“It isn’t the head, but the stomach that determines the fate of the stock picker.”

- Peter Lynch

Emotions are the enemy of every investor.

This is why I love building and relying on trading systems. They strip away the emotional component. They allow the wealth building to be what it truly should be: mechanical.

But I also like to rely on data to help me keep those emotional demons at bay, particularly in times of bubbling up uncertainty.

For example, the Invesco QQQ ETF (QQQ) closed out May with a gain of 6.5%... and delivered as we expected it would. But blue chips on the Dow Jones Industrial Average started running out of gas on May 20. Meanwhile, the S&P 500 and the tech-heavy Nasdaq struggled for traction since May 23.

So, is the rally over?

Let’s take a look…

Tech’s Take on the Summer Lull

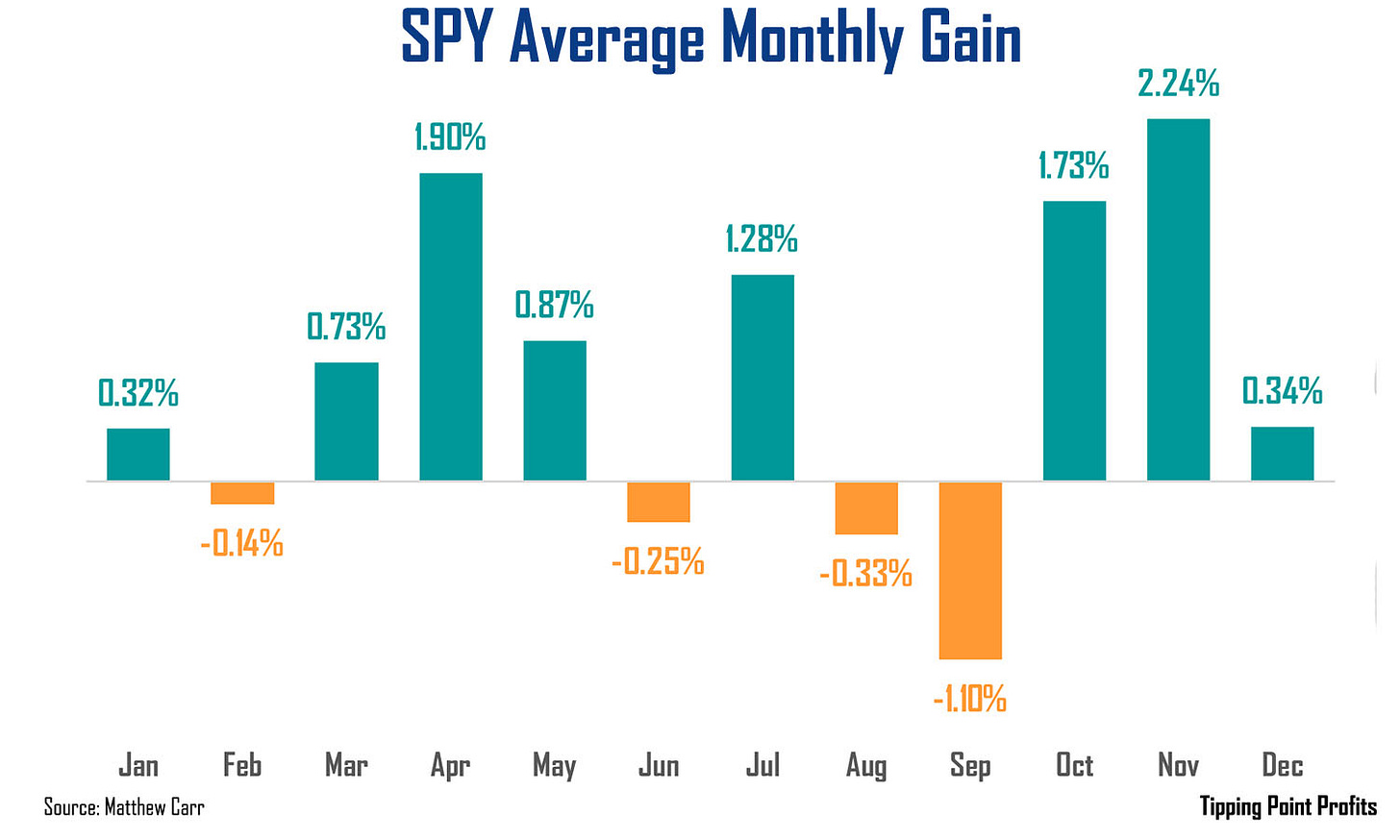

Now, June can be a very tricky month for the Dow and the S&P 500.

In fact, it is one of the worst months for blue chips.

And is only one of four months in the year where the SPDR S&P 500 Trust (SPY) averages a negative monthly return.

