It’s hard to imagine… But the day is nearly here.

And no, I’m not talking about the match between Mike Tyson and Jake Paul.

This match-up I’m referring to actually matters.

We are seven days away from Election Day.

And for most of us, it can’t get here soon enough.

On Tuesday, November 5, Americans will head to their voting places. They’ll wade through crowds of last-minute lobbyers for their respective candidates or issues, stand in line and cast their ballots.

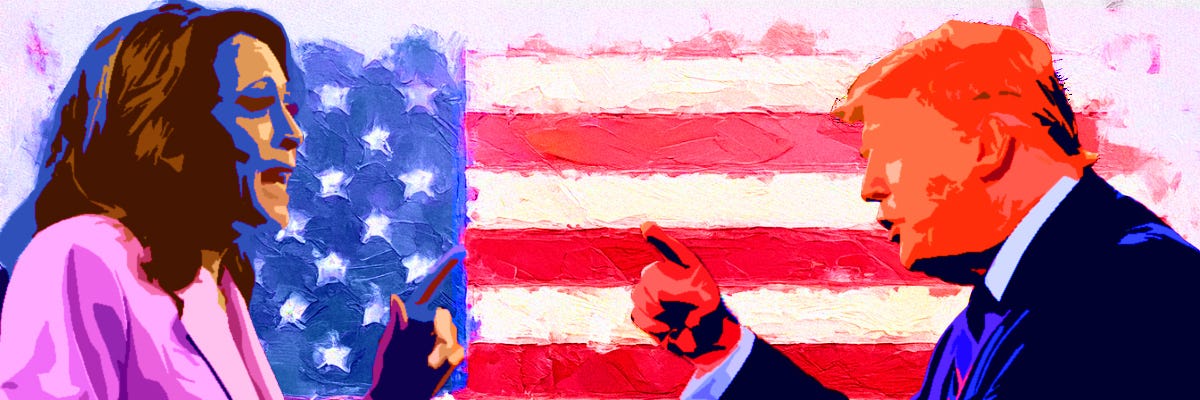

Of course, the headlines center around the race for the White House, between current Vice President Kamala Harris and former President Donald Trump.

And in a divisive political environment - like we currently have - many often see their portfolio returns anchored to whoever’s residing at 1600 Pennsylvania Avenue for the next four years.

But does it really matter?

What Tie Color is Best for the S&P?

The threats occur every election cycle: “If so-and-so wins, the stock market will crash!”

I’ll go ahead and save you the suspense…

For the most part, that’s not true.

But I’ve watched plenty of investors liquidate to cash or refuse to invest in the market because their party didn’t win the election. They claim it’s all going to come crumbling down any minute because the other side’s policies are destructive to investors.

It’s a silly notion.

Now, throughout my years as an investment strategist, I’ve reiterated one phrase: “There will be down days, down weeks, down months and even down years. But the market ultimately moves in only one direction: Up.”

And very few presidents have overseen negative market returns during their time in office… regardless of their domestic and international policies.

In fact, since 1957, the median annual return of the S&P 500 when a Democrat sits in the Oval Office is 12.9%. At the same time, the median annual return for a Republican president is 9.9%.

Neither of those is negative.

And the variance is largely due Democratic presidents overseeing massive economic expansions that led to the stock market skyrocketing…

The two presidents that oversaw the largest stock market gains ever were Democrats – Bill Clinton (January 1993 to January 2001) and Barack Obama (January 2009 to January 2017).

Did their policies shape those returns? Or did they happen to come into office during an economic and market upswing?

The two presidents that saw the worst S&P returns were Republicans – Richard Nixon (January 1969 to August 1974) and George W. Bush (January 2001 to January 2009).

Same questions could be asked.

Now, JPMorgan (JPM) analysis has shown that returns for all eleven S&P 500 sectors were higher during Democratic presidencies. And Democrats oversaw the best years for 10 out of 11 of the index’s sectors.

But there are asterisks… the 2001 dot-com collapse and the 2008 global financial crisis. Both unraveled during the presidency of George W. Bush. Without those disastrous years weighing down the results, the returns would be more even.

Regardless, history has shown us that whoever wins the White House this year, the markets won’t collapse. There may be bumps in the road. But election anxiety and one’s portfolio performance aren’t connected.

Of course, there’s another part of this story investors too often forget…

Turning $100k into $32.6 Million No Matter What

In the U.S., the President is powerful, of course.

But we operate under a system of checks and balances. A president can’t just declare laws and enforce them willy nilly. That would be a dictatorship. So, this is where the two houses of Congress come in.

And it’s important to remember that these two houses of Congress have elections this year as well.

In fact, there are 468 Congressional seats up for grabs.

Of the 100 Senate seats, 33 are facing elections in 2024. And all 435 seats in the House of Representatives will be decided this cycle.

Currently, Democrats control 47 seats in the Senate, while Republicans hold 49. Meanwhile, four Senators are Independents.

In the House of Representatives, Republicans currently hold the majority with 220 seats. Democrats have 212 seats and three are currently vacant.

Now, control of Congress is key. A president has campaign promises to keep and agendas to uphold. If the other party controls Congress, it makes it difficult to keep those promises, as we’ve seen quite often in recent years.

But what’s the impact on stock market returns?

Well, when a Democrat is in the White House and Republicans control Congress, the average S&P annual return is 6.7%. And if there’s a Republican president and a Democrat-controlled Congress, the average annual S&P return is 4.7%.

Too many investors cause irreparable damage to their portfolios by fleeing to the sidelines when their party doesn’t win the election. It’s a double dose of bad news triggered by an emotional response. And is one of the most destructive biases investors can practice.

Here’s the deal… Since 1950, if you invested $100,000 in the S&P 500 and only stayed invested when a Democrat was president, you’d have roughly $3.1 million today. If you did the same for Republican presidents, you’d have $1 million.

But if you stayed invested regardless of who was in the White House or which party controlled Congress, that $100,000 invested in the S&P in 1950 would be worth more than $32.6 million in 2024.

So, remember, the markets don’t care if blue or red wins on Election Day. And investors win no matter what because of that.

Level heads win in the long run,

Matthew

Matt: Nice shoutout from the folks at Giles on this piece.

Well done, my friend!

Bill Patalon III

SPC

https://open.substack.com/pub/gilescapital/p/giles-capital-weekly-week-44?r=3ftiph&utm_campaign=post&utm_medium=web