Well, here we are again… cryptocurrencies are selling off. And all the talking heads are pondering aloud, “What could it possibly mean?”

Over the past week, Bitcoin tanked more than 12.5%.

It’s now mired in its worst stretch since the FTX meltdown.

And even today, the world’s largest cryptocurrency is hovering around $26,000 – well below the $31,000 levels we saw in June and July.

But here’s the deal…

We know the drill.

We’ve been here before. And we’re going to be here again… as you’ll soon see.

But I’m back to once again reiterate our cryptocurrency gameplan I began outlining in March.

Remember, predictability is a powerful tool when it comes to investing.

And when we know how to harness it correctly, we can leverage it to our advantage… as well as for some for some stellar gains!

That means, we won’t end up like 90% of the frustrated crypto traders staring bleary-eyed at their account balances…

Be the 1-Out-of-10

The statistics are sobering.

But just because they’re swearing off booze, doesn’t mean you have to. And hopefully, you’re popping corks to celebrate, not commiserate like the group of sorry sacks we’re going to talk about behind their backs.

According to Glassnode, 88.3% of short-term Bitcoin traders – those not holding coins longer than 155 days – are underwater.

Essentially 90% of crypto traders are sitting on losses, ranging from minor to double-digits or more.

But let’s put this in numeric terms… Currently, 2.26 million of the 2.56 million Bitcoin in the hands of short-term traders are unprofitable.

How can that be?

Because they’re cryptocurrency-ing all wrong.

A lot of traders – especially Bitcoin and crypto traders – love the “Buy High, Sell Higher” strategy. And sure, if we were talking about cannabis, that might sound like a great way to waste a Friday afternoon. But as an approach for building for your financial future, it’s a surefire one that’ll lead to ruin.

That’s due to the fact most practitioners get swept up in FOMO (fear of missing out) and panic selling. So, they end up “Buying High, Selling Low.”

Well, if you remember, our Bitcoin gameplan has been to accumulate at $25,000 or lower. Not to get swept up by the months of upswings. Not to chase. And then wait for our months prone for selloffs to dip our toes back in… because we know what’s coming in 2024.

Hello Darkness…

The greatest aspect of trend trading is recognizing selloffs and pullbacks for what they really are… Opportunities.

But let’s explore the recent Bitcoin nosedive in context of what we expected. And what we expect in the months ahead.

Below is the historic average monthly return for Bitcoin…

Well, would you look at that…

Traditionally, the most difficult months for Bitcoin have been August, September, and even November.

And we just happen to be in August!

Another panic that arrived right on time.

In fact, here’s a chart of Bitcoin’s returns in August since 2015…

The Belle of the Cryptocurrency Ball has dipped in the month six of the last nine years.

And what’s interesting to note, the years of gains were 2017 (part of the two-year reward-halving bull market), and 2020 and 2021 (two years of the reward-halving bull market). The rest, like our current August, have been downers.

But should we swoop in now? Take advantage of these lows?

Well, we can nibble if we want.

But we don’t want to get too full.

Be warned… if history is our guide (and it so often is here), it’s about to get a whole lot uglier.

We’re fast approaching that treacherous curve known as September… A month where many a Bitcoin trader find themselves bleeding red in the proverbial ditch as the market takes a sharp turn for the worse.

