The countdown has begun.

Seconds drift away into minutes…

Minutes fall from the clock, turning into hours…

And now, the number of hours left is few.

Celebrate it or shirk it, Fed Day is here.

At 2:30 PM ET, Federal Reserve Chairman Jerome Powell will stand before a wall of cameras and a bramble of microphones to lay out the U.S. central bank’s latest rate-hike decision.

For more than a year, Powell’s presser has been able to make or break an investor’s week.

And during this time, it blossomed into an integral catalyst to cover. Regardless of the size of the rate hike or if the U.S. central bank holds steady with the pause button, Fed Day has consistently been a market mover.

Though, not always in the direction most investors think…

So, sit up and pay attention… time is running short.

A Coin Flip for Gains

There’s a single sentence that makes me cringe.

It is a crutch investors lean on far too often…

“The market is rigged!”

Every time I hear that, I must gently remind investors that maybe they’re doing something wrong. Perhaps their expectations need re-evaluation.

No one likes to admit they may be guilty of a mistake. But I’ve been in this business long enough to learn that if prices aren’t behaving the way you expected, you’ve likely missed something.

This is why my approach to the market relies on probabilities and readily identifiable trends, especially when it comes to catalysts, as I’ve outlined with my VertEA strategy as well as the long-term reaction to Consumer Price Index (CPI) data.

If I have a picture – either a rough sketch or a detailed masterpiece – of how a company’s shares, or the broader indexes, respond to a particular event, the better off I tend to be. If necessary, I can take the proper precautions, as well as position myself to profit or merely maintain my sanity.

So, let’s apply this approach to Fed Day and Powell’s press conference.

As with CPI, I’ve been devoutly following this every month since January 2022. That includes nearly a dozen rate increases – the fastest ramp-up since the 1980s.

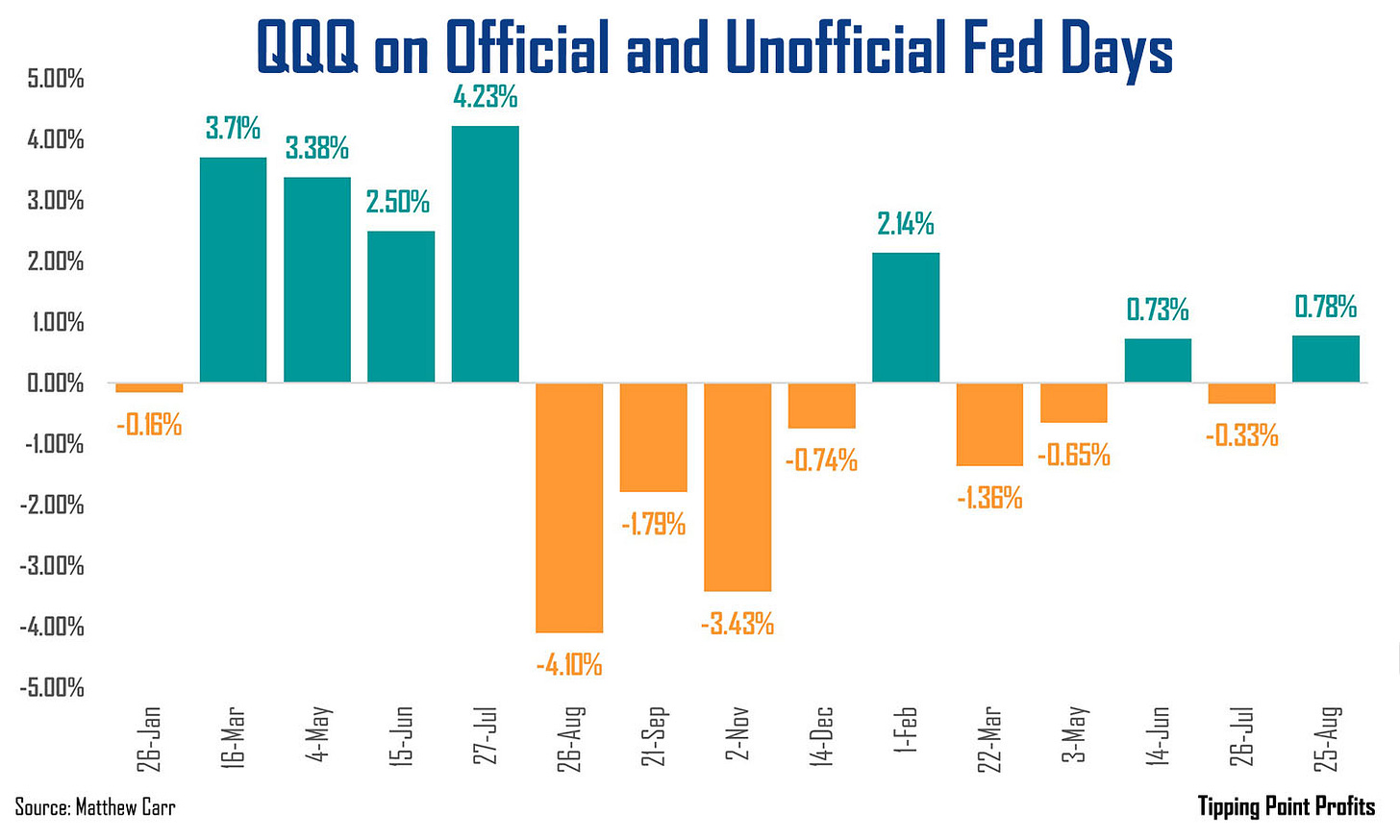

Well, here’s how the Invesco QQQ ETF (QQQ) – the proxy for the Nasdaq 100 – has responded to JPow’s presser…

