3 Tesla Trends to Tackle

On the farm, “false spring” is in full bloom.

A week ago, the temperatures were in the teens, and we were blanketed under several inches of snow.

On Friday, it was 71 degrees. And nature is finding itself a might bit confused. My wife and I had lunch on the deck – short sleeves and no shoes – and watched a fat-bottomed bumble bee search for flowers whose blossoms aren’t due until months from now.

But the untimely spring weather is a pleasant relief from our bitter, brief onslaught of winter.

In the markets, equities are as mildly confused as that bumble bee.

The January flop I warned about was as brief as our winter. Artificial intelligence and a U.S. economy that refuses to hibernate have kept shares warm.

But my focus this week is on a divisive name… in a divisive industry… led by a divisive man. The question is, are the haters going to have more to celebrate? Or are the fanatics being gifted an opportunity they haven’t seen in eight months?

Tesla’s No Good, Very Bad Day

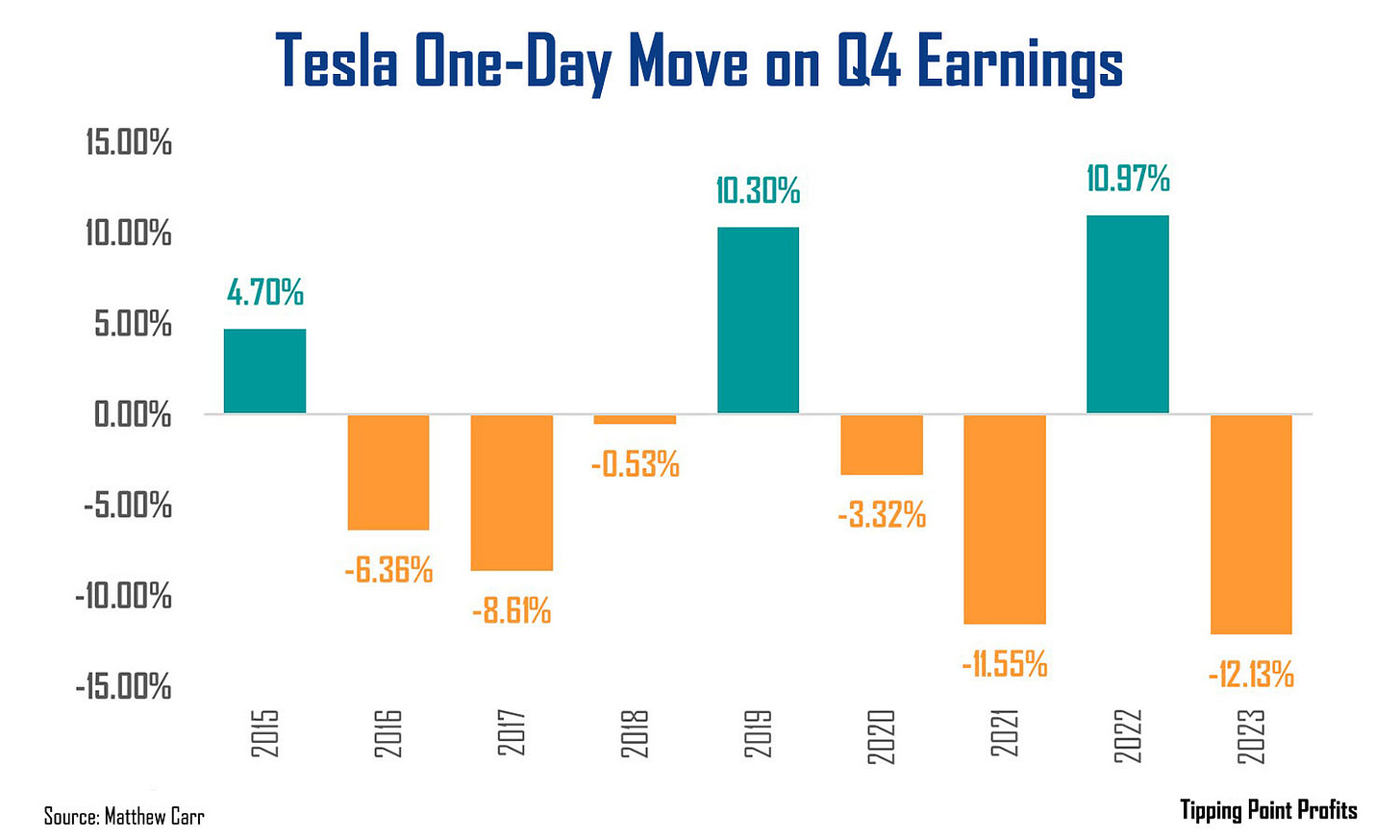

Last Thursday, shares of electric vehicle (EV) maker Tesla (TSLA) tumbled more than 12%.

The move marked the largest one-day drop on earnings since the second quarter of 2019. But more significant, it was the fourth consecutive earnings report where Elon Musk’s crown jewel has tumbled more than 9% on quarterly results.

But I’ll be honest… the most recent move isn’t that surprising for a variety of reasons.

First, Tesla has an unattractive trend going into fourth quarter results. As we can see, shares have ended lower on this report six times out of the last nine years…

Wall Street always has high expectations. And it’s easy for Tesla to come up short on profits, sales, deliveries, or forward guidance. EVs require a complicated supply chain that’s prone to price swings in necessary rare commodities and semiconductors.

In its latest release, Tesla reported record deliveries of 484,507 vehicles, which topped what analysts were looking for. But earnings came in at $0.71 per share, below expectations, and revenue came in at $25.17 billion, also below expectations.

The company then warned, “vehicle volume growth may be notably lower than the growth rate achieved in 2023.”

All of this culminated in a very dark day in an already dark start to the year for the company.

Shares of Tesla are now down nearly 27% so far this month.

This is their worst monthly performance since December 2022, when they tumbled 37.5%.

But it’s likely to get worse before it gets better… all thanks to Tesla’s strategy of a race to the bottom and short-term trends.

