Summer’s end is swift.

This realization struck me as I drove the gravel road that winds the canopy of trees to our farm. Brittle gold and red leaves were scattered about, running after me as I drove past.

Today, I can see the doe’s coats have shifted from red to the color of old wood. The deer meander happily, munching on chestnuts and the apples that have thumped to the ground from the trees. Their fawns – still dressed in their summer coats – tag along behind.

Both are monsters my dogs feel need to be frightened away.

The seasons are changing.

But one certainty has remained…

Tech is king.

That’s one of my favorite mantras to preach. And once again it’s proven profitable in 2023.

Investors have rung the register repeatedly this year following this simple trend.

The Nasdaq has soared, gaining more than 30% year-to-date.

Of course, the jet fuel for this rocket to the Moon has been artificial intelligence (AI). And the returns on individual standouts, like quantum computing darling IonQ (IONQ), are eye-watering. Shares have screamed 450% higher so far in 2023!

But the market’s celebratory mood began to sour a few weeks ago. And many of those thunderous rallies started to stall.

It’s the nature of things.

Though, as we tip-toe our way deeper into September, investors are left wondering… Is this the beginning of the end?

Or an opportunity with gains to reap?

Tech’s Brick Wall

Every rally comes to an end.

And quite often, not with a whimper, but the sound of crunching metal and shattered glass.

From July 31 to August 18, tech stocks crashed. They shed 8.4% of their value.

Since then, we’ve enjoyed a jittery rebound off those lows. But we’re still roughly 4% from that end-of-July peak.

The pullback was the largest we’ve seen since the banking crisis emerged in February. And, as we often do in situations like these, is there more pain to come?

Well, as I always say, there’s a rhythm to life.

And there’s a rhythm to the markets as well.

For nearly two decades, my job has been to recognize and take advantage of these rhythms, as well as safely guide investors through the happy times and the hazards. And what we’ve seen in recent weeks is more comforting than something that fills me full of dread.

At the end of July, I wrote August had a 60% chance for gains. And it would be wise to tighten stops as we prepared for what lay ahead... the September Swoon… the September Spoiler… the September Sell-Off… the September Effect…

It goes by many names.

There’s already been an endless parade of headlines shouting September is “the worst month for stocks.”

Duh.

If you’ve followed me for any period, you know I agree. Not just for sectors like tech, but also cryptocurrencies.

The data speaks for itself. So, I’ll let it have the floor…

The Invesco QQQ ETF (QQQ) has ended the month of September lower five out of the last six years. And it’s averaging a 2.28% loss in the month since 1999.

That’s by far the worst month of the year for tech.

There’s nothing on the calendar as remotely precarious.

Many of you have heard me pound the table that there is no summer lull for the Nasdaq. And there isn’t… But that summer run comes swiftly to an end with September’s brick wall.

We can peek at our portfolios and the indexes and say, “Hey, it’s not that dismal out there! What gives?”

It’s true, Nasdaq 100 is far from being deep in the red this month. But that’s all part of September’s sneaky nature. It likes to set up investors for nasty surprises.

