I never got into Tiger King or Making a Murderer.

Even though I love horror, science fiction and Dungeons & Dragons, I’ve struggled to watch Stranger Things.

I haven’t sat through an episode of Bridgerton.

And I watched Troll – one of the most streamed international movies. But couldn’t fathom what the fuss was all about.

Admittedly, my tastes are more niche. And, unfortunately, that translates to shows that are short-lived.

For instance, one of my favorite shows of the past year is The Brothers Sun, starring Michelle Yeoh and Justin Chien. And that was canceled almost as soon as it started streaming.

But even though I may not have an inkling for what show is going to be a global sensation or have staying power, I have been a successful Netflix (NFLX) analyst for more than a decade. Not to mention, a long-time shareholder to boot.

And with the streaming giant on deck to report earnings tomorrow, I figured I’d share my insights on the company and what to expect…

Slightly Better than Garver

The Seattle Mariners’ Mitch Garver currently carries an unwanted crown.

He has the lowest batting average in the majors this season. The catcher has a mere 47 hits on 268 at-bats for a basement-dwelling average of .175. That means, he gets a hit 17.5% of the time.

Well, Netflix’s performance on second quarter earnings since 2009 is only slightly better than Garver this season…

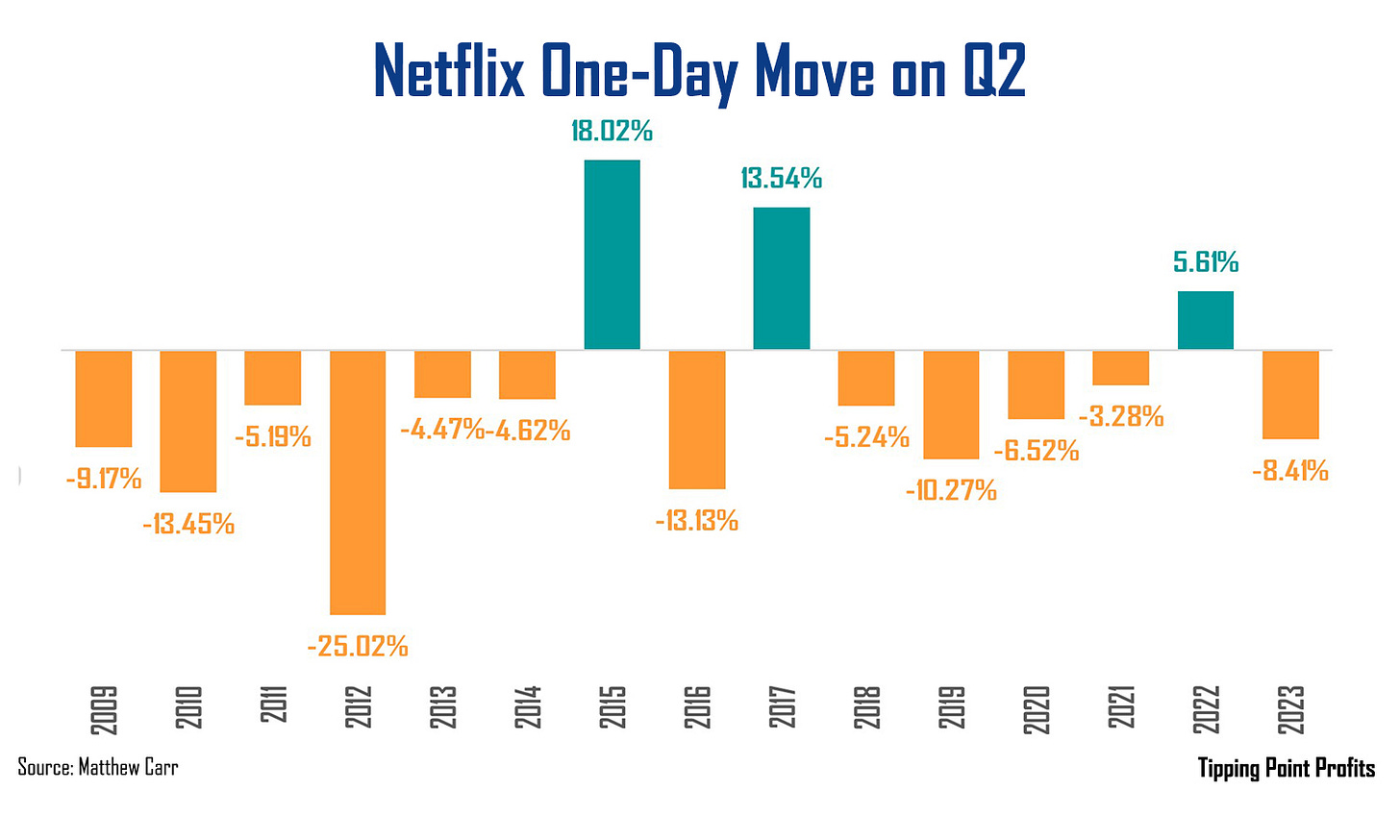

I will tell you now, this is one of the ugliest VertEA charts in my system.

The streaming giant’s shares have gained on second quarter results only three times in the last 15 years.

That’s a 20% success rate!

And they’ve only risen on this report once in the last six years.

Netflix strikes out far more often than it hits on its second quarter earnings release. And the reason for this loathsome trend isn’t luck or an anomaly. Like all trends, it relates back to fundamentals.

Let me explain…

Two Quarter Sulk

Now, if you pull up a quarterly revenue chart for Netflix, you’ll see it doesn’t suffer from a “sawtooth” pattern I so often talk about with seasonal or cyclical businesses, such as retailers.

Nor does its earnings per share (EPS) predictably tank, like we see with a brewer such as Boston Beer (SAM) as it ramps up production to meet anticipated summertime demand.

The streaming giant’s problems are rooted in a growth stock metric staple: subscribers.

And growth here during the first six months of the year is tepid.

For example, the fourth quarter is always Netflix’s strongest quarter for additions. And in the fourth quarter of 2023, the streaming giant saw its subscriber base increase by 13 million.