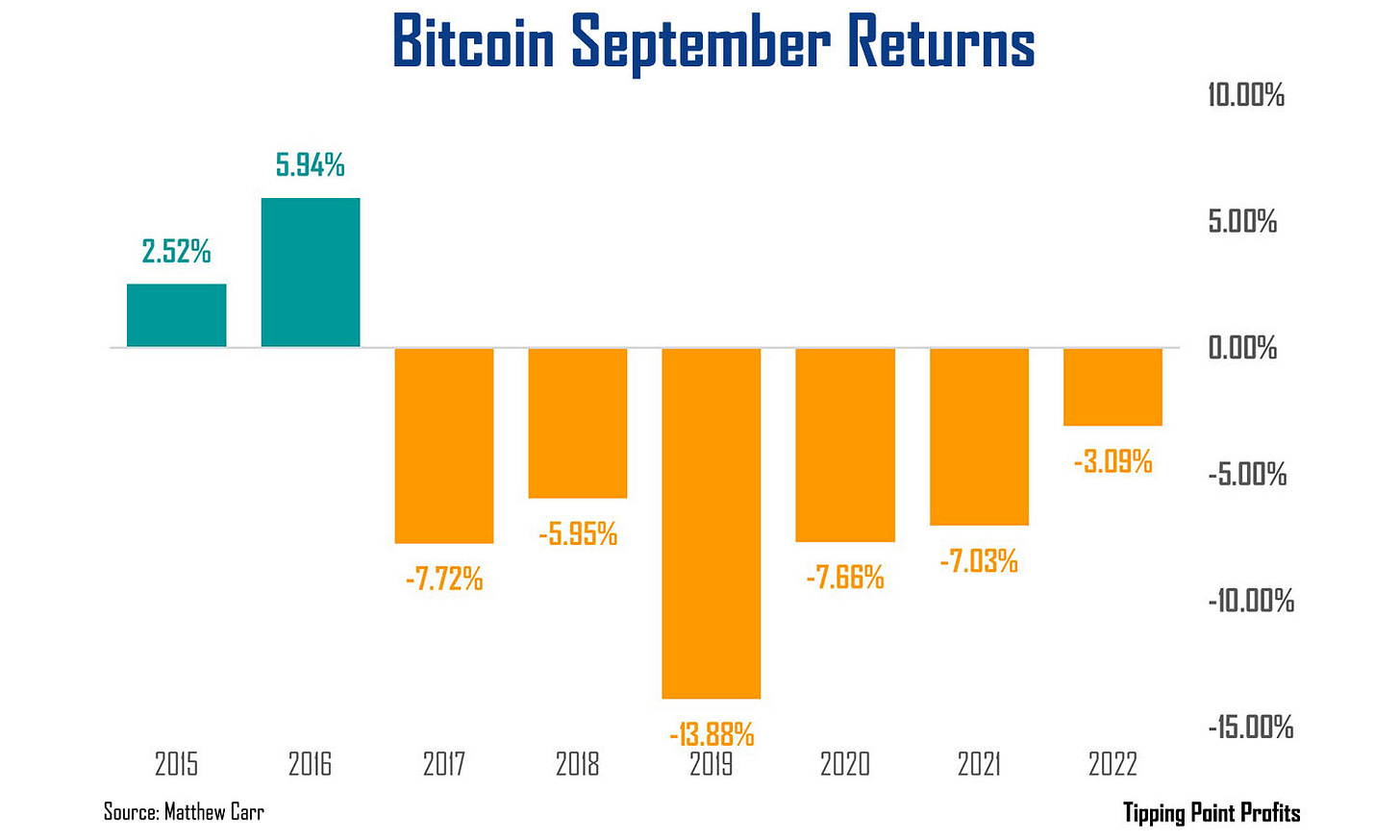

Bitcoin has closed September lower from than where it began for six consecutive years.

Six Septembers straight.

That’s not a misprint…

Of course, that’s a losing streak I wouldn’t be betting against. It’s a clearly defined trend that’s taken place during both bear and bull markets for Bitcoin.

But it’s one I’m going to happily root for (because we want to buy at the lowest prices possible).

It’s also important to recognize that Ethereum sees a very similar seasonal pattern.

September is one of the worst months of the year for the world’s second-favorite cryptocurrency. And it’s losing streak during the month is just as pronounced…

So, I get it…

Right now, seems like a wonderful time to strike. And feel free to nibble at that $25,000 level or lower. But I’d only nibble. Whet your appetite not gorge yourself.

September is coming… the coldest month of every crypto winter.

My current price projections show a move below $25,000 during the month.

But when the headlines are screaming, “Bitcoin is Dead!” and “The Crypto Winter is Here!” We’re not going to be worried or panicked. We’re going to be picking up coins at lows.

Buy Low. Sell High. Repeat

Successful investing is a very simple equation: Buy low. Sell high.

Currently, 90% of Bitcoin short-term traders are sitting on losses. And those losses are about to get larger. That’s because they’re trading on emotions, not creating a plan.

Don’t make those same mistakes.

As I outlined months ago… If you missed March, you could nibble on Bitcoin in June around $25,000… hold off in July... Then we can look to add some more in September… Maybe again in November.

Build your position. Create a nice little stockpile.

We know what’s coming...

We should be off to the races in 2024. And that rally should stretch into 2025 thanks to the reward halving.

On top of that, as we see from Bitcoin’s average monthly gain above, the first half of the year for the crypto is traditionally very strong. In fact, it’s only ended the month of February with a loss once since 2015.

So, this is the pattern we see with Bitcoin again and again and again.

These cycles of boom and bust, bull and bear.

Maybe you ignored 2012… 2016… and 2020.

Do you want to ignore 2024?

With these predictable patterns do you want to let that opportunity pass you by one more time?

Bitcoin is behaving precisely as we expected. No it’s a game of practicing patience.

Knows that winter is coming… and couldn’t be happier,

Matthew

I have some great news: I’m going to be speaking at the MoneyShow/TradersEXPO Orlando this October! And that leads to only one question...

Can we meet and talk markets there – IN PERSON?

I sure hope so...because my friends at the MoneyShow organization have assembled a dynamite lineup of world-class market strategists, economists, professional traders, money managers, and newsletter publishers.

You can see from the just-released preliminary agenda that you’re in for an unparalleled investor education experience at the event, which runs from October 29-31, 2023. In addition to my talk, you’ll have the chance to hear and learn from the likes of...

Charles Payne, Host, Fox's Making Money with Charles Payne

George Gilder, Editor, Gilder's Technology Report

Lindsey Piegza, Chief Economist, Stifel Financial Corp.

Barry Ritholtz, Founder and CIO, Ritholtz Wealth Management

Mark Skousen, Editor, Forecasts & Strategies

John Carter, Author, Mastering the Trade

Howard Tullman, General Managing Partner, G2T3V, LLC

And more than 75+ other experts! They’ll cover everything from stocks, bonds, real estate, energy, and precious metals to alternative investments and elite trading tools and strategies. Plus, the conference is being held at the Omni Orlando Resort at ChampionsGate – one of the nation's premier golf, meeting, and leisure retreats.

AND because you’re one of my valued readers, I CAN SAVE YOU 20% on the purchase of a Standard Pass to the event!

So first, here is my presentation schedule:

How to Prepare for the Death of the Bull in 2024

Or if you prefer, call the MoneyShow team at 1-800-970-4355 and reference my discount code SPKR20.

Then get ready. Because I can’t wait to share my insights, strategies, and forecasts with you – not to mention talk markets IN PERSON – in Orlando!

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.