“Hey Matty! I’m riding this NVDA train! How much track do you think is left?”

That was a text message I received from a close friend this week.

Since all of you are friends, I figured my answer would be of interest to the broader Tipping Point Profits audience!

So, this week, we’re going to dive into whether to buy, hold, or sell Nvidia (NVDA)…

AI and Beyond

Every tech company wants to be at the leading edge.

There are plenty of risks… but the rewards are measured in the tens of billions of dollars.

Well, Nvidia finds itself the belle of the ball at not one, but two lucrative tech trends. And that’s offering eye-watering upside.

The first is artificial intelligence (AI).

The semiconductor and GPU maker currently controls 85% of the generative AI chip market. This means, whatever scraps are left over, whatever orders it can’t fulfill, are fought for between Advanced Micro Devices (AMD) and Intel (INTC).

And this is a rapidly growing market.

Projections are that generative AI chip demand will surge from $43.87 billion in 2023 to $667.69 billion by 2030. That’s a blistering compound annual growth rate (CAGR) of 47.5%!

Of course, AI chip demand has propelled the 425.8% gain we’ve seen in Nvidia shares since November 1, 2022. Remember, OpenAI’s launch of ChatGPT took place on November 30 of that year.

So, on the wagers to be made on the future of AI… Nvidia would be ranked in my top two to own. The other is Microsoft (MSFT) for its $13 billion investment in OpenAI and the subsequent profit-sharing deal.

The second tech trend that the chip maker is profiting from is cryptocurrency.

Nvidia’s GPUs are favored by crypto miners. And the company even launched its dedicated CMP Hx series specifically for mining.

As I’ve covered many times over the past year, 2024 will see the next Bitcoin reward halving. This will take place on April 22. Bitcoin has already crossed the $50,000 threshold and is outperforming the S&P 500 by three-fold year-to-date.

The success of Bitcoin – and subsequent cryptos – leads to a rise in Nvidia shares.

But that’s the view from 30,000 feet. What should investors expect in the short term?

February’s Warm Reception

Shares of Nvidia are currently up almost 17% in February.

I wrote a couple of weeks ago that if we see tech stumble in the month, not to worry. Big tech tends to get tripped up this time of year. But that’s not universal.

And February is actually one of the strongest months for Nvidia shares…

Since 2000, they’ve only closed the month with a loss seven times. That’s currently equal to the number of times they’ve gained 10% or more in the month. The only stretch that’s stronger for shares is November. So, keep that in your back pocket and it’s easy to remember… Nvidia in November.

