Over the last two years, I’ve dubbed the summer travel season, The Summer of Revenge Part I and Part II.

You see, back in the summer of 2022 I began covering that the American Hotel & Lodging Association found that nearly 7 out of 10 Americans had a greater appreciation for travel… all thanks to the litany of missed experiences caused by the pandemic.

I mean, I get it. My wife and I had tickets for performances by Cirque de Soleil and Whose Line is it Anyway? rescheduled multiple times before ultimately being canceled by COVID-19.

No acrobats or improv?!?

What kind of life is that?!

But we also had trips to China, Japan and Southeast Asia shelved.

During the pandemic, the travel industry was gutted. And some companies even went belly up.

Shares of cruise line operators Carnival Corporation (CCL), Royal Caribbean (RCL) and Norwegian Cruise Lines (NCLH) tumbled to their lowest levels in decades.

Airline companies were hammered, with American Airlines (AAL), Delta Airlines (DAL), Southwest (LUV) and United Airlines (UAL) rapidly losing altitude to levels not seen since 2013.

Of course, we know what happens when you deny humans an opportunity to burn those hard-earned dollars… Revenge!

And thus, revenge travel was born.

This year, summer travel season is already off to a hot start!

On Memorial Day weekend nearly 44 Americans hit the road. And the Transportation Security Administration (TSA) screened a record 2.95 million passengers on May 24.

Then, for the Fourth of July, a record 71 million travelers took to the air and roads.

And here’s the kicker… Nine of the 10 busiest days in TSA history have taken place in 2024!

From a data perspective, it seems like a no-brainer for travel stocks.

