Aventador.

Diablo.

Huracan.

Islero.

Reventon.

These are legendary fighting bulls (as well as models of Lamborghinis). But in 2023 and 2024, investors have been scoring big on a bull of their own… one that keeps charging, eviscerating naysayers and shorts.

Artificial intelligence (AI).

This is projected to have a $15.7 trillion impact on the global economy over the next decade. Simply because it will – and is – touch everything in our lives.

Already, tech’s biggest names have delivered monster returns thanks to AI.

Over the past year, shares of Microsoft (MSFT) have gained 33%... Shares of Alphabet (GOOGL) have gained 44%... Shares of Amazon (AMZN) have surged 59%... Meanwhile, Meta Platforms (META) and Micron (MU) have jumped 90%.

But the true bull riders have been chip makers.

For instance, Nvidia (NVDA) shares are up more than 200%... And Super Micro Devices (SMCI) shares have skyrocketed more than 430%!

Now, on Friday, I laid out what to expect from the mother of all AI semiconductors, Nvidia, when it reports first quarter earnings on May 22.

But there’s another AI name reporting that same day as well. And there could be an opportunity for traders, as well as some peace of mind for curious long-term holders,

Melting Growth

Snowflake (SNOW) gained widespread attention when it IPOed in 2020.

The big data cloud services provider has seen tremendous growth. Its quarterly revenue has grown from $133 million to $775 million. And its partner ecosystem now includes major names from tech to staples. We’re talking Microsoft and Micron, Nvidia and Okta (OKTA), as well as Walt Disney (DIS), Hershey’s (HSY), Kimberly-Clark (KMB), and PepsiCo (PEP).

But despite that, it has been easy sailing.

Shares of Snowflake are down 8.5% over the past year. And since going public, they’ve shed more than 32% of their value.

A lot of that has to do with the slowdown in year-over-year growth.

In Snowflake’s fiscal year 2024 fourth quarter, reported back on February 28, total revenue grew 31.58% year-over-year. That’s nearly a third of the growth it saw two years prior.

For the company’s upcoming fiscal year 2025 first quarter, revenue is projected to be $785.87 million. That would be an increase of 26.02% from the $623.6 million Snowflake reported a year ago. And for the second quarter, Wall Street expects the cloud services provider to report $826.26 million, up 22.59% from the $674.02 million it reported 12 months earlier.

Of course, no company can see triple-digit growth year-over-year, quarter by quarter forever. But we can see this slowdown in growth is a headwind.

Now, when Snowflake reported fourth quarter results at the end of February, it beat Wall Street expectations. And it’s topped analyst estimates on both earnings per share (EPS) and revenue for several quarters in a row.

But here’s where VertEA provides an insight others may miss…

A Watered-Down Response?

