and time again.

And it’s done so during bear markets, bull markets, reward-halvings and nearly everything in between.

October.

In the crypto world, the month is lovingly referred to as “Uptober.”

And it’s easy to see why…

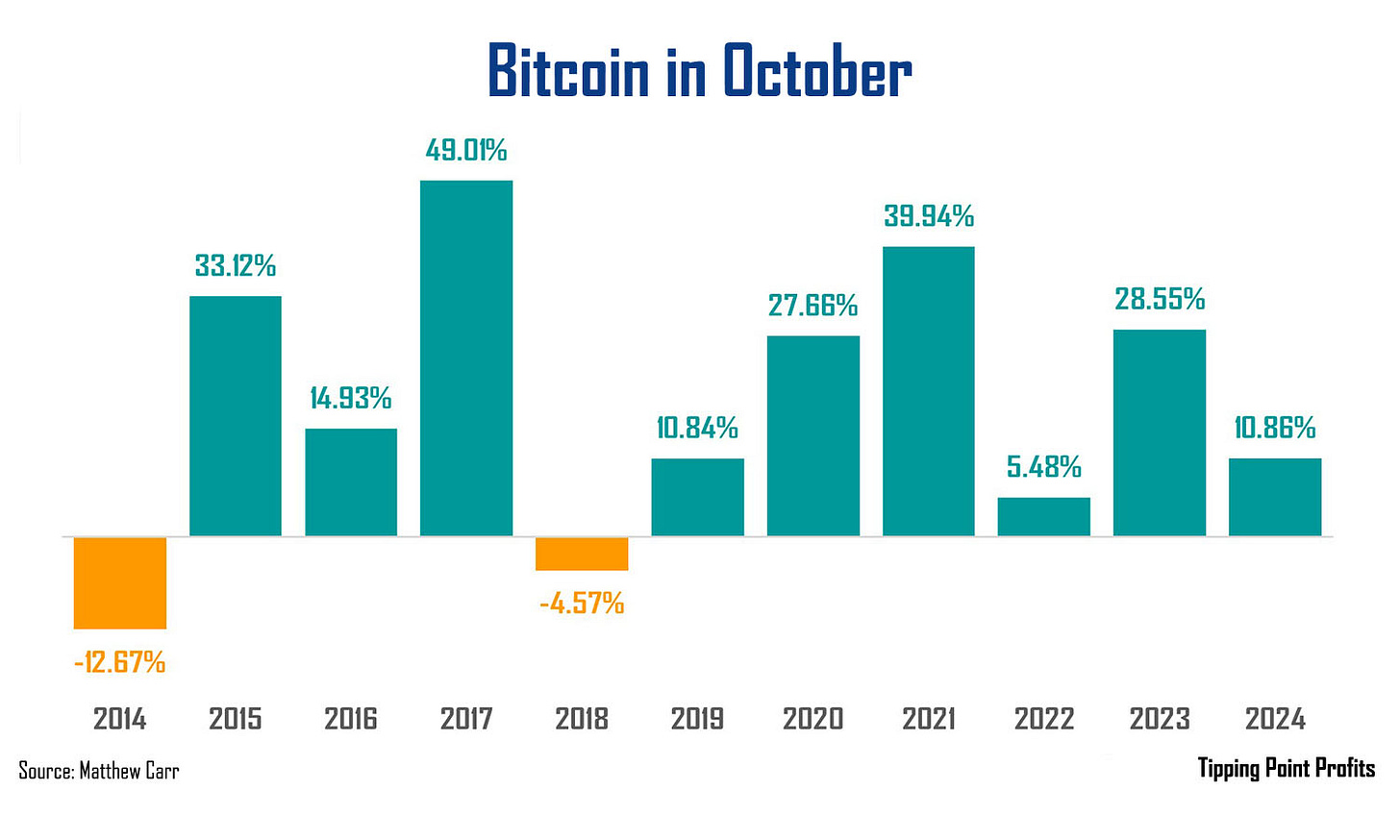

Over the past 11 years, Bitcoin has only ended October lower twice. And the last time was all the way back in 2018… six years ago.

Plus, in the years since, the world’s largest cryptocurrency has gained more than 10% in the month five times.

Bitcoin was already racing towards new highs before the first votes were even counted. It has seasonal tailwinds at its back.

Now what?

