It’s another lazy Friday on the East Coast waiting for the rains to begin… again.

But the markets have been anything but lazy recently.

The Dow Jones Industrial Average peeked its head above 40,000 this week for the first time ever.

The S&P 500 has stormed past 5,300 to new all-time highs.

Meme stocks made a brief comeback with a single tweet from Roaring Kitty.

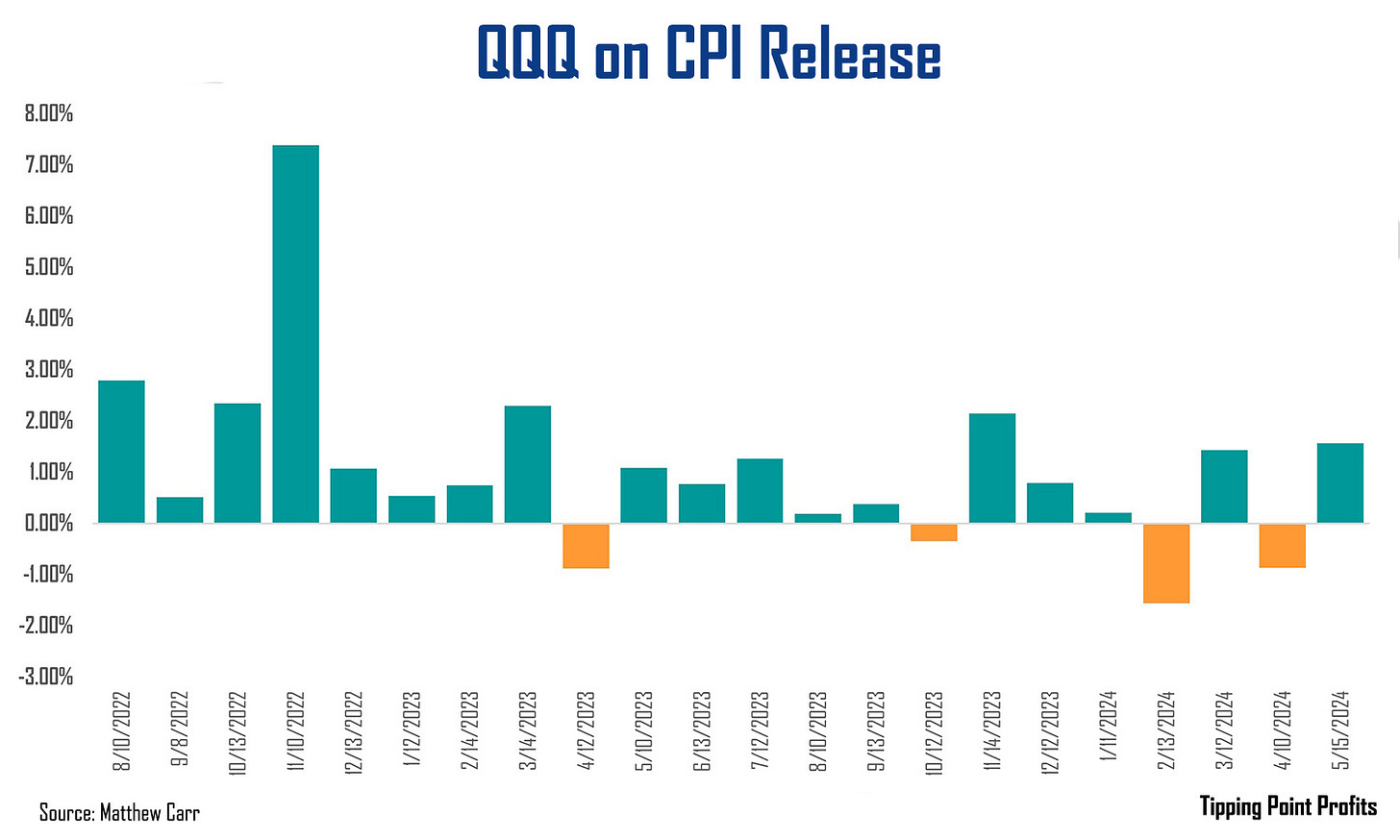

And big tech on the Nasdaq 100 raced higher on this month’s Consumer Price Index release… though that’s nothing new.

