The market's have a new soundtrack this year…

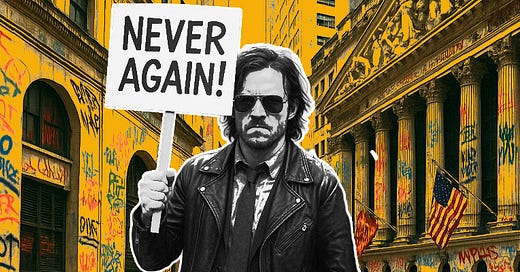

It’s a defiant chant echoing from Main Street to Wall Street.

It's a mantra of resilience… a declaration of independence… a promise to not make the same mistakes of the past…

"Never again."

Retail investors aren’t backing down.

They're pushing back against the established order, and they’re making their presence felt – repeatedly.

They’re not just participants.

They’ve become potentially the most influential force in the markets of 2025.

And that "never again" spirit?

It's their battle cry… and leading to profits.

When Fear Hits, They Fight Back

Let’s think back a month ago to Monday, May 19th.

Wall Street let out a collective gasp after the closing bell on Friday, May 16th when Moody’s downgraded U.S. debt—the third time a major agency has done so in fifteen years.

The news sent a shiver through the market’s fragile recovery.

And predictably, the S&P 500 opened that Monday with a sharp decline.

But then they arrived... the “never again” crowd.

In a stunning display of retail power, individual investors scooped up a net $4.1 billion in shares within the first three hours of trading.

That's the largest retail surge ever recorded for that time of the day!

They represented a staggering 36% of the total trading volume.

And by the time the “smart money” had finished their leisurely lunches, the S&P was back in the green.

But this wasn’t a one-off event… it’s a reflection of a fundamental shift in investor mentality.

From "Diamond Hands" to Defiance

Each week, headlines threaten to topple the market.

U.S. and China trade tensions heat up…

President Trump goes after “Too Late” Powell…

Israel launches strikes against Iran nuclear development…

The U.S. bombs Iranian nuclear strikes…

Iran launches retaliates against U.S. base in Qatar…

And yet, the rally since April 9 has yet to be undone.

The reason stretches all the way back to the pandemic…

Few people had heard of r/wallstreetbets, Roaring Kitty and a “gamma squeeze” before January 2021.

Even fewer believed “meme stock” investors, “apes,” and YOLO traders would grow to the prominence they did during those long months of quarantine.

But that community-driven, herd mentality is still present to this day.

And instead of “buy the dip” or “diamond hands,” their slogan has become more defiant – “never again.”

Never again miss out on an opportunity to take advantage of short-term discounts.

Never again give into fear and be pushed to the sidelines.

So, retail investors are doing exactly what we’ve long suggest… buy the dip.

The only thing that’s different in the branding and the attitude.

The Numbers Speak Volumes

Currently, retail investors account for roughly 19.5% of all trading volume.

That’s a significant uptick from 17% last year.

And while this isn't quite the frenzy we saw during the "meme stock" mania of 2021 – when peak retail investor trading volume soared to 24% - the little guy has undeniably changed.

Their presence isn't just above pre-pandemic levels.

They're a force to be reckoned with, capable of propelling stocks to exhilarating new heights.

And each dip is a buying opportunity, not a reason to flee.

Buying into the mantra,

Matthew

Great, Hope to see some recommendations from Matthew Carr