20 Months to 224% Gains

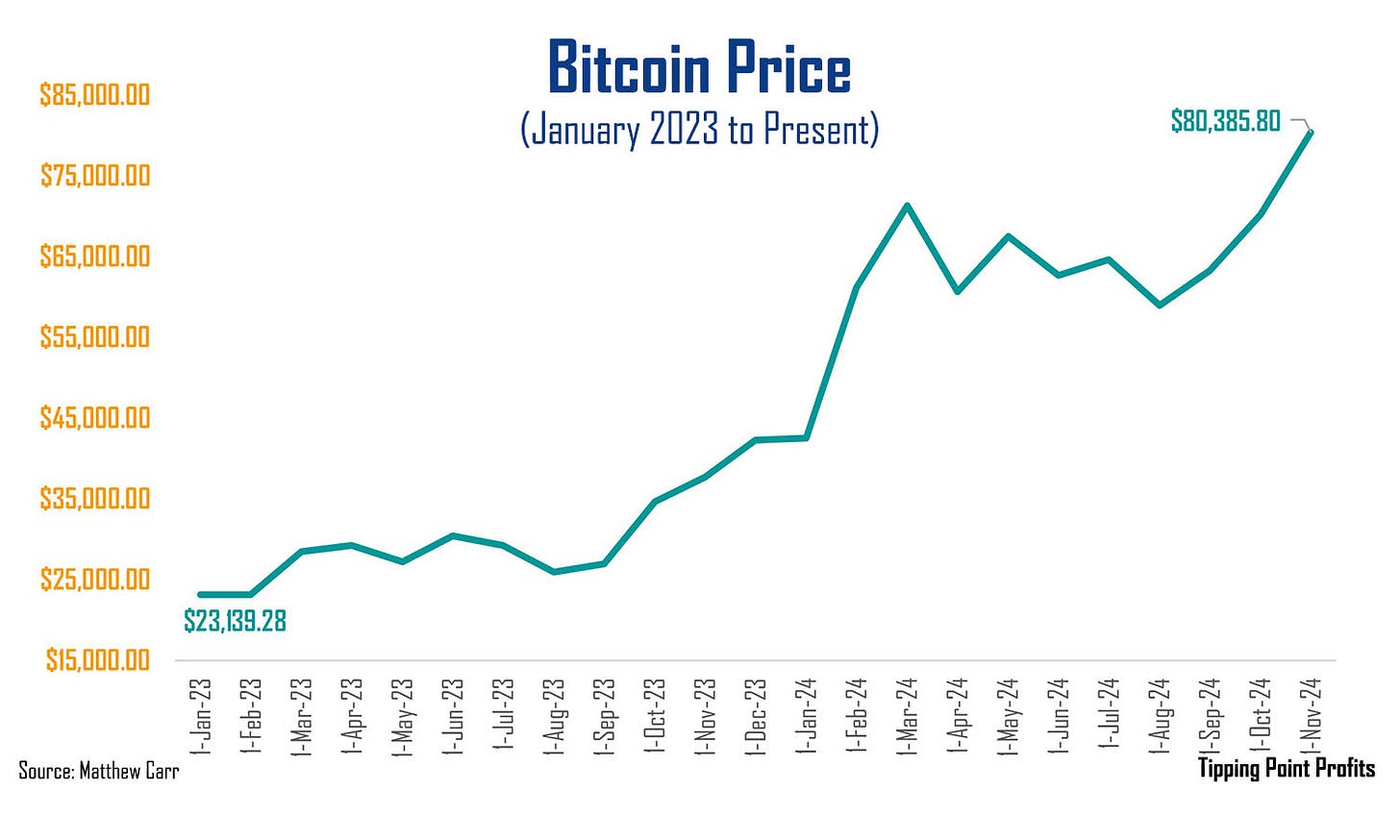

For the past 20 months, we’ve been positioning ourselves for one thing here… new highs in Bitcoin.

I outlined a remarkably simple and easy-to-follow gameplan: Buy Bitcoin anytime it dipped below $25,000.

And throughout 2023, there were plenty of opportunities to do so…

I then raised that buy-up-to level to $63,000.

The reason: we knew what was going to unfold in April 2024. Bitcoin’s fourth reward halving. This historically has led to massive rallies in the world’s largest cryptocurrency price.

And today, Bitcoin is up more than 85% year-to-date, nearly three-times the return of the S&P 500 and the Nasdaq.

It’s also gained more than 220% from my original buy-up-to price.

It’s making a sprint for $85,000 and beyond.

And its run is likely far from over…

The Six-Month Stretch

If you feel you’ve missed out on the recent bullish move, you haven’t.

