The sun is shining on Wall Street.

Shares of RH (RH) – the upscale furniture retailer – are soaring more than 20% today. And with it, it’s dragging the rest of the retail sector higher.

Why?

Not because RH blew second quarter results out of the water. Nor because it announced some new artificial intelligence (AI) initiative. But because the company stated demand for its products in the third quarter has been accelerating.

Now, despite all the frets, fears and handwringing about a U.S. recession, one has yet to materialize. And I’m not sure one will… which has been my stance for much of the past two years.

Instead – and if RH is a precursor - I believe we’re about to experience record spending. A catalyst that’s poised to reward investors who are savvy enough to prepare now.

Shop Til You Drop

I’ve been covering U.S. markets for more than 20 years.

And there’s one part of the economy that triggers more anxiety than anything else… The American consumer.

I hear it every year… like clockwork.

This is because personal consumption expenditures (PCE) represent an outsized portion of the country’s gross domestic product (GDP). In fact, in the first quarter, PCE represented nearly 68% of American GDP.

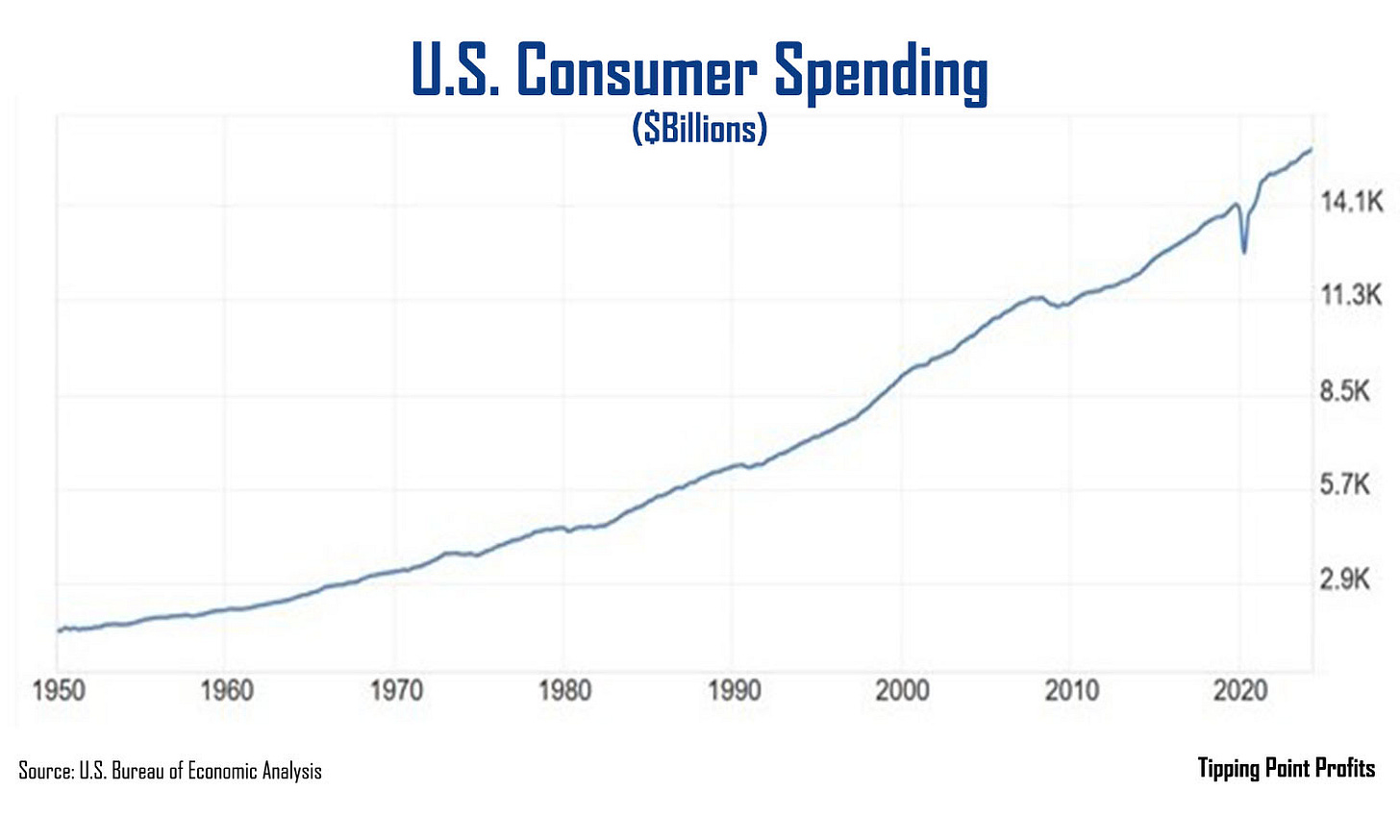

But here’s a secret… U.S. consumer spending has set a record nearly every year since 1950.

There’s been a couple of minor blips. The slight decline and stagnation during the global financial crisis from 2007 to 2009. And then the sudden drop off in the second quarter of 2020 during the global pandemic.

But let that sink in… the only major dip in U.S. consumer spending in the last 70-plus years was when lockdown measures were implemented during a global crisis that brought the world to a halt.

That dip in spending lasted one quarter.

Culturally, Americans are driven to spend. It’s in our blood. Regardless of what’s taking place.

Consider this…

Even though prices have increased more than 20% over the past two and a half years, Americans haven’t stopped spending.

In July, U.S. retail sales rose 2.4% year-over-year. And for the first seven months of 2024, retail sales have increased 2.9% to $4.86 trillion.

In the second quarter, U.S. GDP grew at a 2.8% annualized rate… double the 1.4% growth seen in the first quarter!

With that in mind, we must understand that ahead is our shopping Olympics… our consumer World Cup… our spending Super Bowl.

And it doesn’t last a day or a month. It lasts for almost half a year!

The $1 Trillion Shopping Spree

Even though much of the U.S. was baking under relentless summer heat and storms, the next retail splurge had already begun… Back-to-school shopping.