Shares popped 10.7% on the news.

Well, in the first quarter of 2024, it only added 9.8 million new subscribers. That’s a 3.2 million quarter-to-quarter drop.

So, even though the company’s financials improved substantially year-over-year, shares tumbled more than 9% on this news. And it’s important to point out, shares of Netflix have fallen on first quarter earnings for six consecutive years, as well as seven of the last 10.

Considering its performance on first and second quarter earnings, it should come as no surprise, that two of the worst months of the year for Netflix shares are April and July – the months first and second quarter earnings are released.

This month, Netflix shares are down nearly 5%. So far, it’s their worst monthly performance since April, when they ended the month down 9.43%.

Now, Wall Street is expecting the streaming giant’s second quarter revenue to increase 16.4% to $9.53 billion, with EPS surging 44% to $4.74.

But that doesn’t matter.

All eyes will be on subscriber growth. And until Netflix stops reporting that metric - which won’t happen until 2025 – that’s what investors zero in on. And for much of the past 15 years, these numbers in the second quarter have been a letdown.

The options market is currently forecasting a +/- 8.1% move on Netflix’s second quarter report. To the upside, that’d give us a price of roughly $693. To the downside, which would give us a price of $590. I’d wager it’ll be lower than higher.

According to my VertEA, the average one-day move of Netflix shares on this release is -4.77%. And they’ve tumbled 8.4% or more six times since 2009.

Second quarter earnings is one of the streaming giant’s perennial misses. They strike out nearly as much as Garver. And I don’t think Atlas or Beverly Hills Cop: Axel F or Ultraman: Rising has enough star power to change the course of this scary trend.

There are quarters to buy Netflix. But this isn’t one of them.

It’s a “No” from me on Netflix,

Matthew

P.S. Earnings season is here! If there are companies you’d like me to analyze this earnings season, drop their ticker in the comments and I’ll try to write up a VertEA analysis to share!

Matt,

I had asked a couple of months ago if you were planning a you tube type video like you did with oxford. You said the editing took up a lot of time. You can outsource that on fivver or similiar sights

Do you have any current subscription services available?

Any VERT analysis services available?

Thanks again.