“Teenage angst has paid off well

Now I’m bored and old.”

-Nirvana, “Serve the Servants”

Grunge is back.

Nirvana t-shirts are a modern-day wardrobe staple.

As are old school Air Jordans and “Chucks” (though only call them “Chucks” if you want to trigger the young ones… they really hate that for some reason).

Even JNCO jeans are in vogue, warranting triple-digit price tags. And soon, Gen Z will learn the same as we did… JNCO’s are fun until you walk through a puddle. Then you’re stuck with two damp denim skirts attached to your legs the entire day that’ll never dry.

Yes, Gen Z is embracing the fashion and music of the 1990s.

But the 90s are back elsewhere as well. U.S. equities are enjoying a run not seen since the Nagano Olympics and the impeachment of President Bill Clinton…

As the books closed on 2024, the S&P 500 finished the year up 23.1%. That’s a terrific addition to the 24.2% the index surged in 2023.

And it marked the first back-to-back 20%-plus gains for the S&P since 1997 and 1998!

But it’s a new year… can U.S. blue chips accomplish a “three-peat?”

The One Cycle to Know

Are stocks going up or down?

Will the bulls or bears be in control?

That’s the dream, isn’t it?

To know the market’s next move before anyone else… maybe even before the market itself.

Investors are always on the search for this holiest of grails. And there is a seemingly endless parade of indicators that claim to do just that.

But often these only give monetary glimpses of what may lie ahead. Investors need to be quick, or the opportunity vanishes in a flash. And when used incorrectly – as often is the case – the results can be more devastating than profitable.

For example, MACD and RSI simply provide overbought or oversold signals… They’re only one piece of an overall trading strategy, not the strategy themselves.

9 EMA, 21 EMA and VWAP are purely for day trading…

50 EMA is key for analysis…

And 200 EMA provides a long-term view of support and resistance.

These are many of the tools investors and traders rely on. But not often are they used in the way they’re intended.

Here’s the deal though, there’s a way with cycles to know where the market is going to head next – not the next candlestick but the next year!

And it doesn’t rely on any type of fancy bands, channels, clouds, oscillators, indexes, or indicators.

It relies on a pattern that’s repeated again and again like clockwork.

And armed with this knowledge, you know how to position your portfolio not for the next 12 seconds, 12 minutes or 12 days… But for the next 12 months!

In 17 days, President-elect Donald Trump’s inauguration will take place.

And historically, this date has boded well for stocks… in particular tech.