The real “BTS” investors should pay attention to.

This kicks off in July, particularly with Amazon's (AMZN) Prime Day shopping holiday.

Projections are Americans will spend $31.3 billion on back-to-school gear this year.

But keep in mind, back-to-school isn’t the only shopping holiday on the U.S. calendar.

To kick off September, we had Labor Day sales where if you didn’t buy a new car or refrigerator on Memorial Day, Father’s Day or the Fourth of July, it was your last chance… at least until Toyotathon in November.

If you haven’t noticed, Halloween candy is already on the shelves.

And then we have the big daddy of them all in November and December: the Winter Holiday shopping season.

In 2023, Americans shoveled out $964.4 billion during Christmas holiday shopping blitz.

But this may very well be the year U.S. holiday spending tops $1 trillion for the first time.

With that in mind, let me also point out that there’s been one year – ONE! - since 2003 that U.S. holiday spending didn’t increase year-over-year. And that was in 2008…

That’s it!

Don’t be shaken by headlines exclaiming a recession is near. The U.S. consumer is an economic force that has no equal on planet Earth.

This year, Walmart (WMT) is projected to see $678.3 billion in revenue.

If it were a country, Walmart would be the 22nd largest economy on the planet.

The online retailer Amazon is worth more than $2 trillion and will record $638 billion in revenue this year.

The only company with sales larger is Walmart.

And remember, of the top 50 global retailers, the U.S. is home to six of the top 15.

That’s because the money Americans spend is unparalleled.

In 2023, U.S. consumers plunked down a hefty $7.24 trillion at retailers! That accounts for more than a quarter of the country’s total economy.

But here’s the real kicker… U.S. retail spending has increased 299% since 1992.

And it’s only going higher.

The key difference is, today, we don’t have to leave our homes to buy what we want. And that’s creating an unending retail boom.

Every year I watch retailer shares get hammered on consumer spending fears before the holiday spending spree. And I’m always thankful to pick them up at a discount. Because those fears are almost always wrong.

RH shows the American consumer is still spending, particularly those higher income brackets.

So, savvy investors should already be picking up shares of retailers or creating a wish list of those they want to own on the next dip. That’s the perfect recipe for profits by Christmas morning and fourth quarter earnings in February.

Always a retail investor this time of year,

Matthew