The celebrations have ended.

But the real fireworks are about to begin.

It’s that time of year again…

My favorite month for stocks!

Picture this: a trading pattern so outrageously consistent, so jaw-droppingly dependable, it’s practically the financial equivalent of a cheat code.

We’re talking about a strategy that’s delivered gains more than 94% of the time… not over a couple of lucky years, nor even a decade… but a mind-blowing 17 years.

It’s almost as if Wall Street handed you the keys to its vault.

And here’s the kicker: we’re not talking about some backwater penny stock or a “hidden gem” in a forgotten industry.

It’s the ultimate tech juggernaut…

The Month That Laughs in the Face of Crisis

The Invesco QQQ ETF (QQQ) isn’t just any ETF.

It’s the proxy for the Nasdaq 100. The home to the titans of tech: Microsoft (MSFT), Nvidia (NVDA), Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), Meta Platforms (META), Netflix (NFLX) and Tesla (TSLA).

These aren’t merely mega-cap names - they’re the gods of Wall Street’s “$1 Trillion Club.”

Now, forget everything you’ve heard about the so-called “Summer Lull.”

In the world of tech, July isn’t a sleepy month… it’s a blockbuster event.

While the rest of the market cowers in the shade, the Qs step into the July sun and soar.

It’s the month that shrugs off global meltdowns, U.S. credit downgrades, European debt bombs, Fed rate hikes, trade wars, pandemics, and even bear markets.

Just take a look…

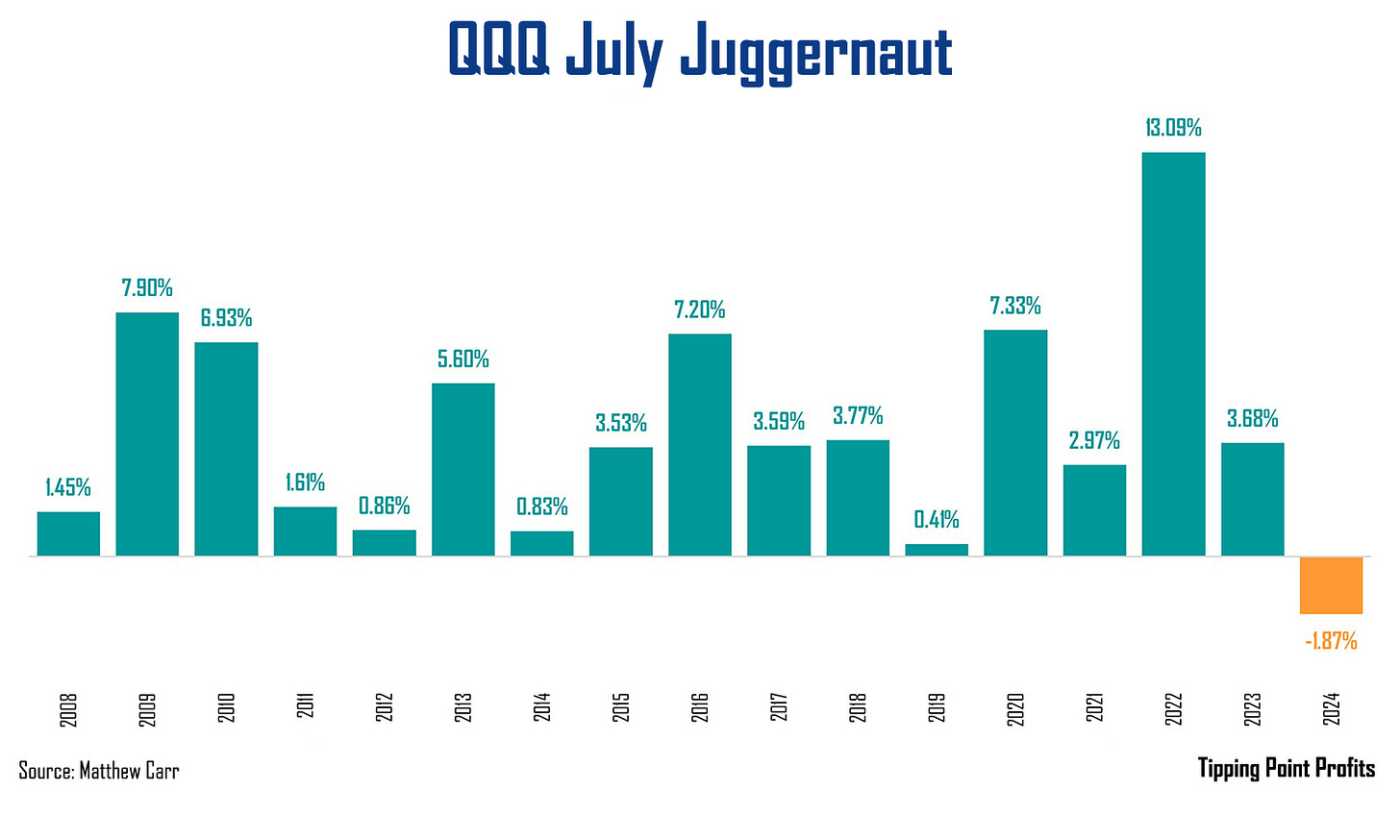

The QQQ has delivered July gains in 16 of the last 17 years.

That’s not just a hot streak… it’s a market phenomenon.

