You can feel the panic start to creep in…

Since September 15, the Invesco QQQ ETF (QQQ) has shed more than 5.5%.

The S&P 500 slipped 5%.

And most of the damage has occurred since September 20…

But that’s precisely the kind of swoon we told investors to prepare for. Even down to the day.

For reference, this marks the sixth decline in September for “the Qs” in the last seven years. Not to mention the fourth consecutive year where the Nasdaq tumbled 6% or more in the month.

This is why I began recommending in August to tighten stops and be patient. Pain was coming.

Now the question from clammy-palmed investors is: What’s next?

Are there more storm clouds on the horizon or some glorious autumn, sunny days?

Well, let’s find out…

Forget the September Scare

October is home to one of my favorite holidays: Halloween.

But it’s not just ghouls and ghosts that fill investors with fright during this spooky month. The markets do too.

This legend is so ingrained that even in Mark Twain’s Pudd’nhead Wilson, the most famous line is about investing.

David “Pudd’nhead” Wilson warns, “October. This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.”

For centuries, October has stood out as an ominous month for investors.

And not without reason.

A half dozen of the worst declines in market history have unfolded in the bewitching month.

Investors have suffered through two “Black Mondays” in October, one in 1929, the other in 1987. They’ve been rattled by “Black Tuesdays” and “Black Thursdays” in the month.

And how can we forget the fright of the infamous October 2008? That’s the month the S&P 500 lost 17% of its value as the global financial system melted down.

Due to these nightmarish memories, its understandable investors tend to eye October with suspicion. They keep a watchful eye out for “The October Effect,” or what’s known in more literary-minded circles, “The Mark Twain Effect” (ignoring the joke that all months are dangerous months to speculate). They tiptoe gingerly deeper into fall, oftentimes just surviving the horror show that is September.