But for tech, June has emerged as a turnaround story…

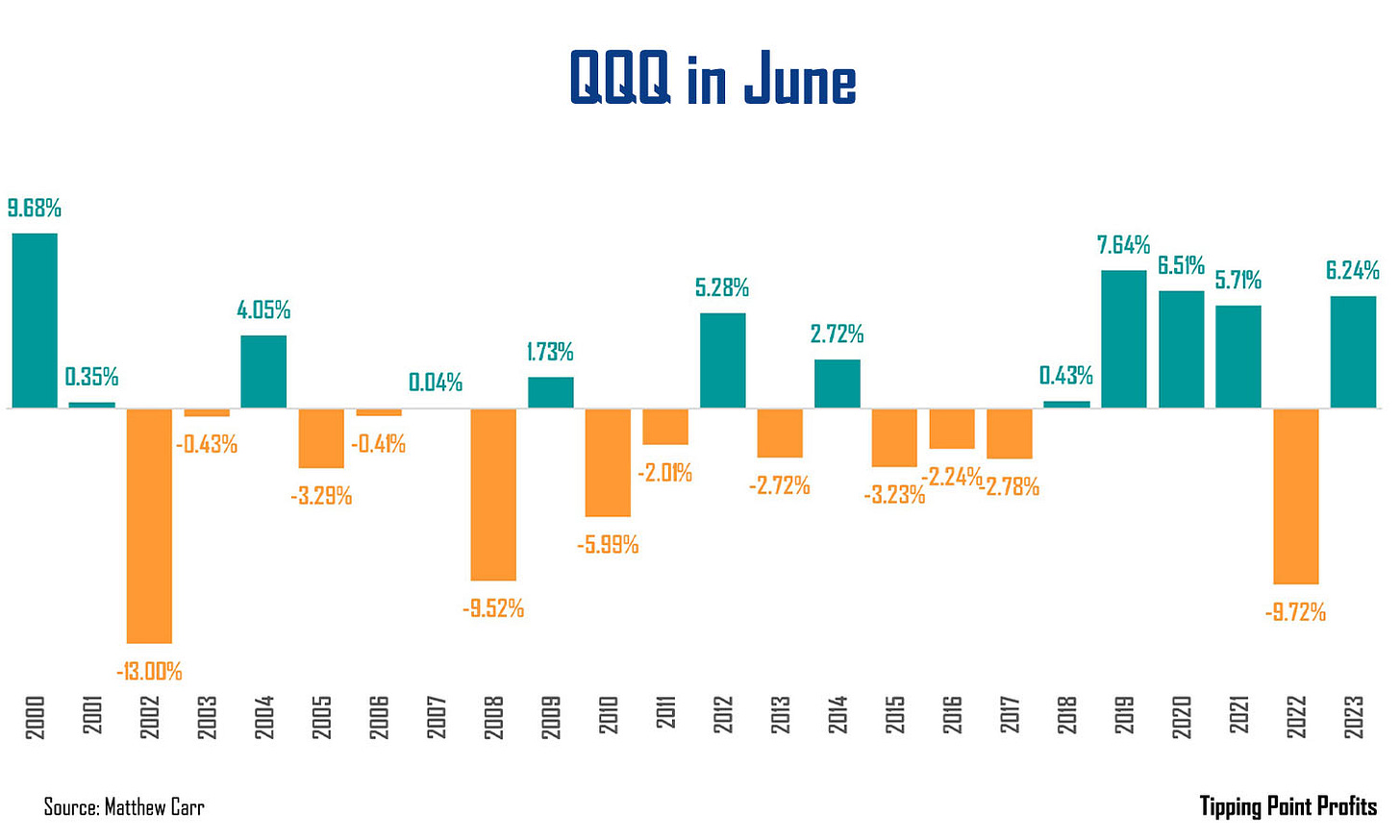

The Nasdaq 100 has ended the month lower 12 times since 2000. That’s a 50% success rate. And that’s slightly worse than Shaquille O’Neal’s career shooting from the free-throw line of 52.7%.

But there is a Hall of Fame twist for tech in June.

When we look more closely, we see the troubling losses in the month took place in 2002, 2008, and 2022. That was the dot-com collapse, the financial crisis, and the 2022 bear market.

So, we know tech in June and a bear market is bad news.

But six of the remaining losses the QQQ suffered in the month were 3% or less.

And then we see that over the past six years, tech’s June tune has dramatically changed… The Nasdaq 100 has gained more than 6% in the month four times! At the same time, scoring gains in five of the last six years.

That’s a positive trend to pay attention to (and why I always consider, five-, 10-, and 20-year trends).

Does that mean we should expect that trend to pay off in 2024?

