Well, today’s the day.

And those investors who were patiently sitting on the sidelines are ready to pile in.

Last month, one of the largest stocks in the market, Nvidia (NVDA) became the latest S&P 500 component to announce a stock split in 2024. Today, it’s trading at the post 10-for-1 levels.

Now, for long time Tipping Point Profits readers, this isn’t a surprise.

We expected it.

And this is a moment to be embraced. Especially for those who were left waving from shore as this millionaire-minting ship set sail two years ago.

But here’s what investors need to know before they crack open their wallets and drop a crisp new C-note on this semiconductor powerhouse.

A Trend So Rare You Can Count with One Hand

There was a time stock splits were all the rage.

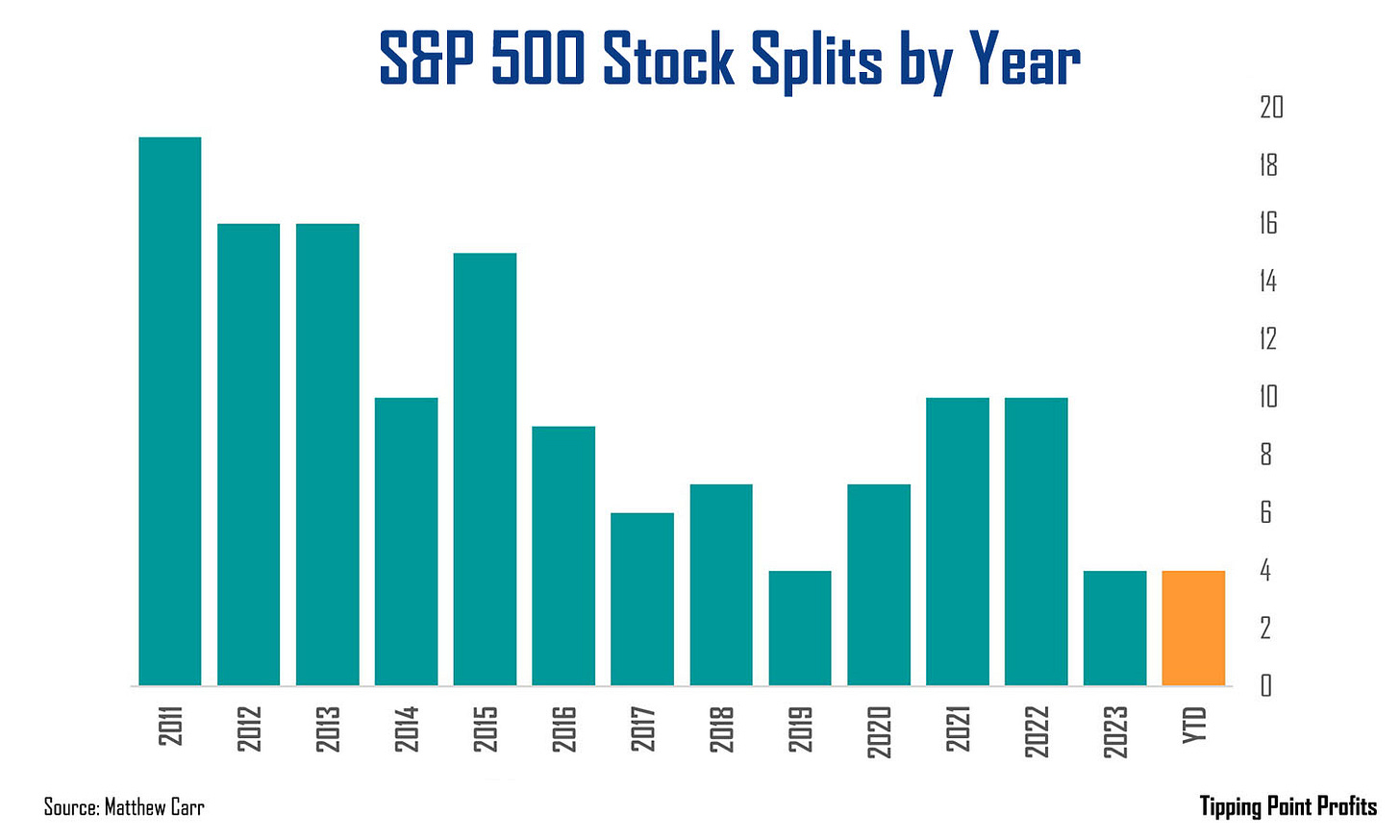

But they’ve gone nearly extinct.