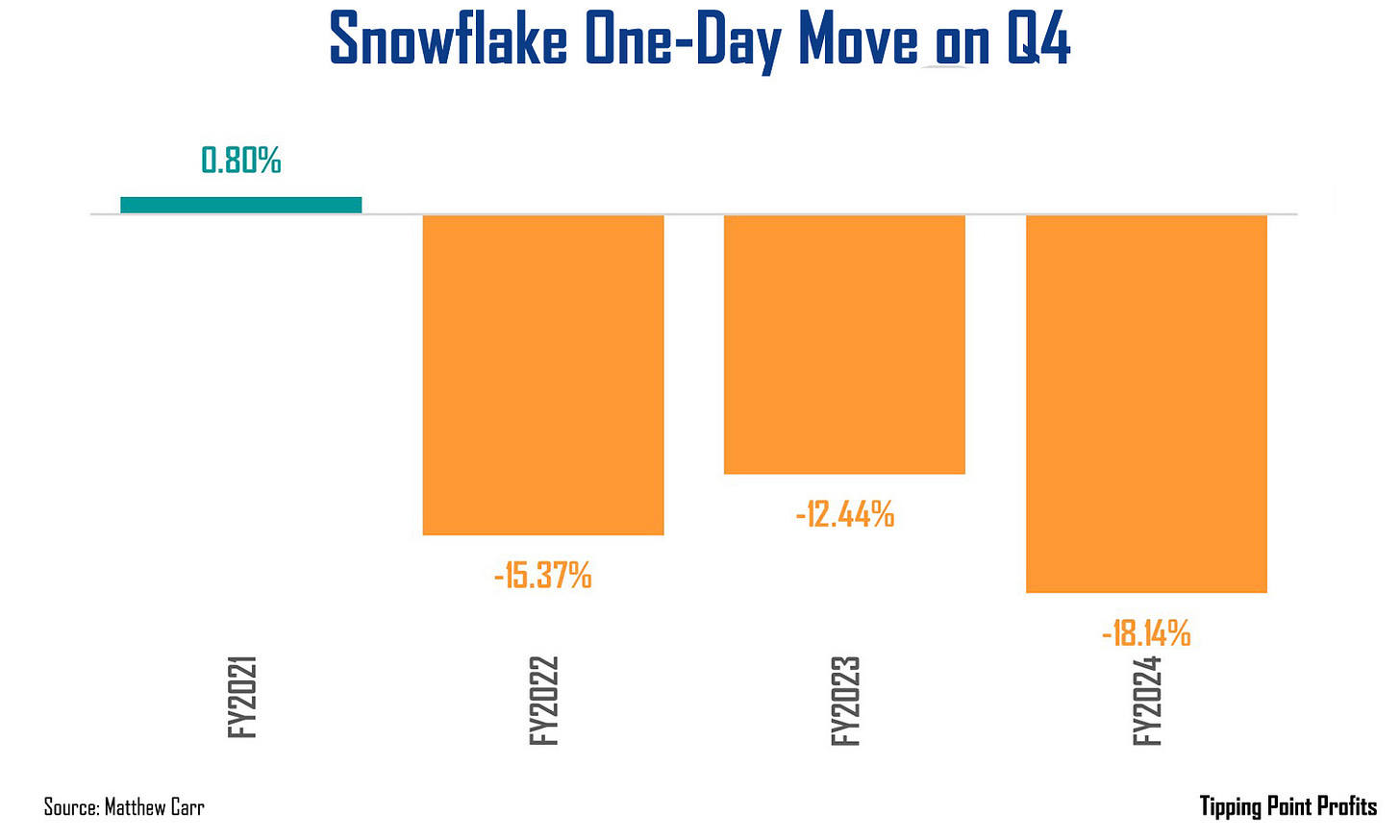

You see, shares of Snowflake plummeted more than 18% on its fiscal year 2024 fourth quarter release. An unwanted trend we’ve seen consistently since the company went public…

Shares are averaging a one-day loss of 11.29% on fourth quarter results. This earnings reaction is the primary cause that March is the worst month of the year for shares. And this year’s 18% dip is the main reason Snowflake’s shares are in the red in 2024.

So, that’s a trend worth remembering… whether you’re looking to trade short-term or buy on dips for the long-term.