June and U.S. Presidents

Here’s the good news…

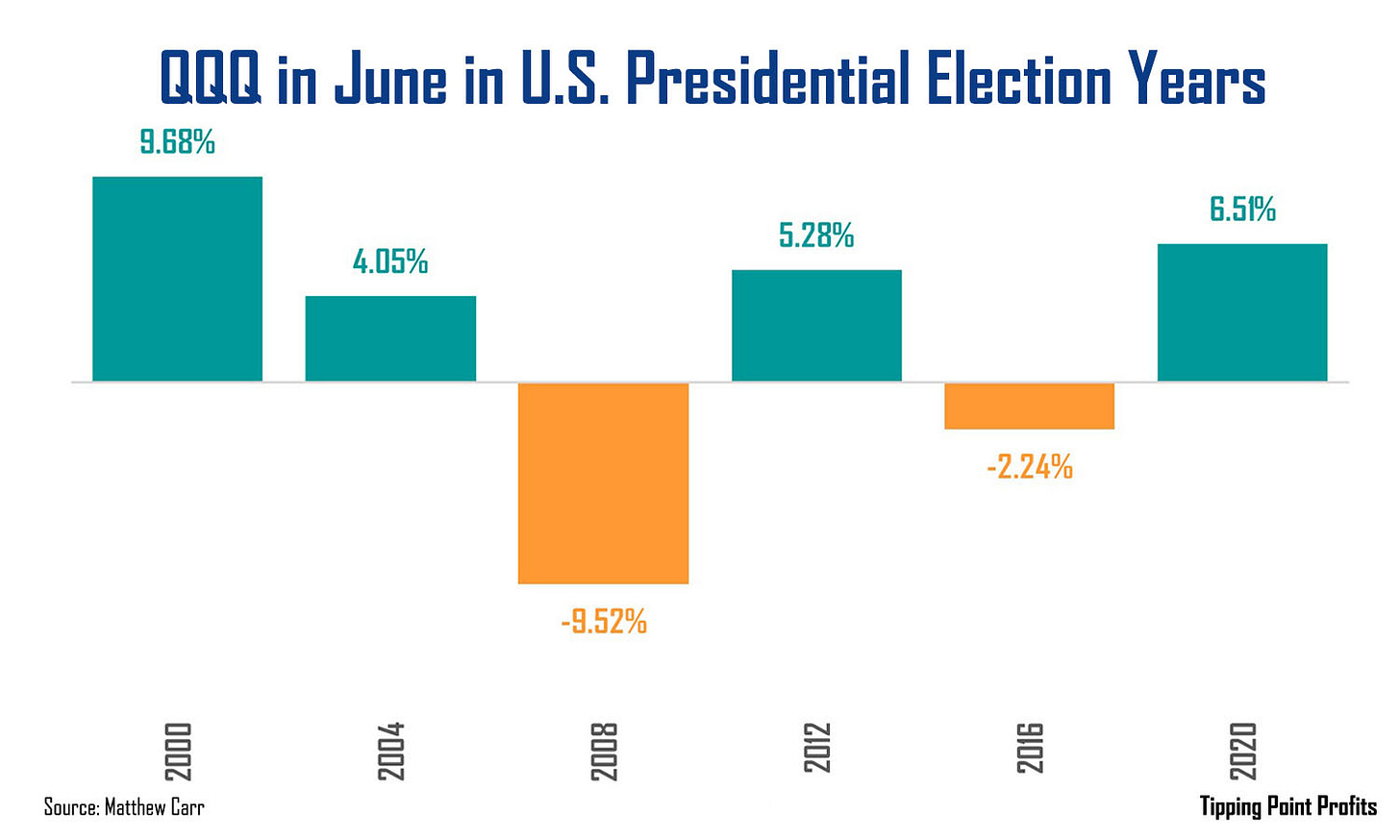

During U.S. presidential election years tech’s performance in June is stronger than normal.

We can see that the QQQ has risen in the month four out of the last six election cycles. And all four of these gains were for at least 4%…

Here’s what’s particularly important to recognize about this trend as well… Since 2000, the QQQ has only closed June with a gain of 4% or more seven times… and four of those were in election years.

This is part of the summer surge we see from tech in the lead-up to a U.S. presidential election… which unfortunately ends in dramatic fashion. But more on that later.

Knowing is Half the Battle

I never worry about the “Summer Lull.” Especially in tech. And I hope you won’t either.

And the reality is, there are always opportunities for assets that are going to outperform during sideways stretches.

For instance, athleisure and footwear do well during the “Summer Lull.” Not every beach is “clothing optional” and runners run all year round.

But at the very least, it’s best to make sure your portfolio is positioned for a bullish run. Especially as some of the best months for tech lie ahead.

This week, we’ve got a handful of earnings reports to watch. I’ll comment on some of those. But the biggest news is Nvidia’s (NVDA) stock-split date. And I’ll break down what to expect next!

Stay tuned!

Ready for June’s sun to shine,

Matthew

Thank you for your insights regarding this time of the year! The data helps!

Very thoughtful! I missed you when you left Oxford Club and am glad to have found you here.