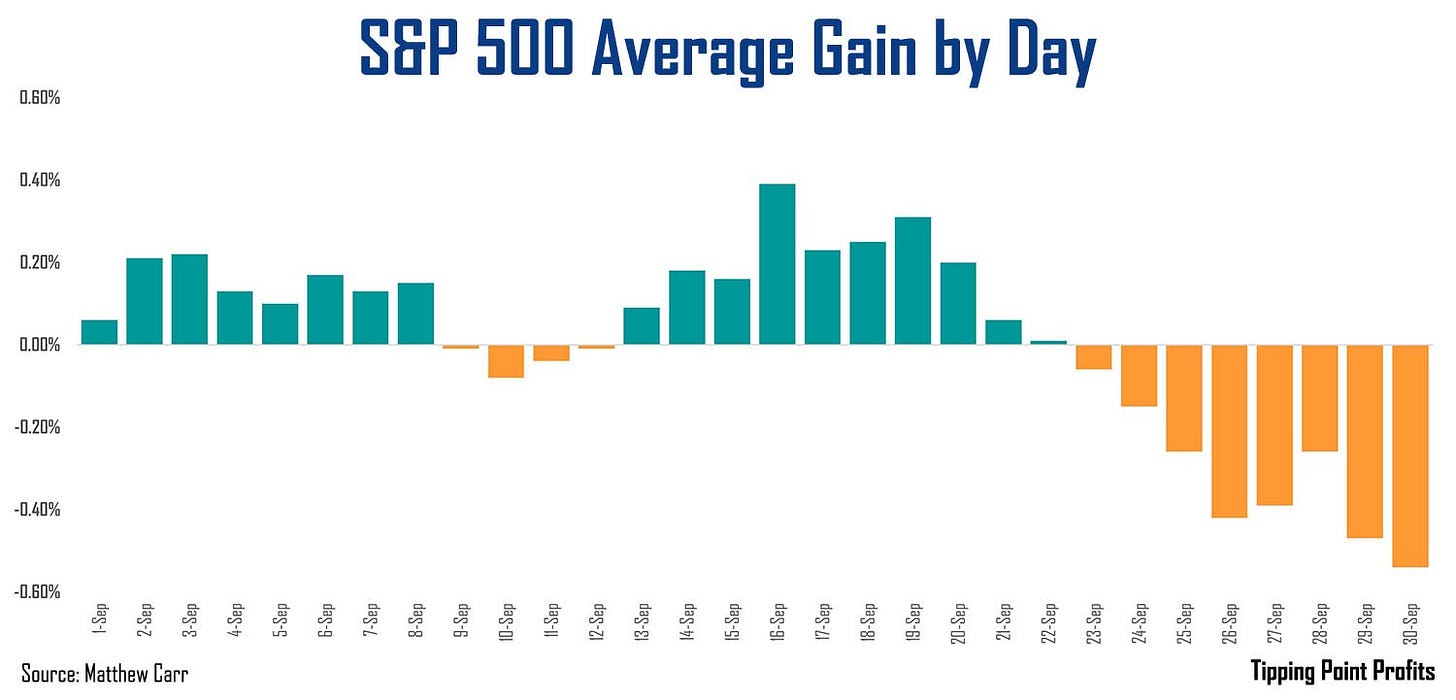

Historically, most of the pain felt by stocks during the month happens in the closing days. In fact, here’s a look at how the S&P 500 has fared by day in September since 1951.

It’s typically a blood bath in the final week.

Of course, a great aspect of data like this is that we can prepare for when the market will shift gears to the exact day.

So, let the good times roll… at least around September 21… then all hell could break loose. With that in mind, it’s worth noting our next Federal Open Market Committee meeting is September 19 and 20. Right on time for September’s closing slump.

A Spoiler? A Swoon? An Opportunity?

We’ve experienced some violent weeks recently.

More volatile than we’ve seen in quite some time.

And we’re in that stretch of calm before the storm.

September has rightfully earned a reputation for being a month full of declines. But that’s fine. Because look back above at the average monthly gain chart for the QQQ… two of the best months for tech – October and November – are on the horizon.

So, this is a time to start compiling your wish list.

Don’t get egged into chasing.

Don’t put yourself in a position to get your legs swept out from under you by September’s closing surprise.

But think of that end-of-September selloff as an early holiday present to yourself. It’s the perfect opportunity to add shares of great companies at a discount.

Of course, the markets won’t be without turbulence until November. But we use these dips to build positions and wait for the next leg higher.

So, I never think of this as the “September Swoon” or the “September Spoiler.” I like to think of it as a chance for a “September Stock Up.”

Ready to stock up,

Matthew

I have some great news: I’m going to be speaking at the MoneyShow/TradersEXPO Orlando this October! And that leads to only one question...

Can we meet and talk markets there – IN PERSON?

I sure hope so...because my friends at the MoneyShow organization have assembled a dynamite lineup of world-class market strategists, economists, professional traders, money managers, and newsletter publishers.

You can see from the just-released preliminary agenda that you’re in for an unparalleled investor education experience at the event, which runs from October 29-31, 2023. In addition to my talk, you’ll have the chance to hear and learn from the likes of...

Charles Payne, Host, Fox's Making Money with Charles Payne

George Gilder, Editor, Gilder's Technology Report

Lindsey Piegza, Chief Economist, Stifel Financial Corp.

Barry Ritholtz, Founder and CIO, Ritholtz Wealth Management

Mark Skousen, Editor, Forecasts & Strategies

John Carter, Author, Mastering the Trade

Howard Tullman, General Managing Partner, G2T3V, LLC

And more than 75+ other experts! They’ll cover everything from stocks, bonds, real estate, energy, and precious metals to alternative investments and elite trading tools and strategies. Plus, the conference is being held at the Omni Orlando Resort at ChampionsGate – one of the nation's premier golf, meeting, and leisure retreats.

AND because you’re one of my valued readers, I CAN SAVE YOU 20% on the purchase of a Standard Pass to the event!

So first, here is my presentation schedule:

How to Prepare for the Death of the Bull in 2024

Or if you prefer, call the MoneyShow team at 1-800-970-4355 and reference my discount code SPKR20.

Then get ready. Because I can’t wait to share my insights, strategies, and forecasts with you – not to mention talk markets IN PERSON – in Orlando!

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.