Slash and Burn

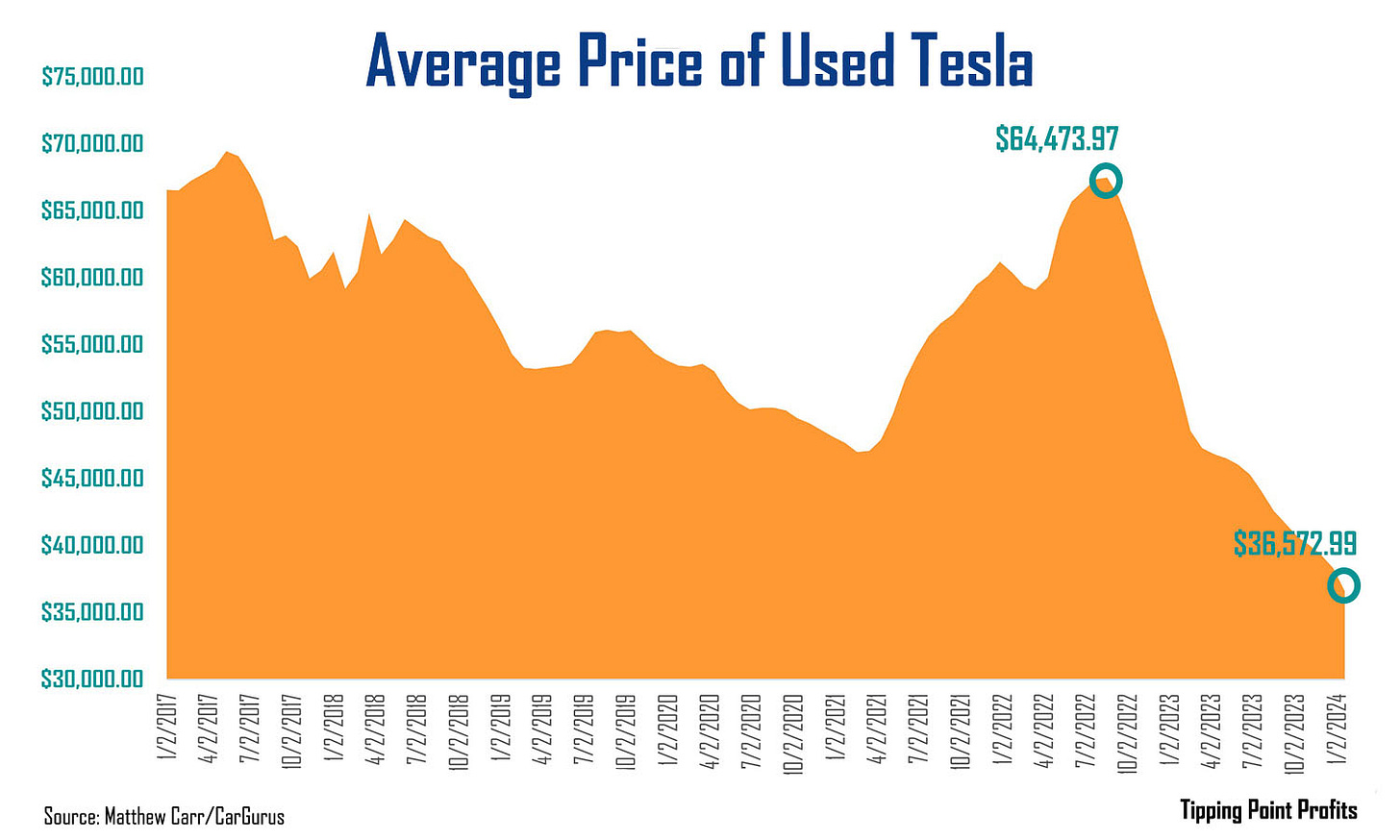

To kick off 2024, the price of a used Tesla has tumbled to its lowest level ever.

But even more striking is how rapidly the bottom has fallen out of this market over the past 15 months…

The average price of a used Tesla rallied during the pandemic to a peak of $64,473.99 the week of August 18, 2022, according to data from CarGurus (no relation to yours truly).

This has since plummeted 43.3% to $36,572.99!

Tesla has been engaged in a price war with every other major EV maker on the planet. And has been slashing prices for little more than a year. In fact, the company has cut the average price of the Model Y in the U.S. by 26.5% over the past 12 months.

Now, the cost to produce a Model Y has declined as raw materials costs have dropped. In the fourth quarter, Tesla spent roughly $36,000 out of pocket to produce a vehicle. That’s down from over $39,000 a year earlier.

But every price-cutting strategy comes with compressed margins. And with see that squeeze taking place. In the first quarter of 2022, Tesla’s automotive gross margin was 32.9% and total GAAP gross margin was 29.1%. By the fourth quarter of 2023, total GAAP gross margin had tumbled to 17.6%.

So, what we’ve seen since its peak in 2022, profits are falling even as revenue continues to push higher.

Tesla made EVs cool… even an aspirational luxury item even.

But the competition is heating up.

Now, Tesla’s Model Y and 3 were the best-selling EVs globally in 2023. And Tesla is the largest EV manufacturer in the U.S. producing nearly 1.85 million vehicles last year, up 35% from 2022.

But China’s BYD Company (BYDDY) is the largest EV maker in the world. It sold 1.57 million EVs in 2023 – a 73% year-over-year increase – as well as another 1.44 million hybrids. China has a booming EV industry. But beyond that, China has surpassed Japan as the largest auto exporting country… all thanks to EVs… as well as a friendly relationship with Russia.

Of course, we can’t forget the host of other automakers who have jumped into the EV fray. There’s BMW (BMWYY) Fisker (FSK), Ford (F), General Motors (GM), Honda (HON), Hyundai (005380.KS), Mazda (MZDAY), Mercedes-Benz (MBGAF), Mitsubishi (8058.T), Nissan (NSANY), and Toyota (TM), just to name a few.