We can see that over the past 22 releases, the Invesco QQQ ETF (QQQ) has only ended the day lower four times.

But despite all that, at the moment, there are only four little letters rattling around in investors’ heads. It’s a name on everyone’s tongue. And its prospects are being lobbed back and forth like a hot potato on every mainstream financial news network… Nvidia (NVDA).

The last of the “Magnificent 7” to report earnings.

But we don’t have much longer to wait. So, what can investors expect?

The Trend Says…

Nvidia is the King of Semiconductors.

It sits at the crossroads between artificial intelligence (AI), big data, cryptocurrencies, and anything and everything in need of high-powered chips.

Already in 2024, shares of Nvidia have steamed 88% higher… that’s 8 times the performance of the S&P 500.

And they’re up 29.7% since we last covered the company here.

Over the past five years, shares of Nvidia have gained 2,286%! And the company has been transformed into a $2.3 trillion juggernaut.

But one of the world’s biggest wealth creators in recent years faces its next hurdle on the evening of May 22, when it reports first quarter earnings.

Now, Nvidia’s business is booming. Revenue is projected to jump 277% to $24.57 billion. Meanwhile, earnings are projected to surge 468% from $0.99 per share to $5.57 per share. This is why, despite the meteoric rise in shares, Nvidia’s forward price-to-earnings is a mere 39.06.

For comparison, Tesla’s (TSLA) forward P/E is 69.93, Advanced Micro Devices (AMD) is 46.30 and Texas Instruments (TXN) is 38.17. And these companies offer a fraction of the growth Nvidia does.

(As a note, I always prefer forward P/E to trailing P/E since we want to know the value of the price of shares compared to projected future growth, not historic growth. And I always want forward P/E to be lower than trailing P/E. If forward P/E is higher than trailing P/E, it typically means there’s a problem.)

In May, shares of Nvidia are up roughly 10%. Historically, we are in line with what we see from the chip maker in the month. In fact, shares of Nvidia have only ended May with a loss once since 2016. That was in 2019. And since 2000, shares have gained 22% or more in the month seven times.

So, this is typically a strong month.