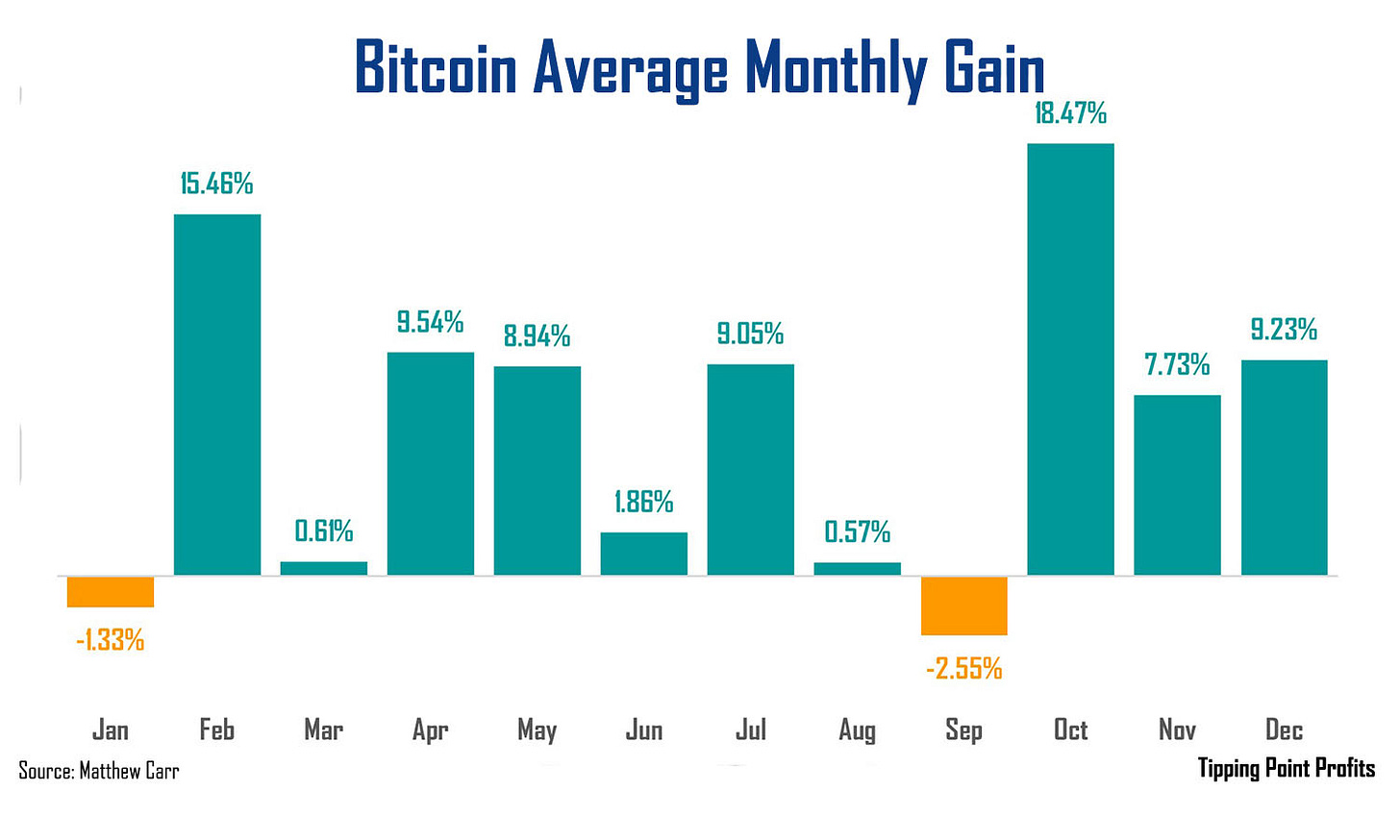

In fact, my favorite month for Bitcoin – and the month that delivers some of the largest gains - still lies ahead.

On top of that, between now and then are two extremely strong months for digital currencies: November and December.

In fact, since 2014, Bitcoin has been averaging a gain of 7.05% in November. It then closes out the year by averaging a gain of 9.25% in December.

But look what’s on the docket after those months fall from the calendar…

We traditionally see a small pullback in January before a massive move higher in February.

And February is my favorite month of the year for Bitcoin.

Why?

Because crypto has only fallen once in the month over the past decade. And that was in 2020 when the world was first tumbling into the panic of the pandemic.

February also marks the beginning of what is historically Bitcoin’s strongest six-month stretch. This runs from February through July.

In August and September, we generally see crypto begin to stumble (something to keep in mind as we get into 2025). For instance, Bitcoin has ended August lower seven of the last 10 years, including the last three straight.

Now, we know Bitcoin’s reward halving triggers a bullish run that lasts for two years. That’s because there’s a supply shock, prices jump, and it triggers FOMO from investors who want their ship to be part of the rising tide.

But there’s another factor at play at the moment poised to supercharge this run…

Going for a $150k Run

Trump positioned himself as the “Crypto Candidate.”

He accepted crypto donations to his campaign, raising more than $7.5 million through tokens.

Plus, he even has his own cryptocurrency, Trump Coin.

But for the larger ecosystem, what matters is he promised to create a strategic national stockpile of cryptocurrency. And now that he has a Republican-controlled Senate, as well as potentially the House, there are no roadblocks to these plans.

Furthermore, he stated that if crypto is the future, he wants it to be mined in America. All part of his “America First” strategy.

