On Friday night, like the rest of the world, I sat glued to Netflix (NFLX).

Jake Paul - YouTuber and content creator turned pummeler of middle-aged, over-the-hill fighters - was facing off against Mike Tyson - infamous ear biter and convicted rapist, who in 1986 became the youngest heavyweight boxing champion ever.

Now, beyond the non-stop buffering, the not-so-subtle promotional tie-ins, the unexpected appearance of Tyson’s bare butt cheeks, and the not-so-surprising anticlimactic outcome, there was something heartwarming about the spectacle: Everyone in the world was tuned in to the same event.

Outside of the Olympics, we as a society don’t experience that much anymore. Gone are the days of “Must See TV” or in-his-prime Tyson fights – which drew in avid and casual fans alike, as well as the looky-loos.

So, maybe this new era of Netflix will bring some of that back.

Well, in the markets, we have our own Paul v. Tyson. And it will take place mere hours from now. The world will be watching and digging through every data point and data center mention… So, what should we expect?

Nvidia’s Nice November

Nvidia (NVDA) sits at the crossroads between artificial intelligence (AI), big data, cryptocurrencies, and anything and everything in need of high-powered chips.

On one hand, this translates into the company putting out more press releases and blog posts than nearly any stock covered by analysts like myself. On the other hand, this unique position has delivered gains time and time again for shareholders.

Year-to-date, shares of the graphics card maker are up 194%!

And they’re up more than 7% in the month of November… historically one of the strongest months for shares…

But third quarter earnings could be an obstacle.

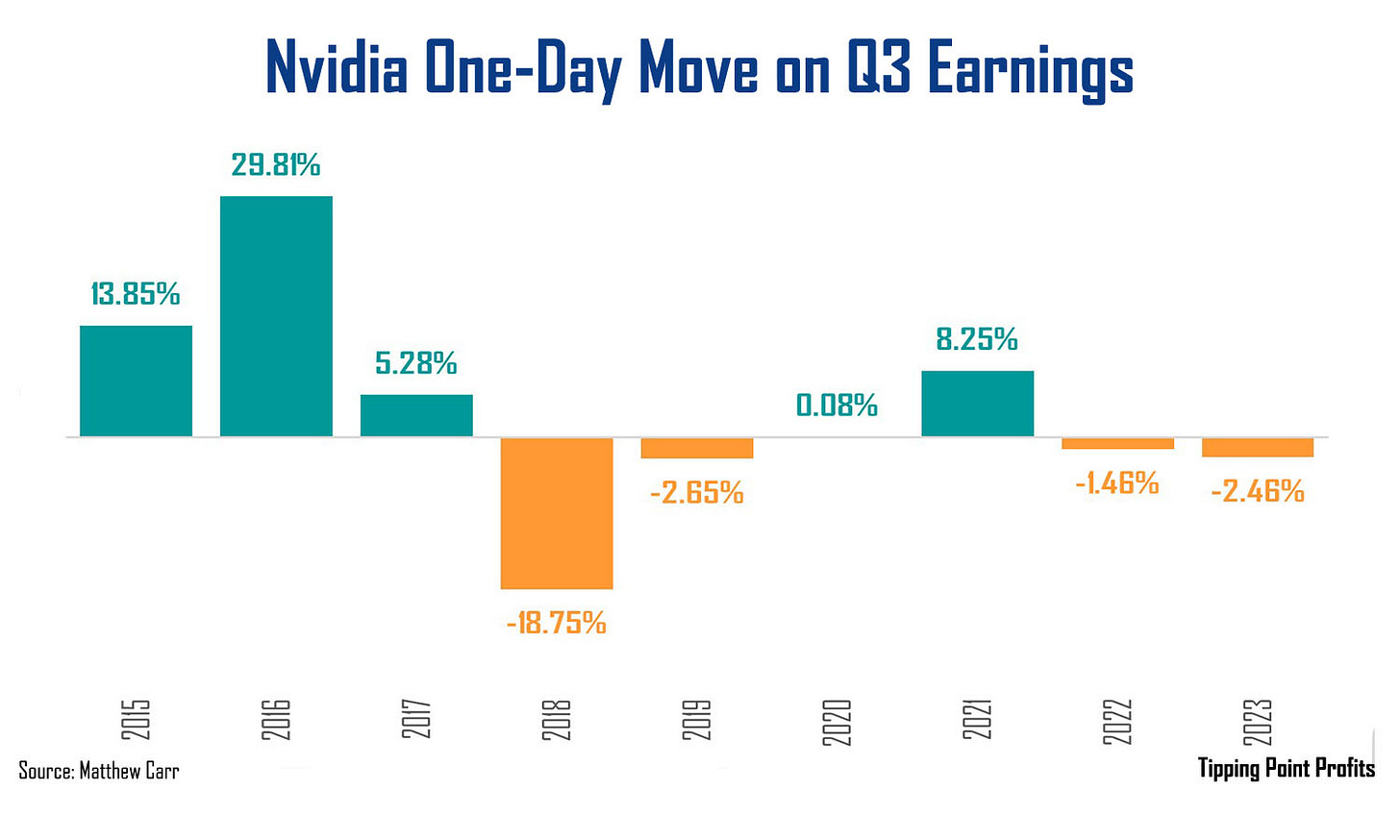

Now, when using VertEA we see that Nvidia shares have fallen on third quarter results four times since 2015…

And in reality, they’ve dipped on this release four of the last six years.

Though, let’s be honest… only that 18.75% tumble in 2018 was dramatic. The rest of the pullbacks were marginally lower.

But our average one-day move for Nvidia shares on third quarter earnings since 2015 is a gain of 3.55%. That makes it the second worst-received report during that span. And most of the gains were prior to 2018.

The current projected move from the options market is +/- 8%. That means a jump to $157 or a drop to $134.

But as I’ve covered in recent quarters, here’s where things get a little tricky for the chipmaker…

For the third quarter, Wall Street is expecting Nvidia’s revenue to rise 82.9% from $18.12 billion to $33.13 billion. This would be a new record. And earnings per share (EPS) are forecast to increase 87.5% to $0.75.

Those are fantastic figures.

But here’s the deal…

Nvidia is becoming a victim of its own success.

By that I mean, growth - which is still tremendous – is entering a period where the comparables are becoming increasingly difficult.

For example, second quarter revenue rose 122% to $30 billion as EPS rose 152% to $0.68.

Great results. But shares tumbled 6.4% on the news.

Even though most companies would sacrifice a board member or four for those growth figures, for Nvidia they represent the one thing you don’t want to see from a growth stock: a slowdown.

You see, in the first quarter, the chipmaker reported revenue growth of 262% to $26 billion with earnings surging 461% to $6.12.

That meant second quarter growth was less than half what was seen in the first quarter.

And now for the third quarter, expectations are for growth of less than 88% for both revenue and earnings.

Those days of triple-digit year-over-year gains are gone… much like “Must See TV” and Tyson’s chances of returning to his former glory.

As I warned before second quarter results, Wall Street often takes a negative view to this type of slowing. Even though it's merely part of the aging process. No company can report 200%-plus quarterly growth forever, just as no 58-year-old boxer with serious medical issues can hope to knockout a 27-year-old in peak condition.

Tonight, for Nvidia, the world will be tuned in. An audience of millions will be glued to their screens dissecting each number.

But, if there’s a drop in shares, don’t be surprised. It doesn’t mean the company is struggling. It simply means the math is working against it these quarters. There’s still plenty of upside and many more glory days ahead before its put out to pasture.

Still bullish on Nvidia,

Matthew