But the reality is, October has earned more of a bad rap than it deserves…

A Great Month with Bad PR

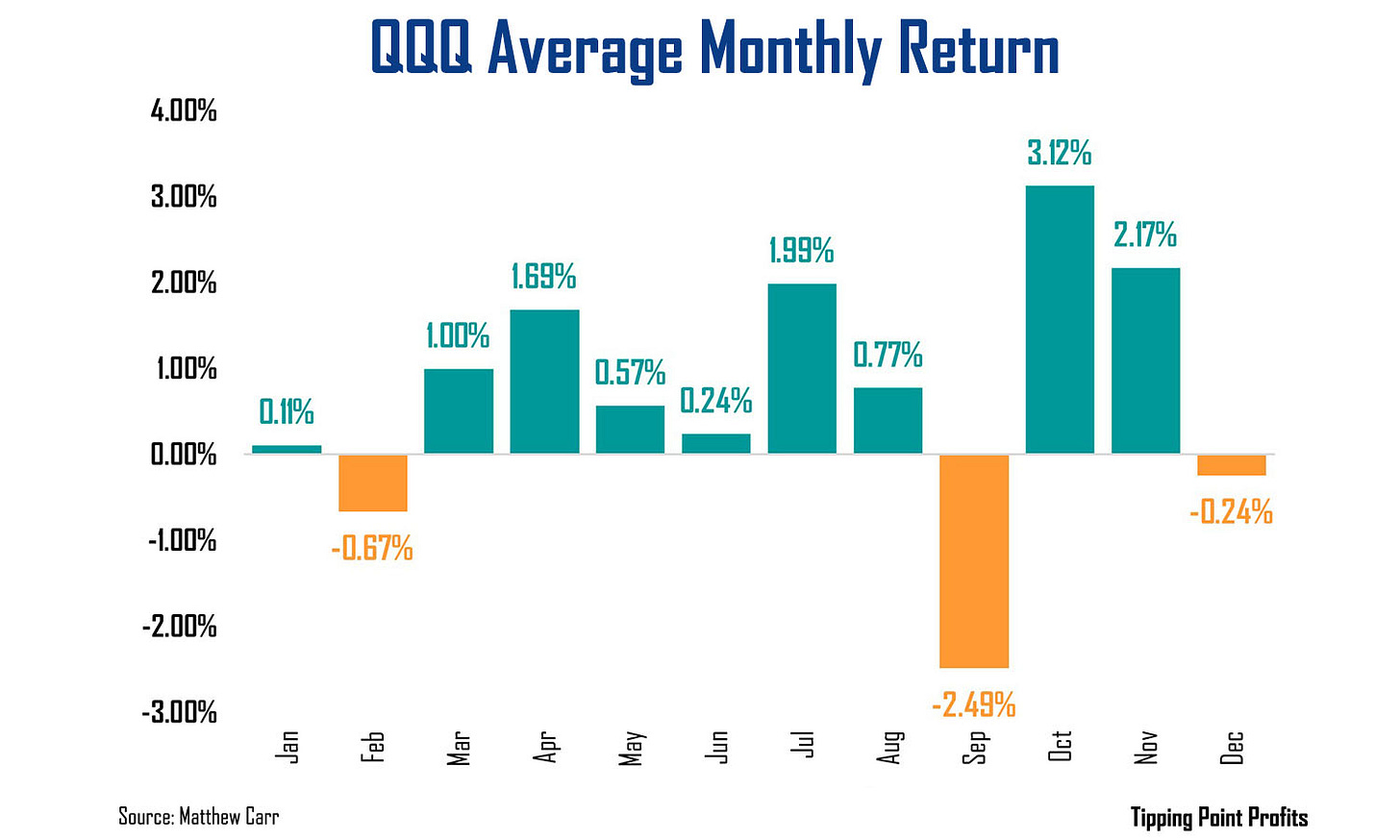

Over the last 20 years – which spans the release of four installments of the Halloween movie franchise – the Nasdaq has weathered October fairly well.

In fact, during that stretch, the Nasdaq 100 proxy has only ended the month lower seven times...

That’s a 65% success rate.

That may not sound like a sure thing. And it isn’t. But it does represent a tremendously strong opportunity for gains. Especially when you understand the nuances of the trend.

For instance, the only months with better success rates for the Qs than October are July and November.

But there’s a particularly important element to understand about volatility and October…

The worst unfolds in election years.

Look at the chart above.

Only three of the losses in the month over the last two decades weren’t U.S. presidential election years – 2005, 2009 and 2018.

And the largest of those declines, 2018, was part of the U.S. trade war with China that escalated to the worst Christmas Eve session on record.

The rest of the QQQ’s stumbles in October were investor jitters leading up to election day. And this is a trend not only seen in tech stocks, but also on the Dow Jones Industrial Average and the S&P.

So, you’ll hear that October’s volatility is “frightful” and “legendary.”

But most of the time, it’s due to unease over the upcoming ballot box battle and who’s going to be living in the White House, as well as what party is going to control Congress. Throw in some global economic uncertainty, like we had in 2008, and the market collapse can be historic.

So, if this were an election year, I’d tell investors to be afraid heading into October.

But even though the debates are underway, there’s still more than a year before the next Election Day.

A Sweet Month for Returns

Historically, October is the best month of the year for tech...

That’s because we’re heading into the all-important holiday shopping season. That provides a boost for stocks.

The swoons in September are triggered by sweating palms over third quarter earnings. Marco headlines come into focus. The Federal Reserve’s September rate decision takes main stage. But by the time October gets underway and third quarter earnings season begins, that anxiety starts to fade.

In turn, we end up being rewarded with a great multi-month stretch of gains.

So, investors shouldn’t fear October. The reality is, Pudd’nhead is right – every month can be dangerous to speculate on stocks. But the data shows October isn’t any more “peculiarly” dangerous than any other… in fact, quite the opposite.

Don’t be spooked by September’s scare. Instead, prepare for a rally from here.

Looking to scare up some gains this October,

Matthew

I have some great news: I’m going to be speaking at the MoneyShow/TradersEXPO Orlando this October! And that leads to only one question...

Can we meet and talk markets there – IN PERSON?

I sure hope so...because my friends at the MoneyShow organization have assembled a dynamite lineup of world-class market strategists, economists, professional traders, money managers, and newsletter publishers.

You can see from the just-released preliminary agenda that you’re in for an unparalleled investor education experience at the event, which runs from October 29-31, 2023. In addition to my talk, you’ll have the chance to hear and learn from the likes of...

Charles Payne, Host, Fox's Making Money with Charles Payne

George Gilder, Editor, Gilder's Technology Report

Lindsey Piegza, Chief Economist, Stifel Financial Corp.

Barry Ritholtz, Founder and CIO, Ritholtz Wealth Management

Mark Skousen, Editor, Forecasts & Strategies

John Carter, Author, Mastering the Trade

Howard Tullman, General Managing Partner, G2T3V, LLC

And more than 75+ other experts! They’ll cover everything from stocks, bonds, real estate, energy, and precious metals to alternative investments and elite trading tools and strategies. Plus, the conference is being held at the Omni Orlando Resort at ChampionsGate – one of the nation's premier golf, meeting, and leisure retreats.

AND because you’re one of my valued readers, I CAN SAVE YOU 20% on the purchase of a Standard Pass to the event!

So first, here is my presentation schedule:

How to Prepare for the Death of the Bull in 2024

Or if you prefer, call the MoneyShow team at 1-800-970-4355 and reference my discount code SPKR20.

Then get ready. Because I can’t wait to share my insights, strategies, and forecasts with you – not to mention talk markets IN PERSON – in Orlando!

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.

Great comments as usual and we’re missing having you on the O.C.