In fact, the announced splits for 2024 we can count on one hand…

Cooper Companies (COO)…

Walmart (WMT)…

Chipotle Mexican Grill (CMG)...

And then Nvidia.

They’ve become uncommon, especially among the elite S&P 500.

In fact, the number of index components that have announced forward splits (not reverse splits) has dropped 79% since 2011!

Back in the 1980s, there was an average of 44 splits per year. During the dot-com boom from 1998 to 2000, these rocketed to an average of 91 per year. Stocks were doubling nearly every six months!

In 1997, 102 S&P companies conducted splits.

But by 2019, this had tumbled to a mere 4. And that’s the same level we’re at five years later.

Now, there are a few arguments as to why stock splits approached near extinction.

One is that the market has been controlled by institutional investors, not retail investors. I’ve long argued as the market has become more volatile, a higher share price tends to create stability.

The second argument is made that companies maintain a high share price because they’re less confident about the future.

But whatever the cause, the result is quite clear. There are now 288 companies on the S&P 500 with share prices above $100.

Of those, 53 sport hefty price tags above $400. That’s more than 10% of the entire index!

Not to mention, there are 10 S&P 500 components with quadruple-digit share prices.

All of this translates into extremely expensive stocks. The average share price of an S&P 500 stock is more than 480% higher than the $36.53 it was in 2003.