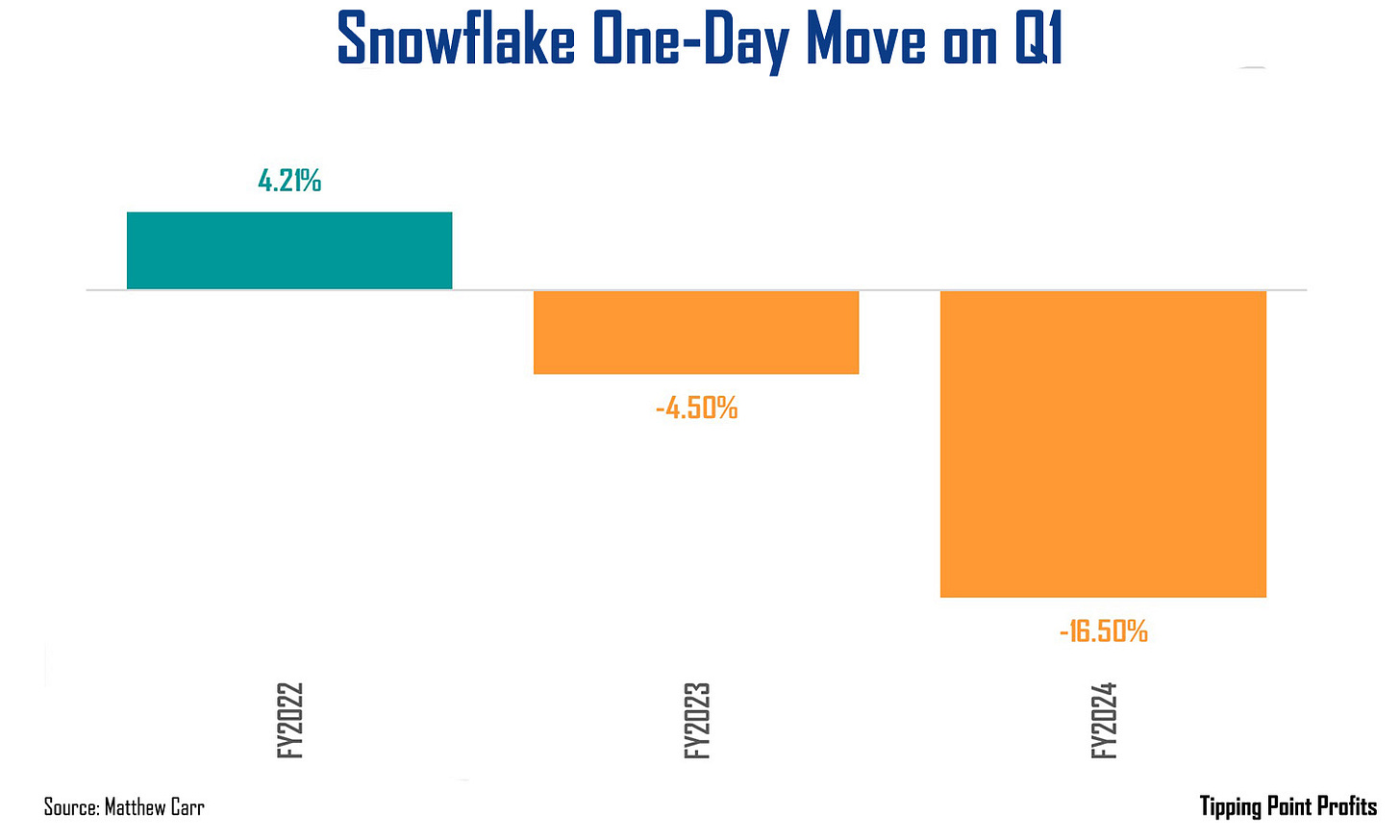

Now, for Snowflake shareholders, unfortunately, there’s not a lot of data for first quarter reaction. But the data that there is doesn’t paint the most welcoming of pictures.

Shares of Snowflake have dropped on two of the company’s three first quarter releases…

What’s worth noting is the trend has followed the reaction to fourth quarter results. So, since going public, shares are averaging a one-day loss of 5.6% on first quarter earnings.

The options market is forecasting a 9.8% move on this release. That would take shares to $181.21 or down to $149.02.

The VertEA trend says it’s likely to be lower than higher.

The upshot is, after first quarter earnings, Snowflake shares enter three of their best four months of the year – June, July, and August. It’s just often a bumpy ride before then.

AI has sparked a stampede higher in the markets over the past year. And it’s triggering wild rides on earnings as companies exceed or fail to live up to the hype. Snowflake is just one of several AI names set to report. Rest assured bulls and bears alike will be tuned in… each hoping to ring their respective registers to the tune of a Countache or Murcielago. Though, the trend says to side with the bears… albeit momentarily.

Feeling chilly on this Snowflake,

Matthew

P.S. Thank you, Yosef for the recommendation! Hope it helps!

Thank you so much Matt, this is very helpful !!