And as we can, for 16 consecutive years, July was a winning month for the large cap tech - an unbroken streak that’s practically unheard of.

Even during the carnage of 2022’s bear market - when portfolios everywhere were bleeding red - the QQQ rocketed more than 13% in July.

That was the single best month of the year for tech.

That’s the type of resilience we see this time of year.

So, what’s the play?

The Most Consistent Trade on Wall Street

Well, if you see the QQQ dip in early July, don’t hesitate… history says it’s a gift.

Over the past 17 years, the Nasdaq 100’s average gain in July is a stunning 4.05%.

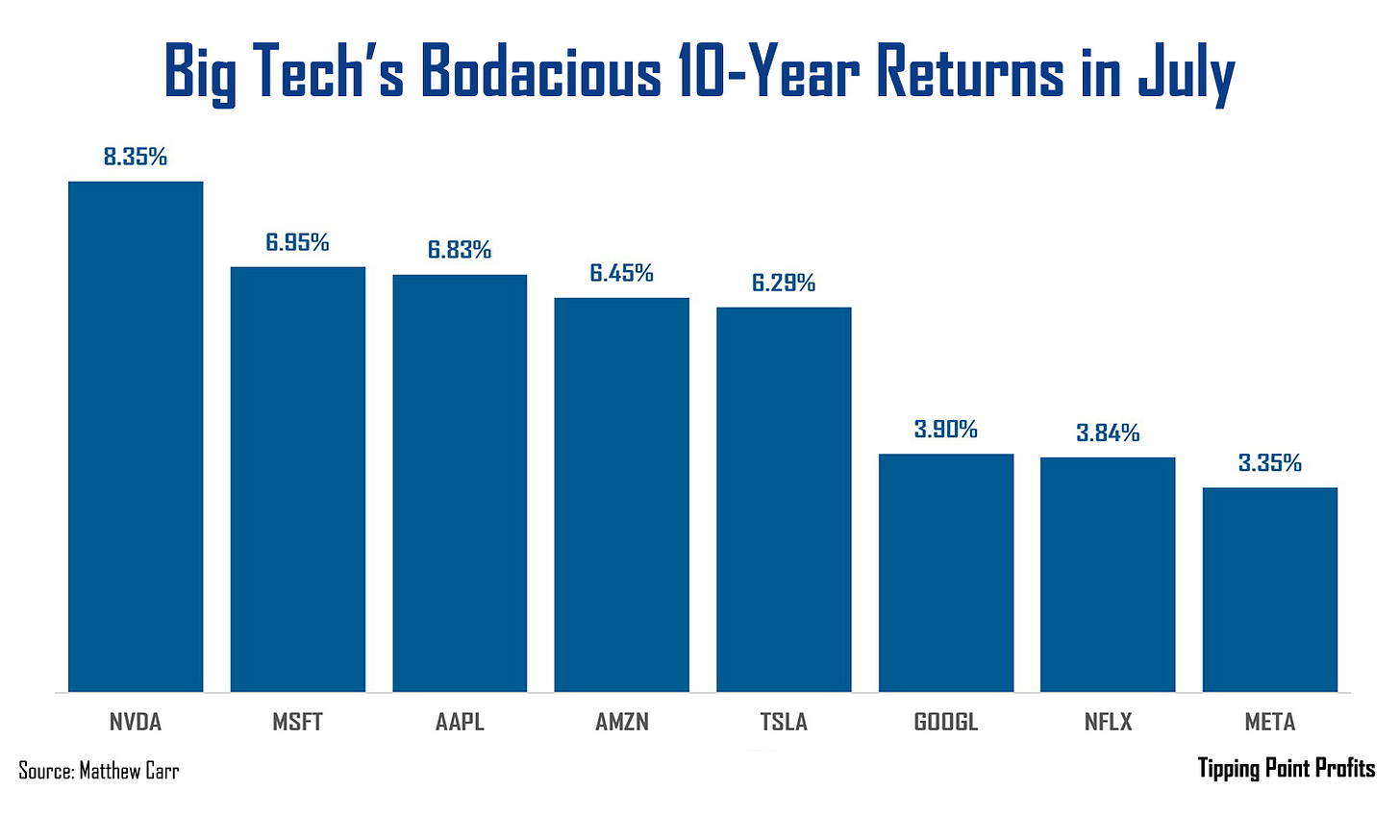

But keep in mind, those bodacious gains are also driven by the biggest of big tech… some of which are putting up even better numbers in the month over the past decade…

It’s worth noting shares of Apple haven’t closed the month of July with a loss since 2015.

And even though Alphabet offers one of the lower average returns in the month of the mega-cap tech stars, shares have only closed July with a loss twice since 2003.

While everyone else is complaining about the “summer slowdown,” those in the know are quietly riding one of the most lucrative trends in tech.

July isn’t just another page on the calendar - it’s a golden window of opportunity.

And with a track record like this, it’s as close to a sure thing as you’ll ever find in the market.

As the summer sun blazes and the fireworks crackle, remember: July isn’t just for vacations.

It’s for portfolio victories.

And this July juggernaut is just starting to roll.

So, are you going to get on board… or just watch from the sidelines as it leaves you in the dust?

Sipping lemonade and collecting gains,

Matthew

Matt,you're a great stock analyst but I miss your stock advise .This news letter doesn't do it for me.