Investors are obsessed with data.

Every tick, percentage, gain, or decline is consumed voraciously and analyzed endlessly.

And that’s because the Federal Reserve has taken a stance of obsessive data dependence.

The future and pace of race hikes hinge on data points and the story they’re telling… or not telling.

So now, every upcoming data release leads to handwringing… because it’s the most important data release… until the next one.

Unfortunately, for investors with frayed nerves, we start each month with a cannonade of government releases. And this one’s even more spectacular… the first U.S. presidential debate smack dab in the middle of the onslaught.

For two decades I’ve been a trend and catalyst trader.

And I keep my sanity – as well as protect my portfolio – with my own obsession with data.

I don’t get lost or confused by all the noise. I strip all that away and focus only on the facts.

In turn, I end up having a clearer picture of what to expect from markets... even as the rest of the financial world endlessly questions what the indexes will do next.

80% Chance for Green

On Wednesday morning, before the opening bell, we’ll receive Consumer Price Index (CPI) data. This is the Fed’s favored measure of inflation. And that makes it a key one to watch.

Despite all the hemming and hawing from financial media outlets, for much of the past two years, the CPI release has largely been one to ignore.

Why?

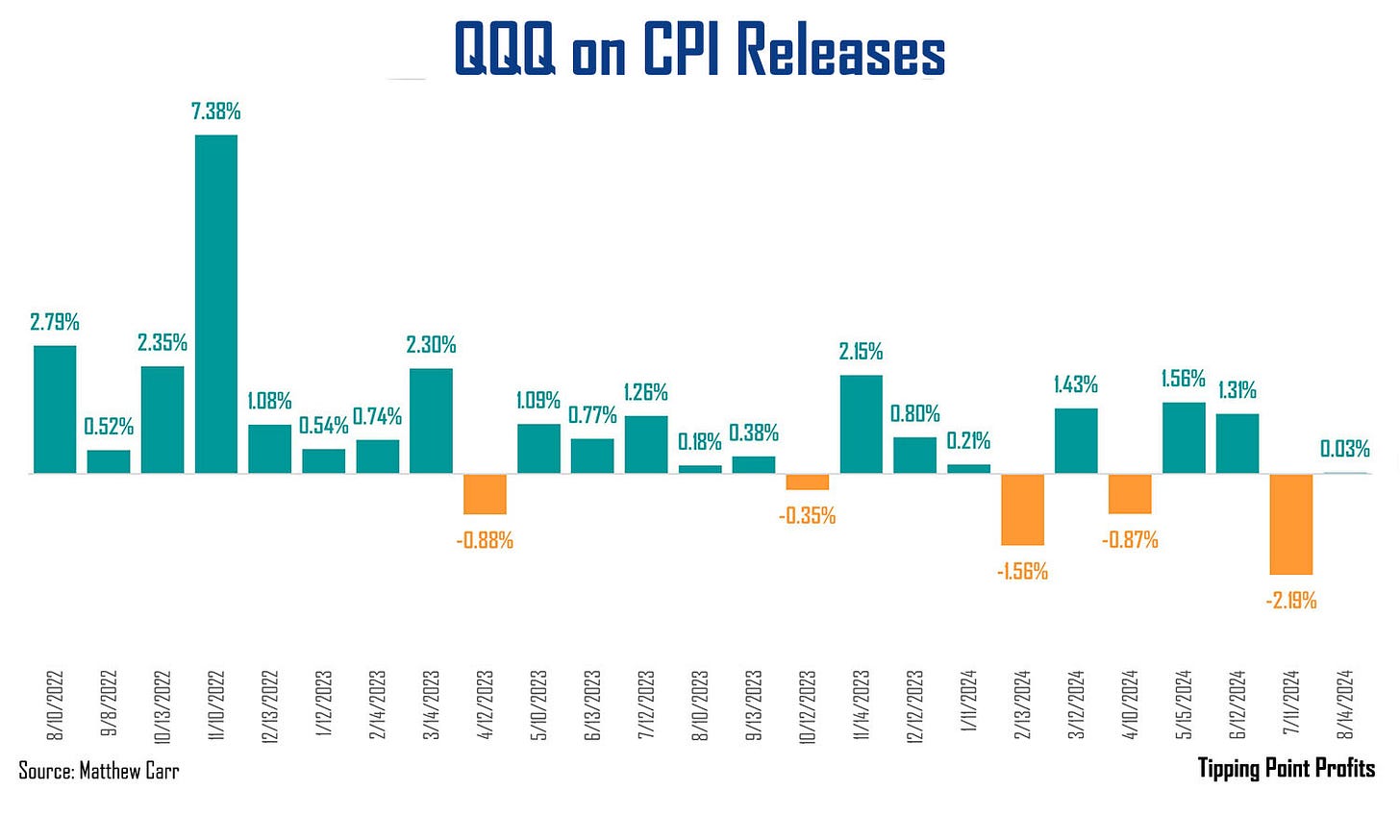

Well, take a gander at this… the Invesco QQQ ETF (QQQ) has only fallen on CPI five times over the last 25 months…

That is a success rate of 80%.

And from August 2022 to September 2023, the proxy for the Nasdaq 100 only slipped once on the report.

Now, with that said, 2024 has been somewhat of a different animal. We’ve had five up and three down… though, two of those gains were pretty paltry.

You may be asking, “Well, why is that?”

And the answer is straightforward… since peaking in June 2022, the steep declines we saw in headline and core inflation have stalled.

At the moment, inflation stands at 2.9%.

That’s still well above the Fed’s 2% target rate.

But this week’s reading is expected to show a drop to 2.6%. That would be the lowest reading since March 2021.

Consumers are getting a helping hand from an area I’ve covered for decades…

Crude, Cuts and Small Caps

I’ve written over the years that crude has a very defined trading pattern.

In fact, over the past 39 years, U.S. crude prices have gained an average of 8.69% from January to July. But they then decline an average of 1.48% from July through December.

There’s a concrete reason for this… refinery utilization rates and seasonal maintenance.

Well, today, U.S. crude is trading below $68 per barrel.

Since the start of July, the price of oil is down 18.5%. And over the past month has slipped more than 11%.

Now, in our last CPI reading, housing accounted for 90% of the monthly increase in inflation. Meanwhile, energy prices were essentially flat month over month.

The issue for this week is, we know a Fed rate cut is coming next week.

The only question that remains is it 25 basis points (bps) or 50?

Currently, the market is predicting there’s a 71% chance of a smaller cut. And only a 29% chance of a 50-bps cut.

Well, if inflation comes in cooler than expected - as we saw with July’s release - it cements that smaller cut. But then does the market take that in stride, or freak out?

Regardless, I do think its important investors continue to pay attention to “Mighty Mouse” stocks - small caps - and add more exposure here.

Year-to-date, the Nasdaq and S&P 500 have outperformed the Russell 2000 by almost four-fold. But since July, the tables have turned. Small caps have gained nearly 4% while tech and blue chips have piled up losses during that stretch.

And its important to keep in mind, that once a Fed rate cut cycle ends, the Russell goes on a tear. In fact, the small-cap index averages a gain of 36% in the 12 months following a rate cut cycle’s end. That’s four times its average annual return of 9%.

If you haven’t started looking at the iShares Russell 2000 ETF (IWM) yet, you may want to put it on your list.

The market has been obsessed with data. And that’s because the Fed has been obsessively data dependent.

But for the past two years, I’ve been able to keep myself – and my readers – sane with my own data obsession: how the markets react to each data release. And there are clear trends that can provide guidance to gains, as well as ensure you sleep better each night knowing what to expect.

Adding Mighty Mouse for strength,

Matthew