Crytpo fans rejoice!

On Tuesday, July 23, spot Ethereum exchange-traded funds (ETFs) debuted in the U.S.

For those not in the know, Ethereum is the second-largest cryptocurrency in the world with a market cap of $392 billion. It’s often considered the “little sibling” to Bitcoin, which has a current market cap roughly 3.5 times larger.

But the approval of nine Ethereum ETFs by the Securities Exchange Commission (SEC) is the second major victory for crypto investors in 2024. The first was 11 spot Bitcoin ETFs being greenlit by the agency back in January.

That approval arrived just in time for Bitcoin’s fourth reward halving in April.

But now that there are more options for crypto investors and traders, is there a right or wrong Ethereum ETF?

Let’s take a look…

Pillaging One to Benefit All

There’s an old adage on Wall Street: “Money flows to where it’s treated the best.”

And in their first day of trading, Ethereum ETFs cobbled together $107 million in net inflows. Though, one could argue most of the money was merely shuffled around at the sacrifice of the industry’s largest player…

The Grayscale Ethereum Trust (ETHE) is the greybeard in the industry.

It was founded in December 2017 in Canada. But has traded over the counter (OTC) here in the U.S.

This is the largest Ethereum fund with $7.47 billion in assets under management (AUM), representing 2.28 million Ether.

For a long time, it was the only game in town for Ethereum traders. And it was robbed on the first day of large-scale Ethereum ETF trading… and I’ll explain why below.

With $266.5 million in inflows in the first day, the iShares Ethereum Trust (ETHA) is sitting pretty at the top of the list.

Now, this is important to note… the iShares Bitcoin Trust (IBIT) saw a historic $20 billion increase in AUM in its first six months of trading!

In fact, IBIT has surpassed the Grayscale Bitcoin Trust (GBTC) to be the largest Bitcoin ETF. The GBTC has $17.5 billion AUM, while IBIT’s AUM currently tops $21.9 billion AUM.

BlackRock (BLK) expects the ETHA to follow the same trajectory. And sees IBIT’s growth, as well as ETHA’s, as proof of the substantial demand that exists for these products.

I mean, who doesn’t love trading cryptos without having to open a separate wallet? And you can do so directly in your IRA!

Already, ETHA’s average daily trading volume is more than double that of the Grayscale Ethereum Trust. Similarly, IBIT sees five-times the average daily volume of the GBTC… and for good reason: fees!

The GBTC carries an expense ratio of 1.5%. The ETHE has an expense ratio of 2.5%! And the Grayscale Ethereum Mini Trust (ETH) is a spin-off of the ETHE with a lower management fee of 0.12%.

All of Grayscale’s competitors – both in the Bitcoin and Ether space – have waived or are waiving fees for the first six months or until they reach a certain AUM.

Even then, when those expenses kick in, they’re a fraction of what Grayscale charges… and Grayscale has stated they have no intention of lowering fees.

Money was treated better elsewhere when the Ethereum ETFs launched, which is why it fled Grayscale.

Are the Fees Key?

Year-to-date, Ethereum has charged a little more than 47% higher.

Bitcoin has fared a might better, surging 64.5% in 2024. And right in line with our expectations here.

The Grayscale Bitcoin Trust has outperformed Bitcoin by a hair, gaining 65.4% this year. Meanwhile, the Grayscale Ethereum Trust has underperformed Ethereum, increasing just 38.9% year-to-date.

But both Grayscale crypto ETFs currently trade at a discount to their underlying cryptocurrencies.

So, the question now is, which Ethereum ETF is going to perform the best?

That’s a tricky one to answer. But I decided I’d look at the performance of the first Bitcoin ETF launches in January to today for some insight…