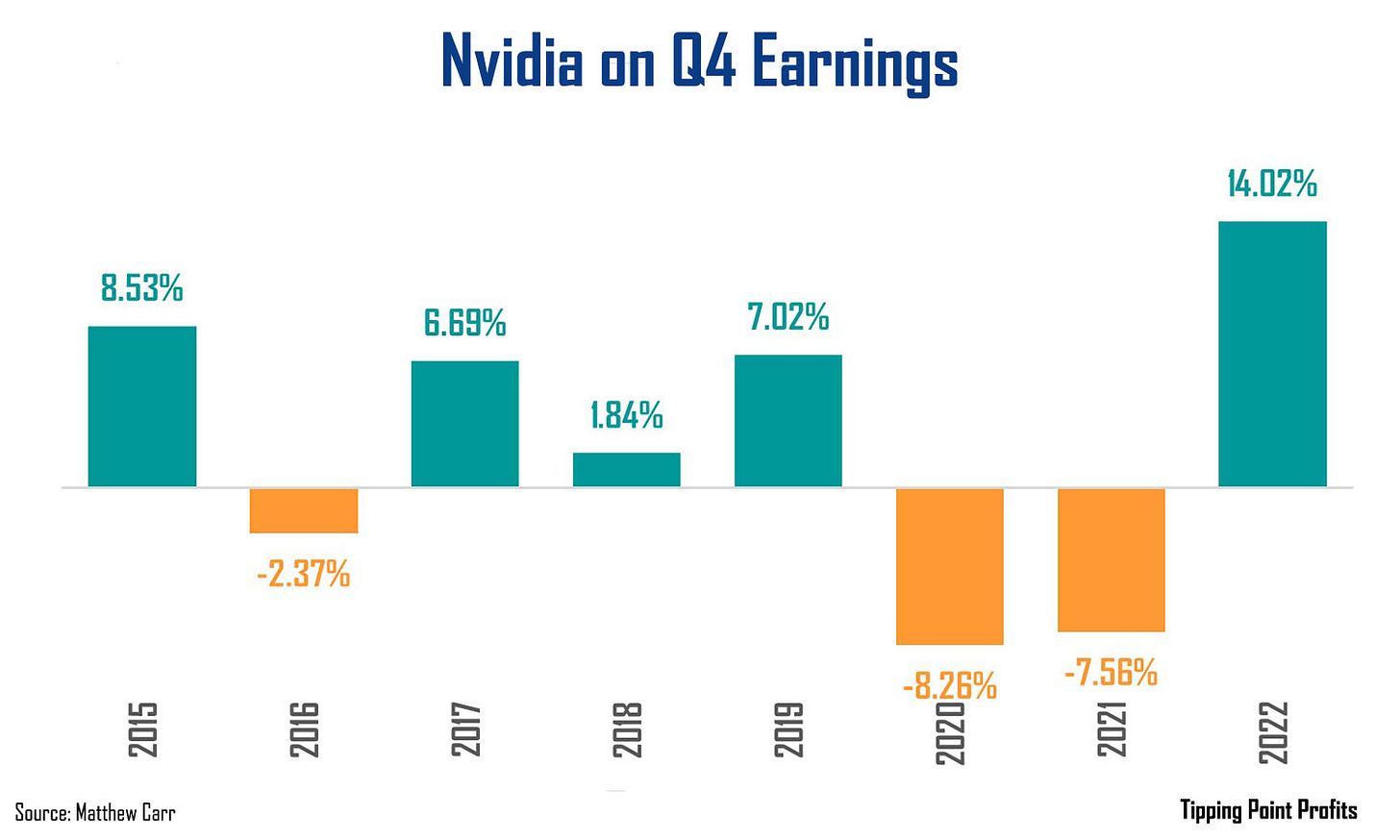

Now, part of the reason GPU maker’s shares perform so well in February is fourth quarter earnings. Since 2015, shares have risen on this report five times…

We can also see from the chart that the moves higher tend to be substantially.

Nvidia will report fourth quarter earnings this week on February 21.

Expectations are for the company to see a 236.8% increase in revenue to $20.38 billion. And analysts are looking for earnings to grow 418% from $0.88 a year ago to $4.56 per share.

What’s amazing is, this is an acceleration of the 206% revenue growth to $18.12 billion Nvidia reported in the third quarter.

So, even though Nvidia is a $1.8 trillion company, its business is rocketing higher at a triple-digit pace. That’s vital to keep in mind. Obviously, it can’t keep it up forever. But for the year ahead, Wall Street expects the GPU maker to earn $21.56 per share with more than $95.5 billion in revenue.

Those are big numbers. In fact, that revenue total is more than AMD and Intel are expected to report… combined. And a semiconductor reporting profits of $21.56 per share is breathtaking. Which brings me to my final point on Nvidia…

These Shares are Too @#&?* High!

Shares of Nvidia aren’t cheap.

They’re currently trading above $726.

And they’re setting new all-time highs.

But here’s the deal… Nvidia has a rich history of spreading the love. It likes to keep its shares within reach of employees and Average Joe investors.

To do that, it’s undergone several splits of the years.

The last time shares were trading near this level, in 2021, Nvidia announced a 4-for-1 stock split.

We had a 3-for-2 stock split in 2007… A 2-for-1 stock split in 2006… Another 2-for-1 in 2001… And again in 2000.

The great thing about stock splits is they lead to outperformance.

Stock splits are to be celebrated!

There isn’t one, but two different studies by David Ikenberry that showed companies that underwent 2-for-1, 3-for-1, and 4-for-1 splits outperformed the market by an average of 8% over the next year. Longer term, these shares outperformed the market by an average of 12% three years post-split.

The reason is simple… Those shares that many investors considered too expensive were suddenly attainable. So, when a company reduces its share price by half or more, it adds a second wave of momentum. And that helps reignite the wave that carried those shares to new all-time highs in the first place.

Plenty of investors want to snag a piece of Nvidia’s AI – and cryptocurrency – boom. But $726 per share is too rich for their blood.

I’m not saying Nvidia most definitely will announce a split. But I wouldn’t be surprised if we didn’t hear one from them sooner than later.

With the mix of long-term and short-term catalysts, Nvidia is still a buy in my book. There’s still a lot of mileage ahead on this track. And until someone can invent a better chip than Nvidia, the future of AI is dependent on the company.

Even if you’re on the right track, you’ll get run over if you just sit there,

Matthew Carr

Matt, I loved you over at Oxford and religiously followed your seasonal comment and advice. Also used your "V" Score (hope I'm close on the name) before many purchases.

You need to get over to MTA as a regular contributer with your buddies Karim and Bryan!!!

Matthew always gives the best information on Company's your interested in try him out!!