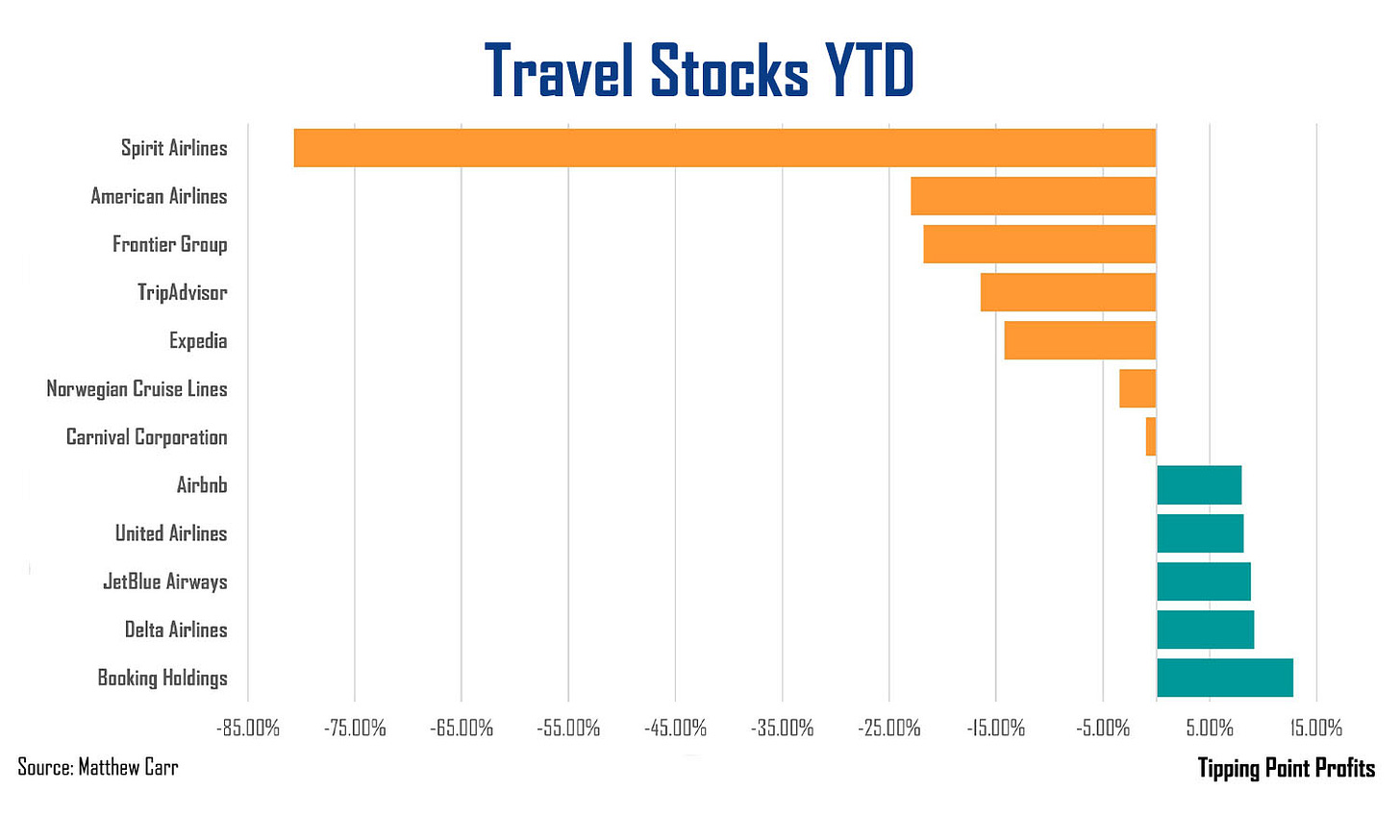

But if you’ve made the mistake of investing in them this year, you’re likely not a happy camper…

Heading South Fast

I’ve been bearish on travel companies in 2024 for some very critical reasons.

Up front, one of the largest headwinds is the price of crude.

Year-to-date, U.S. crude has gained more than 16%. And it’s up nearly 12% over the past year. Of course, we’re down from those late 2023 highs above $90 per barrel. But this extra cost is going to keep the profits of airlines and cruise ships grounded… and it already has.

On top of that, capacity is at record highs.

Projections are for 40.1 million flights in 2024. This is a nearly 9% increase over 2023, as well as a 137% increase from the lows of 2020. The rise in flights has been so great that at the moment several markets are suffering from overcapacity.

What this all means is, airlines have higher costs – higher fuel prices and more planes in the sky. But they have less price control as they race to undercut one another.

For example, Southwest Airlines recently slashed second quarter guidance. The company announced revenue per available seat mile (RASM) is expected to fall between 4% and 4.5%. That’s far worse than the previous projection of a drop of 1.5% to 3.5%.

At the same time, it said unit expenses would increase 7.5% and capacity would be up 9%.

Shares of Southwest are down more than 5% this year. But let’s be honest… some airlines would simply welcome that lackluster performance because their shares have been grounded…

Delta Airlines echoed Southwest in its second quarter earnings. The company stated lower ticket prices, rising fuel and rising operational costs are eating away at profits.

Meanwhile, American Airlines and Southwest have already announced capacity reductions. And more will likely follow, particularly as the summer travel season starts to cool as we approach autumn.

But are they a buy… or a wait-and-see?

From Best to Worst

This week, we have an airline that will take center stage. And it could help set the tone for the rest of the sector.

United Airlines will report second quarter earnings on July 17.

The company has added nearly 200 flights to its schedule for political conventions. And has increased its Milwaukee flights by 75% to accommodate the Republican National Convention this week.

And the story here is one we’ve heard repeated across the sector.

Expectations are for the airline to see a 20% decline in earnings to $3.99 per share. Meanwhile, revenue is projected to increase 6.8% to $15.14 billion.

Now, the options market is predicting a +/- 7.8% move on United shares the report.

And it’s important to remember the key quarters for airlines are the second and third quarters… That’s the height of summer travel season.

But I can tell you that since 2009, the average gain of United shares on its second quarter report is a meager 0.37%. It’s been a mixed bag of big moves higher and lower, especially since the pandemic.

In fact, July used to be one of the best months for United shares. But they’ve ended the month lower three of the last four years and are down nearly 9% in July this year.

The months of August, September and October are suffering from a similar unwelcome trend for United shares. Historically, these are some of the best months for gains for the airline, but shares have ended each of these months lower at least three of the past four years.

It’s become an area of turbulence, not smooth sailing. So, tread carefully.

Next week, we’ll hear earnings from American and Southwest. And then travel stocks will report in earnest in early August.

Despite the record number of Americans hitting the highways and skyways, few companies in the travel sector are enjoying sunny days. They’re struggling under the weight of inflation just like the rest of the world. But getting hit with a double-whammy by having to wrestle with falling ticket prices at the same time. Something to keep in mind.

Not betting on airlines taking off… yet,

Matthew

P.S. Earnings season is here! This week I’ll be releasing a VertEA analysis on Netflix, which will come out Wednesday. If there are companies you’d like me to analyze this earnings season, drop their ticker in the comments and I’ll try to write up a VertEA analysis to share!

hi Matt!

I saw today the new ETH ETFs are trading. Can you share the different ticker symbols and which one would you recommend or not and why ? thank you!

Love it . What about STT?