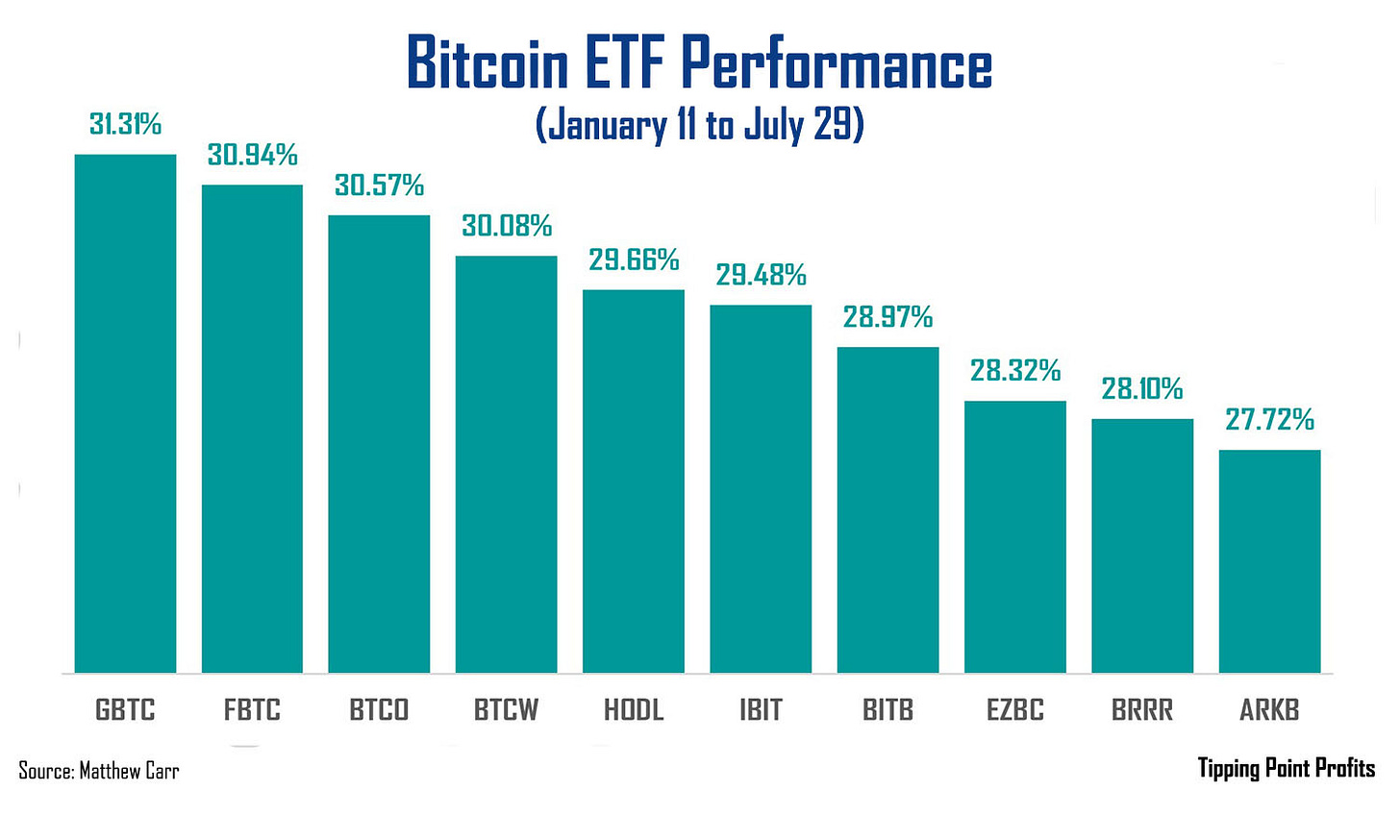

During that span, there’s a pretty wide disparity… especially considering they’re all spot Bitcoin ETFs.

Though, I did notice a couple interesting tidbits…

The ARK 21Shares Bitcoin ETF (ARKB) is the worst performer, gaining just 27.72%. Worth noting, it did not offer a waiver on its 0.21% expense ratio when it launched. All the other ETFs (expect the GBTC) did.

The second worst performer has been the Valkyrie Bitcoin Fund (BRRR), which started with a 0% expense ratio that then leapt to 0.25% on April 11.

The top performer, the GBTC, has been around for years. It also has the highest expense ratio at 1.5%. And that will not change.

The Fidelity Wise Origin Bitcoin Fund (FBTC) offered a 0% expense ratio until August 1. And it’s the second best-performer. Similar situation for the Invesco Galaxy Bitcoin ETF (BTCO), which offered 0% until July 10.

But the IBIT – which has the highest daily trading volume and largest AUM – is in the middle of the road in terms of performance. It started with a 0.12% expense ratio until January 2025 for the first $5 billion AUM. Then the expense ratio jumps to 0.25%.

Now, the iShares Ethereum Trust, the ETHA, will follow the same strategy. The expense ratio starts at 0.12% for the first 12 months or until it reaches $2.5 billion AUM, then it jumps to 0.25%.

Out of the gate, the Grayscale Ethereum Trust has been hit with a massive outflow. Largely because that money shifted to less expensive funds. The ETHA – backed by BlackRock – will likely surpass the Grayscale fund in size. And already, it’s daily trading volume is twice that of the Grayscale Ethereum Trust.

I’d expect the initial 0% fee funds to perform well. Though, will they be able to outperform Grayscale? I’m not sure. The bigger question is: can the Grayscale Ethereum Trust outperform the other ETFs minus the fees? Because that’s a tall order.

Either way, investors win with an easier way to access Ethereum and stash it in your portfolio for the long haul… or merely to trade.

Cheering for more crypto choice!

Matthew