The Six Pack Investors Need to Sneak a Peek At

The Valentine’s Day action is going to start early.

Of course, there will be plenty of “magic” happening in your bedroom or various other locales throughout your personal Chateau d’Amour (depending on how heavy your romantic dinner was and how much stretching you did beforehand).

But the real action will unfold right around breakfast time tomorrow.

I’m sure your loved one is mixing you up a batch of heart-shaped pancakes… or cutting your avocado toast into a heart shape… or making some other not heart-shaped food item into a heart… or maybe they’re doing something else entirely, like topping your morning peppermint mocha with red hots (hopefully, the cinnamon candy, not those little spicy hot dogs).

But during all that heart-shaped/wiener/non-wiener madness, keep in mind Valentine’s Day will also be a pivotal one for the markets.

That’s thanks to the Consumer Price Index (CPI) release at 8:30 AM ET.

Look, we all know it’s expensive out there. Most people have to take out a second mortgage just to purchase a dozen eggs. Used cars have had their “tulip mania” run. Butter was closing in on $5 per pound. And don’t get me started on lettuce… Lettuce!

Inflation has been running amok for the past year.

And the Federal Reserve has declared war against rising prices. Their weapon of choice: raising interest rates to make everything more expensive.

Those higher rates start to trigger massive layoffs and ultimately, dwindling consumer demand as no one has the money or confidence to buy anything.

Prices for goods then begin to drop.

Ta da!

Inflation is defeated! The US central bank declares victory and all it costs is a minor to severe recession. Which one will it be? We won’t know for a few months.

Now, this means the CPI data release each month is extremely important. It lets us – and the Fed – know whether the way against inflation is being won.

Back in June 2022, US inflation growth peaked at 9.1%. The year-over-year increases has steadily come down since then, with January’s CPI reading an increase of 6.5%. Of course, stripping out volatile items such as food and energy, CPI rose 5.7%.

For tomorrow’s CPI, the expectation is a 6.2% year-over-year increase with Core CPI (minus food and energy) rising 5.4%.

Look, it’s still not great. But the upshot is, it’s moving in the right direction.

For investors, this is key. And honestly, the only thing that matters.

So, here’s what you need to know…

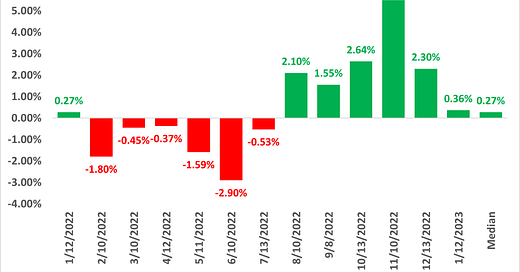

Over the last six monthly CPI prints – going back to August 10, 2022 – the SPDR S&P 500 Trust (NYSE: SPY) and the Invesco QQQ Trust (Nasdaq: QQQ) have posted six consecutive gains on the data release.

The SPY has posted a one-day gain of greater than 1.5% on five of those six CPI reports, with four of those more than 2%.

The QQQ has posted four one-day gains of more than 1% on the report.

All-in-all, that’s a six pack of wins for the SPY and QQQ. A trend worth paying attention to.

We’ve seen how the market has moved every time Fed Chair Jerome Powell has coughed out the word “disinflationary.” And tomorrow morning, investors will be glued to their TVs and trading stations at 8:30 AM ET, waiting to peek at another piece of evidence that this is true.

So, the real action for investors won’t be in the bedroom (or some other room) this Valentine’s Day. The mood will be set by the time most of us have had breakfast (heart-shaped, with or without spicy tube meat). And as long as CPI is moving in the right direction, the market’s shorts won’t be celebrating a drop.

Here’s to high returns,

Matt