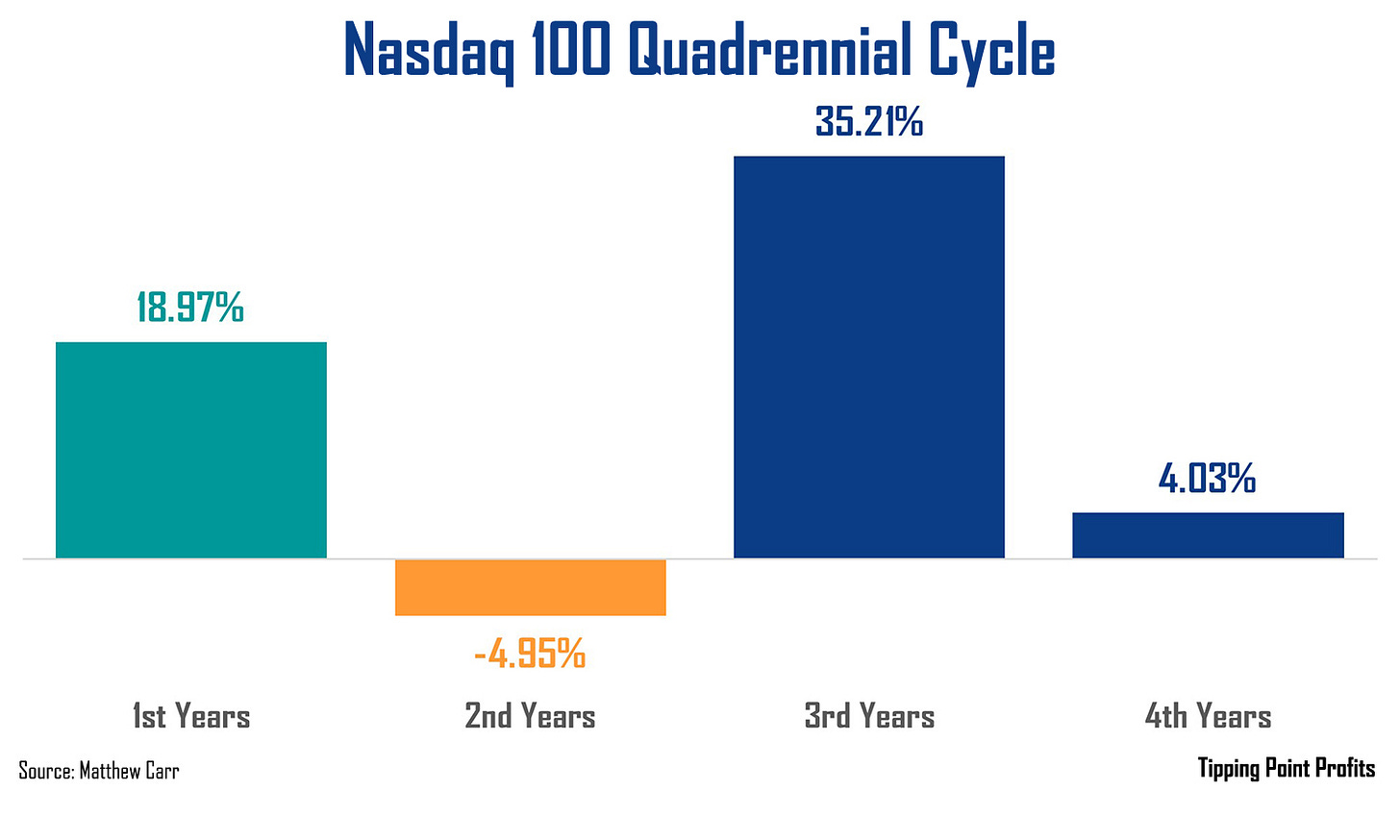

When we look at the Invesco QQQ Trust (QQQ) – the proxy for the Nasdaq 100 – and its Quadrennial Market Cycle, we see a double-digit reason to be bullish…

In the first year of a new presidential term, the U.S. index is averaging a 18.97% gain.

The only year that’s traditionally better is the third year of the four-year cycle.

Plus, keep in mind, that’s only an average. Since 2009, the Nasdaq 100 has surged more than 26.6% in the first year of this cycle. And they only time they’ve fallen in this part of the cycle for more than two decades was all the way back in 2001… when Scrubs first aired.

Why such optimism?

Well, in this part of a cycle Congressional and the presidential elections are over.

And there’s an overflow of optimism and momentum for all the new bills to be passed and signed into law. For all the campaign promises that elected officials will surely keep… this time.

So, for the most part, regardless of what’s happening at the macro level, equities tend to rally.

What to Aim for in 2025

I believe Quadrennial Market Cycle is a guide every investor must know.

It doesn’t forecast the next candlestick on the Dow, Nasdaq 100, or S&P 500... it provides a roadmap for the next year. And it does so long before the deluge of New Year’s Day forecasts.

It’s proven its accuracy time and time again.

That’s why it’s a core piece of my investing game plan every year.

By following this cycle, investors will know where the market is likely headed before anyone else.

If it pulls back, you’re not surprised… that’s what it tends to do in second and fourth years.

If it rallies, you’re prepared that as well… welcome to first and third years

It’s efficient. It’s clear. It allows you to lead your life. That’s everything I want from a tool I use to help me know the market’s next move.

The Quadrennial Market Cycle forecasts a close of 611.85 on the QQQ this year.

It’s also forecasting for the S&P 500 to end 2025 at 7,068… a jump of 19.73%.

For some comparison, on Wall Street, Oppenheimer has a 7,100 end-of-year forecast for the S&P… that’s a 20.3% projected gain.

Wells Fargo sees the S&P ending 2025 at 7,007… that’s an 18.7% gain.

And Deutsche Bank and Yardeni Research both see the index closing the year ahead at 7,000… a gain of 18.6%.

I would like to point out as well that the S&P has gained 20% or more during the last four first years of the Quadrennial Market Cycle.

The 90s are back in a big way. The fashion and music are hip again among the younger generations. And equities are enjoying their own 90s renaissance. The last time the S&P gained 20% or more in three consecutive years? … 1996 to 1998. But 2025 could end that drought.

Longing for my 90s locks,

Matthew

P.S. On Monday, January 6, MoneyShow will be releasing their signature investor intelligence briefing of the year, the 2025 Top Picks Report! This blockbuster report includes timely picks from myself for the coming 12 months. It also contains dozens more recommendations from other top contributors in MoneyShow’s expert roster.

Best of all: I’ve arranged for you to receive a FREE copy!

So, be on the lookout on Monday for a special email from me with a link to this 90-page essential guide for 2025!

Matthew, I always enjoy your articles.

WRT the quadrennial cycle, this is what concerns me: “Plus, keep in mind, that’s only an average. Since 2009, the Nasdaq 100 has surged more than 26.6% in the first year of this cycle. And they only time they’ve fallen in this part of the cycle for more than two decades was all the way back in 2001…”

Personally, I see a lot more similarities between the current market and the lead up to the epic bear market in the early 2000s than I see differences. Well, as always we will see, and we’re all adults, so let’s make our bets!!

Happy New Year, Matthew.

This was a timely and helpful Article. I am paying close attention. Thank you!