Their race is to steal even more market share from those two dominant manufacturers, BYD and Tesla. And it appears to be working. Telsa’s share of the U.S. EV market has fallen to the lowest level on record – roughly 50% - even as American EV sales hit record highs.

Now, there is serious money at stake... In 2023, more than $561 billion in EVs sold. And that’s projected to rise to more than $906 billion by 2028.

But to keep competitors at bay, Tesla is in a race to the bottom. And that will continue to pressure margins. The question is, how long can it keep it up and keep investors happy?

Buy Now or Wait for Spring?

Back in February 2023, Tesla was one of the companies I highlighted in my “Year of the Dogs” essay. That those worst performers of 2022, like the EV maker, Meta Platforms (META), and Warner Bros. Discovery (WBD) would be big winners last year.

Tesla and Meta shares trounced the S&P 500. And Warner Bros. Discovery – after a hot start – ended the year in line with the S&P.

Well, what to do now with the company that made Musk the world’s wealthiest person?

Fund manager David Baron – who runs Baron Focused Growth Fund – sees Tesla shares soaring by 550% by 2030. And he believes SpaceX’s valuation will triple by then.

But in the shorter term, let me share two trends of note…

The first is, since going public, Tesla shares have only delivered a negative annual return twice: 2016 and 2022.

That’s an impressive streak.

But in both of those years, the EV maker’s shares ended the month of January down more than 17%. In fact, they were the only two years that saw such sharp pullbacks in January.

As a reminder, shares are down roughly 27% so far.

Now, there have been two other years Tesla shares have ended January in the red: 2011 and 2015. The EV maker’s shares ended up only gaining 6.4% and 7.7% in those years.

Those are severe underperformances for a stock that has posted three triple-digit annual returns and another five of 36% or more since IPOing in 2010.

Also, in three of the four years Tesla shares have dropped in January, the selloff continued into February. And the one positive February gain after a January rout was a mere 1.68%, though that was after shares crashed to a new 52-week low.

So, if the trend is our friend, we’re likely in store for another pullback from this level.

Second, Tesla shares have fallen on first quarter earnings – reported in April – seven times in the last nine years. (I’ll revisit this once again when we get closer to that date).

All of this paints a short-term bearish picture for Tesla. Shares had entered 2024 in need of a brief winter. And they got one. One that’s likely expected to continue for another few weeks.

But for Musk fans and Tesla bulls this is a name to watch. With the potential to snag some shares at new lows and ride higher from there in the coming months. By 2030, due to a variety of global measures to reduce internal combustion engines, EVs will own a substantial share of the automotive market… and Tesla will continue to be a major player. The one benefit the company has is its margins were so fat on EVs, it could implement severe price cuts and still be profitable.

Beyond that, shares have delivered only two annual negative returns… so far. Though if the trend holds, we could see a third in 2024. But when holding for the long term, we want to buy at lows… not highs.

So, if you haven’t snagged a piece of Tesla yet, your ideal entry could appear during the next several months.

Waiting for “true spring” to appear,

Matthew Carr

P.S. The MoneyShow organization just released its blockbuster annual publication, MoneyShow’s 2024 Top Picks Report: 90+ Stocks to Buy for 2024. The gala report includes timely and insightful recommendations from your very own Matthew Carr, plus dozens of investment ideas from friends and colleagues at several other publishers and independent research firms.

Best of all: We’ve arranged for you to receive a FREE copy! Simply CLICK HERE to access it immediately.

This year’s edition includes 91 recommendations from 53 contributors. They run the gamut from conservative, quality blue chips designed to generate safe and steady returns to high-growth stocks with massive potential upside. You’ll also find several non-common-stock investments in this year’s report. That includes ETFs and other vehicles designed to help you profit in multiple sectors, asset classes, and investing styles.

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.

Hi Matthew - interesting article. My POV is that the EV craze is peaking. So, I view TSLA as continuing to be risky. I made a lot of money with you when you were at Oxford, and for that I think you.