“History repeats itself all the time on Wall Street.” Edwin Lefevre

I’m going to let you in on a little secret…

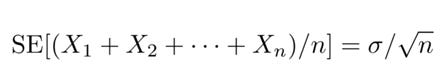

It’s an equation like this that triggered a global financial collapse…

The equation may seem daunting, especially if you don’t like math.

But don’t worry about the variables.

It’s the idea behind this equation that’s important.

It’s amazingly simple and unbelievable powerful.

But what many don’t realize is how exceptionally dangerous it can be.

And we could be seeing these ramifications play out on Wall Street right now.

The Infinite Money-Making Machine

If you’re a bank, you lend money.

But you can’t simply hand out sacks of cash with dollar signs on it and expect everyone to pay it back on good faith.

That’s silly.

You’d go bankrupt.

And that’s even if 98% of your borrowers paid the money back in full. They’re not the problem. The problem is the rascally 2% that didn’t – that defaulted. Those would ultimately be your own undoing.

So, to avoid your own financial ruin, you charge a fee to lend people money. You charge interest on your loans.

The higher the risk a borrower has of defaulting, the more interest you charge to lend them money. You run a series of calculations that help you target the sweet spot in interest rates – ones that are high enough to ensure a profit even in the face of defaults, but not so high that it scares customers away to some other bank.

It’s a great, stable, sustainable business plan. The interest from the loans allows you to be profitable even as you take a bath on that unfortunate 2% that default.

But then you have a light bulb moment… More loans = More profits.

Of course, that’s not that profound. The profound part is… in that equation, even if your default rate doubles, from 2% to 4% or higher, as long as you keep ramping up your number of loans and set a slightly higher interest rate, you’ll always stay ahead of disaster and be profitable.

It’s an infinite money-making machine!

Unfortunately, you realize too late that there’s a fatal flaw in the equation.

It assumes no two defaults are related. It assumes each default is its own independent event. For instance, a borrower loses their job and can’t make payments... Sales at a business decline, presumably because it was poorly run or products ran out of style... Those defaults aren’t connected.

The equation doesn’t consider a systemic risk that would trigger a rapid escalation in defaults... from 2% to 4% to 10% or beyond, while at the same time seeing evaporating demand for new loans.

And because of that, you can’t see that a single crisis could wipe you out practically overnight.

Now, you might think banks are operated by even-keel, pencil pushers that would never fall for such an emotional trap…

But versions of the equation above were used by banks all over the world leading up to the subprime mortgage crisis. And after they showed other people the infinite money-making machine equation, they were able to collateralize the debt.

Of course, we know all too well how that ended.

The housing market was booming. People didn’t want to miss out on the party. And banks gave everyone they could a loan. Even if they knew they were going to default.

The infinite money-making machine!

The U.S. housing market was strapped to a rocket ship to the stars, and it was never going to stop… until it did.

Home prices crashed. Borrowers couldn’t refinance. Delinquencies and defaults exploded. Home prices tumbled further. A global recession followed, millions lost jobs, businesses shuttered their doors, and banks were swallowed by the black hole-weight of their debt.

Today, banks are back in the spotlight… in a bad way. And, the root of the problem has similarities to the infinite money-making machine equation that toppled the world in 2008.

The Scariest Chart on Wall Street

This is the scariest chart on Wall Street in 2023…

It shows the performance of the iShares Regional Bank ETF (IAT) and the SPDR S&P Regional Bank ETF (KRE).

Year-to-date, both of these are down more than 25%.

And all the damage has been in the last week. Keep in mind, the IAT and KRE were up more than 10% in 2023 back on February 7.

By now, you’ve more than likely heard that Silicon Valley Bank (SIVB) and Signature Bank (SBNY) have collapsed. The contagion has spread to First Republic Bank (FRC), which is down more than 50% today.

You may be asking, what do they have to do with the infinite money-making machine equation?

Well, one of the key functions of banks – besides providing loans – is to take deposits from customers.

As the name might suggest, SVB’s primary customers were start-ups and venture capitalists (VCs). As some of you may know, I’ve covered the initial public offering (IPO) market for a long time and even had a trading service on this group of stocks.

In 2020, when the Federal Reserve slashed interest rates in response to the pandemic, the IPO market boomed. And we saw a record year in 2021. SVB was a huge beneficiary. Its non-interest-bearing deposits essentially doubled from $67 billion in 2020 to $126 billion in 2021.

Now, nobody likes money sitting around being lazy, especially banks. So, we’ll often see those deposits invested to achieve a return. That money ends up earning its keep.

And here’s where are equation comes back in… as long as new deposits and the return on the deposits invested outpaces withdraws you have a perpetual profit generator.

SVB dumped most of that cash into very safe 10-year Treasuries. And its long-term securities portfolio bloomed from $17 billion to $98 billion as the deposits from start-ups rolled in.

What could go wrong?

But there’s that pesky problem that a systemic crisis isn’t part of the infinite money-making machine equation.

In 2022, the Fed began raising rates at the fastest pace in decades. The IPO, start-up, and VC markets collapsed.

This meant no new deposits. Even worse, the accounts already with SVB needed that cash to operate in a rising inflation environment. And they were burning through it. By 2022, SVB’s non-interest-bearing deposits fell to $45 billion.

At the same time, with the Fed raising rates, 10-year Treasuries started tumbling in value.

To cover the money being pulled from its accounts for normal business operations, SVB was forced to liquidate its long-term securities portfolio at increasing losses.

The fatal flaw in the infinite money-making machine equation struck again. And SVB collapsed.

The story at Signature Bank isn’t vastly different. Its clients were in crypto, not start-ups.

Now, it’s too late for them… but not for you.

I want you to print out that equation above.

You don’t need to understand it. You just need to understand what it represents… the infinite money-making machine and its fatal flaw.

Tack it to your wall, tape it to your computer screen, carry it in your wallet, tattoo it on your forehead. Whatever you want. But let it serve as a reminder. When a sector becomes overheated – whether that be housing, start-ups, or cryptocurrencies – and there are financial institutions heavily dedicated to that rise, be wary.

That’s a time to think of shorts… not to get wrapped up in the mania and false promises of the infinite money-making machine.

Raging against the machine,

Matthew

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.

Matthew you're a brilliant financial analyst ,but this letter is boring and not giving me any information I care for.