This is great news for crypto miners such as Marathon Digital (MARA), Riot Blockchain (RIOT) and CleanSpark Inc. (CLSK).

This should add fuel to Bitcoin’s run over the next year.

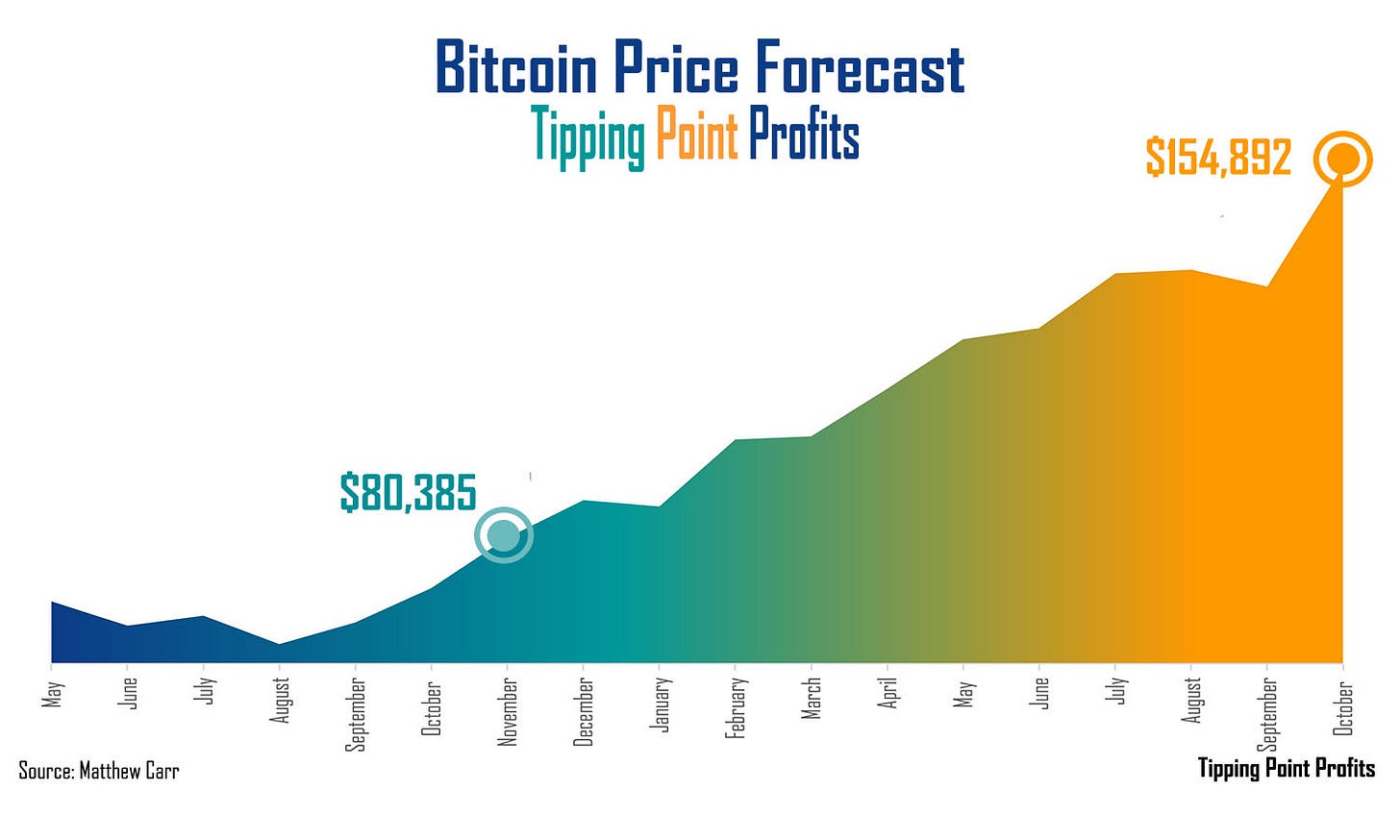

Back in April, I forecast Bitcoin would top as much as $128,500 by the end of this year. And that we could see $165,000 near the end of this cycle in 2025.

Well, I’m updating my forecast…

We had a few months of sideways moves. But I believe Bitcoin is now on the path to hit $154,892 by October 2025. We’ll have a couple of bumps in the road – like August and September next year. But we look to be on a solid trajectory to cross $100,000 in the months ahead and more new highs after that.

Remember…

Bitcoin has been the best-performing asset for a decade and a half.

And not by a little… but by astronomical sums.

That means every investor’s portfolio MUST have some exposure to crypto.

That can be through tokens, the new array of exchange-traded funds (ETFs), or shares of miners.

Investors who don’t will be kicking themselves once again. Not only for the boat they missed in 2024… but also in 2025.

HODLing until October 2025,

Matthew