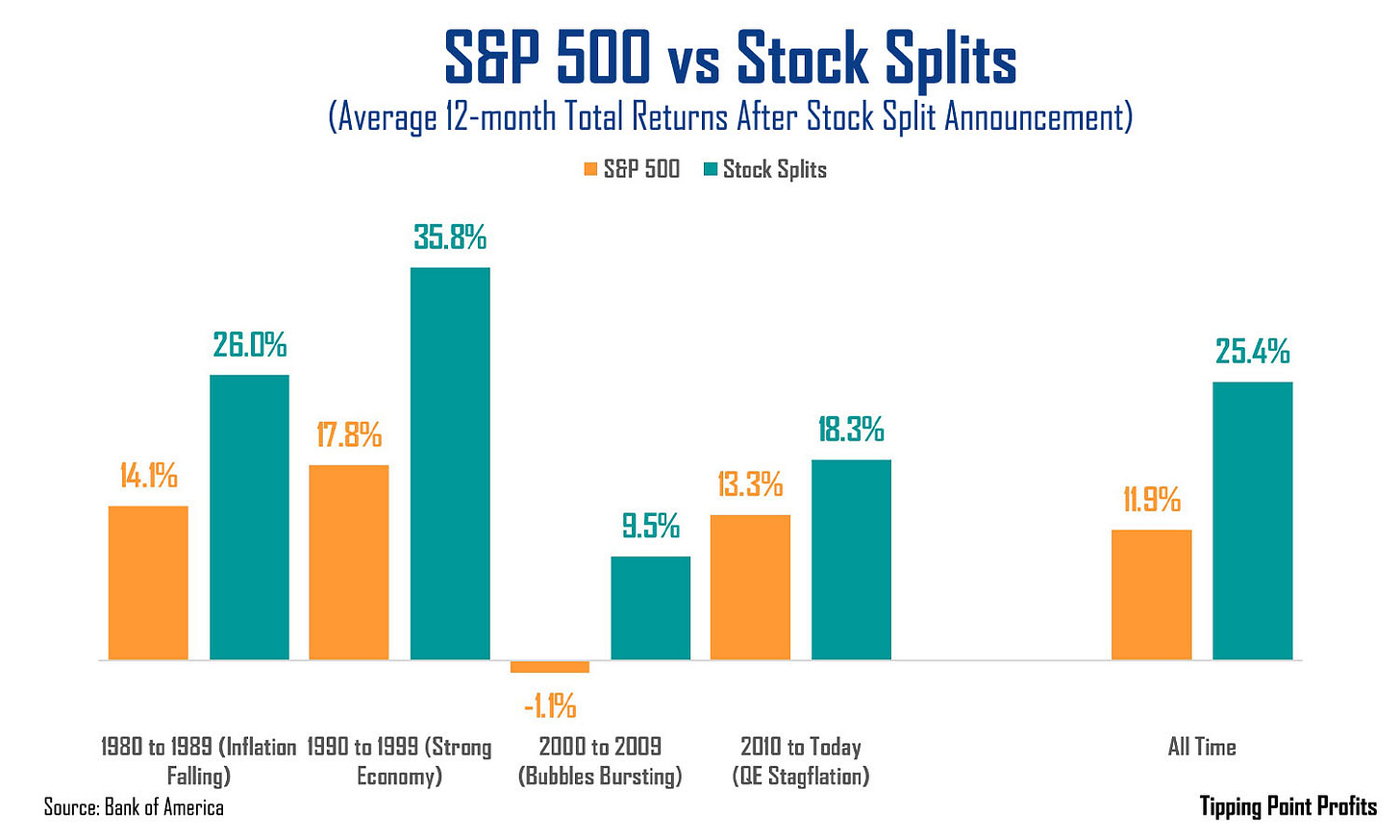

But all that really matters when it comes to splits is… They deliver outperformance.

And not by a little.

These Shares are Too @#&?* High! Revisited

Back in February, I wrote:

“Shares of Nvidia aren’t cheap.

They’re currently trading above $726.

And they’re setting new all-time highs.

But here’s the deal… Nvidia has a rich history of spreading the love. It likes to keep its shares within reach of employees and Average Joe investors.

To do that, it’s undergone several splits over the years.

The last time shares were trading near this level, in 2021, Nvidia announced a 4-for-1 stock split.

We had a 3-for-2 stock split in 2007… A 2-for-1 stock split in 2006… Another 2-for-1 in 2001… And again in 2000…

I’m not saying Nvidia most definitely will announce a split. But I wouldn’t be surprised if we didn’t hear one from them sooner than later.”

Nvidia shares went on to set even more all-time highs. And instead of announcing a split during its fourth quarter earnings release, it waited until its first quarter.

Now, a company’s share price surges because business is booming (unless it’s GameStop (GME)).

Investors, both small and large, want a piece of the action. But once share prices cross a certain threshold, they are seen as too expensive to smaller investors.

A company’s success ultimately prices some investors out of participating.

This is why stock splits are key. And why they tend to deliver outperformance.

Two separate studies by David Ikenberry – on 1,000 companies that did 2-for-1, 3-for-1, and 4-for-1 splits – found these shares post-split outperformed the market by 8% in the year following the split. And over the longer term, they fared even better, outperforming by 12% over the ensuing three years.

In its own research, Bank of America (BAC) found that, “Average returns one year later are 25% vs. around 12% for the broader market. Splits seem to be bullish across all market regimes, something management teams consider if shares look too expensive for buybacks.”

That means, stocks that split have outperformed the market by more than twofold since 1980.

By no means is that a trivial amount.

Part of the reasoning for this outperformance is those expensive shares – which many investors want to own – are suddenly more affordable. And when companies cut their share price in half – or more - it helps continue that momentum that led to the share price hitting such high levels in the first place.

It triggers renewed investor interest.

It reignites investor demand.

For decades, stock splits have declined to the point of near extinction. They are almost as rare as unicorns. And we may likely never see stock splits return to the levels we saw in the 1980s and 1990s. But that means, when they do occur, we can’t be afraid to take advantage. We can’t be afraid to rush out and grab a piece of the action…. Whether that’s Nvidia, Cooper, Walmart, or Chipotle.

Looking to add at these levels,

Matthew

Stock split trend is interesting, Matt ...

Been telling my local pizza joint to advertise their pies having 16 slices. They finally did it and sales ramped up by a factor of 46%. My Tweet on 5/22

@paulbovi

May 22

Most novice investors resist buying a hi priced stock tho it is market cap (shares outstanding x share price) that determines how expensive it is. Conversation I've had repeatedly, sometimes w the same person. Here is Chipotle bought in Jan at $2285, now 3172. #investing