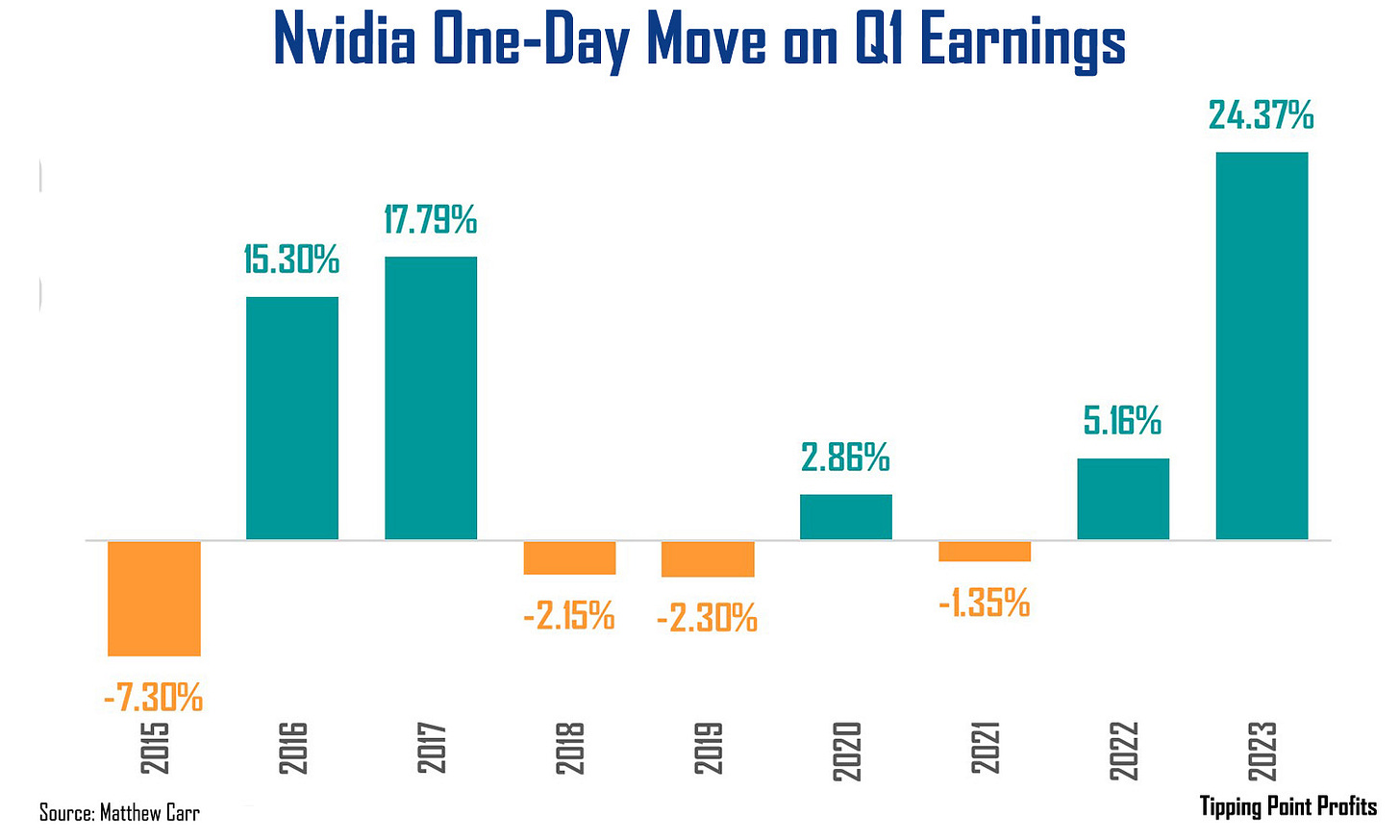

That’s generally do to the fact that shares of Nvidia tend to perform fairly well on first quarter earnings. Since 2015, gains have outnumbered losses…

Our average one-day move on this report is 5.82% since 2015.

Now, the current projected move from the options market is +/- 9%. That means a move up to $1,015.30 or a move lower to $848.15.

During the past nine years, we haven’t seen a move lower of that size. Though, we’ve seen three gains much larger than that. That’s something to keep in mind.

It’s also worth noting that over the past four earnings releases from Nvidia (going back to first quarter 2023) our average one-day move is 9.52%.

Nvidia has been my No. 2 AI stock to own behind Microsoft (MSFT). And it’ll be the talk of the talking heads until its release and beyond.

I wouldn’t be surprised to see shares of Nvidia ease back prior to first quarter results. Very similar to what we saw before the company’s fourth quarter release in February. But the trend here on first quarter earnings has been quite positive… not as positive as second quarter results in August. But that’s a story we can revisit another time.

Note: We are nearing the end of first quarter earnings season. If there are any companies you want me to highlight before they report in the next week or so, drop their ticker in the comments and I’ll try to send out a VertEA analysis beforehand!

Still bullish on Nvidia,

Matthew

Hi Matt,

I love your work and have been reading and watching your work since 2017 at the Oxford club. Keep up the great work! I loved what you shared above and I would for you to share your view on SNOW and its upcoming earnings

Hey Matthew I was wondering what you thought of DECK? They are reporting on the 23rd.

Thanx

Greg