We can see tech stocks have dropped on seven of the last 10 official and “unofficial” Fed Days.

I always include the Jackson Hole Economic Symposium every August in my analysis. That’s because there’s no Federal Open Market Committee (FOMC) meeting that month, but the Fed chair’s headlining presentation serves as an “unofficial” Fed Day.

What’s important to note in the trend – and something I’ve been pounding the table over in 2023 – is though it’s been an even split between gains and losses the last 15 months, we’re nearing the end of this rate hike cycle… If we’re not already there. That’s why we’ve started to see the market push higher on this catalyst in recent months.

There have been pauses and allusions to the end being in sight.

Though, we’re not out of the woods. Not quite yet…

One Bullet Left

No gunslinger wants to have their ticket punched while they still have a round in the chamber.

Back in June, the Fed penciled in two more rate hikes in 2023.

One of those was spent in July (and the QQQ ticked 0.33% lower on the announcement).

That means, there’s still one round left so to speak.

We know all head holes will be tuned in to hear what JPow has to say at 2:30 PM ET.

Currently, rates are 5.25% to 5.5%.

And growth in CPI has fallen from its peak of 9.1% in June 2022 to 3.7% in August.

That’s the good news.

But here’s the caution…

The U.S. central bank is desperate to avoid the mistakes of the 1970s. That’s when inflation was allowed to regain steam as the Fed let up too soon. And some are worried that’s what we’re starting to see.

August’s headline CPI rose 3.7% year-over-year, representing an acceleration from July’s 3.2%. It also marked the first acceleration in inflation since June 2022. Now, the blame for that falls squarely on the shoulders of energy prices, with crude oil rocketing 34% from $67 per barrel at the end of June to over $90 per barrel today.

Of course, when we strip away those volatile energy and food prices, such as with the Personal Consumption Expenditures (PCE) index, inflation appears much tamer. Not gone mind you - and nowhere near the Fed’s goal of 2% - but less concerning than August’s CPI read.

So, is today the day the U.S. central bank fires off that last round?

Probably not.

Sure, there will be tough talk to keep the doves at bay. But also expect plenty of mentions of “wait and see.” And that’s something investors will want to hear. The question is, whether it’ll be enough to spark a renewed rally. As I outlined last week, the end of September is where the real pain historically begins… and Fed Day is here, smack dab in the middle of that annual bloodbath.

Best to temper expectations. And if the market does jump on JPow’s presser? Well, it’s okay to be pleasantly surprised.

Patiently waiting,

Matthew

I have some great news: I’m going to be speaking at the MoneyShow/TradersEXPO Orlando this October! And that leads to only one question...

Can we meet and talk markets there – IN PERSON?

I sure hope so...because my friends at the MoneyShow organization have assembled a dynamite lineup of world-class market strategists, economists, professional traders, money managers, and newsletter publishers.

You can see from the just-released preliminary agenda that you’re in for an unparalleled investor education experience at the event, which runs from October 29-31, 2023. In addition to my talk, you’ll have the chance to hear and learn from the likes of...

Charles Payne, Host, Fox's Making Money with Charles Payne

George Gilder, Editor, Gilder's Technology Report

Lindsey Piegza, Chief Economist, Stifel Financial Corp.

Barry Ritholtz, Founder and CIO, Ritholtz Wealth Management

Mark Skousen, Editor, Forecasts & Strategies

John Carter, Author, Mastering the Trade

Howard Tullman, General Managing Partner, G2T3V, LLC

And more than 75+ other experts! They’ll cover everything from stocks, bonds, real estate, energy, and precious metals to alternative investments and elite trading tools and strategies. Plus, the conference is being held at the Omni Orlando Resort at ChampionsGate – one of the nation's premier golf, meeting, and leisure retreats.

AND because you’re one of my valued readers, I CAN SAVE YOU 20% on the purchase of a Standard Pass to the event!

So first, here is my presentation schedule:

How to Prepare for the Death of the Bull in 2024

Or if you prefer, call the MoneyShow team at 1-800-970-4355 and reference my discount code SPKR20.

Then get ready. Because I can’t wait to share my insights, strategies, and forecasts with you – not to mention talk markets IN PERSON – in Orlando!

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.

Thank you for getting back to me keep me posted please I like your work .

Cheers Wayne Marriott

Hello Matthew do you have any other services that you are involved with

Thanks Wayne