In yesterday’s Tipping Point Profits, we started going in-depth into Bitcoin’s predictability.

So, if you haven’t yet read, be sure to check it out here.

Because today, we’re getting into the nitty gritty. And I’ll show you how investors can use two predictable and powerful forces colliding in crypto right now to their advantage!

Stop Doing it Wrong!

I’ve long argued that investors that lose money in cryptocurrency are simply doing crypto wrong.

No matter how smart they might think they are, their strategy is flawed.

They fall victim to their emotions – either fear or greed… The two most dangerous emotions in investing.

Admittedly, in a Ben & Jerry’s catalogue of crypto and token flavors, I stick to plain old vanilla and chocolate – Bitcoin and Ethereum.

I don’t waste my time with Dogecoin, Shiba Inu, ScamCoin, or many of the other 23,000 cryptocurrencies.

Many of these are merely fueled by hype, wash trading, and/or are outright scams.

Just for comparison, there are 2,385 publicly traded companies listed on the NYSE. There are 3,611 listed on the Nasdaq.

The Nasdaq was founded in 1971, while the NYSE was founded in 1792.

To have the number of cryptocurrencies explode from one in 2009 to tens of thousands today is untenable.

This is why the Securities and Exchange Commission (SEC) has gone after Binance, Coinbase (COIN), and other crypto exchanges for trading unregistered securities.

This is also why a laundry list of celebrities who promoted some of these coins are in the crosshairs.

In fact, only Taylor Swift – who was approached for a $100 million sponsorship deal – was savvy enough to ask the simple question … “Can you tell me these are not unregistered securities?”

She was one of only a handful that did their due diligence. She turned down $100 million and walked away. Meanwhile, tons of other A-listers are mired in legal problems, though most will only be served with a slap on the wrist.

Now, this renewed crackdown from Washington D.C. has cast a shadow over cryptocurrencies.

Of course, just like the Mt. Gox collapse, Bitfinex collapse, QuadrigaCX collapse, Cryptopia collapse, the LUNA crash, the FTX scandal (who offered Swift that $100 million), the failures of Silvergate, Silicon Valley Bank and others… this too shall pass.

And for the most part, it already has.

But here’s where it gets fascinating for Bitcoin…

We have two predictable but powerful forces colliding. And harnessing these has the potential to prove exceptionally profitable over the next 18 to 24 months.

Will 4 x 12 = $60k?

Not too long ago, I penned a piece here, If You Hate Bitcoin, You’ll Hate This Article.

I broke down the cryptocurrency’s four-year cycle revolving around reward halving.

If you haven’t read my take on this, be sure to take a moment to familiarize yourself here.

So, I’m not going to spend much time on that subject in these pages as I’ve already covered that in depth.

But understand, that is the first of our two predictable but powerful forces colliding.

That is the spot on the horizon we are focusing on. That is where our eye is constantly looking towards.

Our second predictable but powerful force is crypto seasonality.

This is something most investors never realize exists. But it does. (And this can help provide us with the most efficient entry points! This is our advantage!)

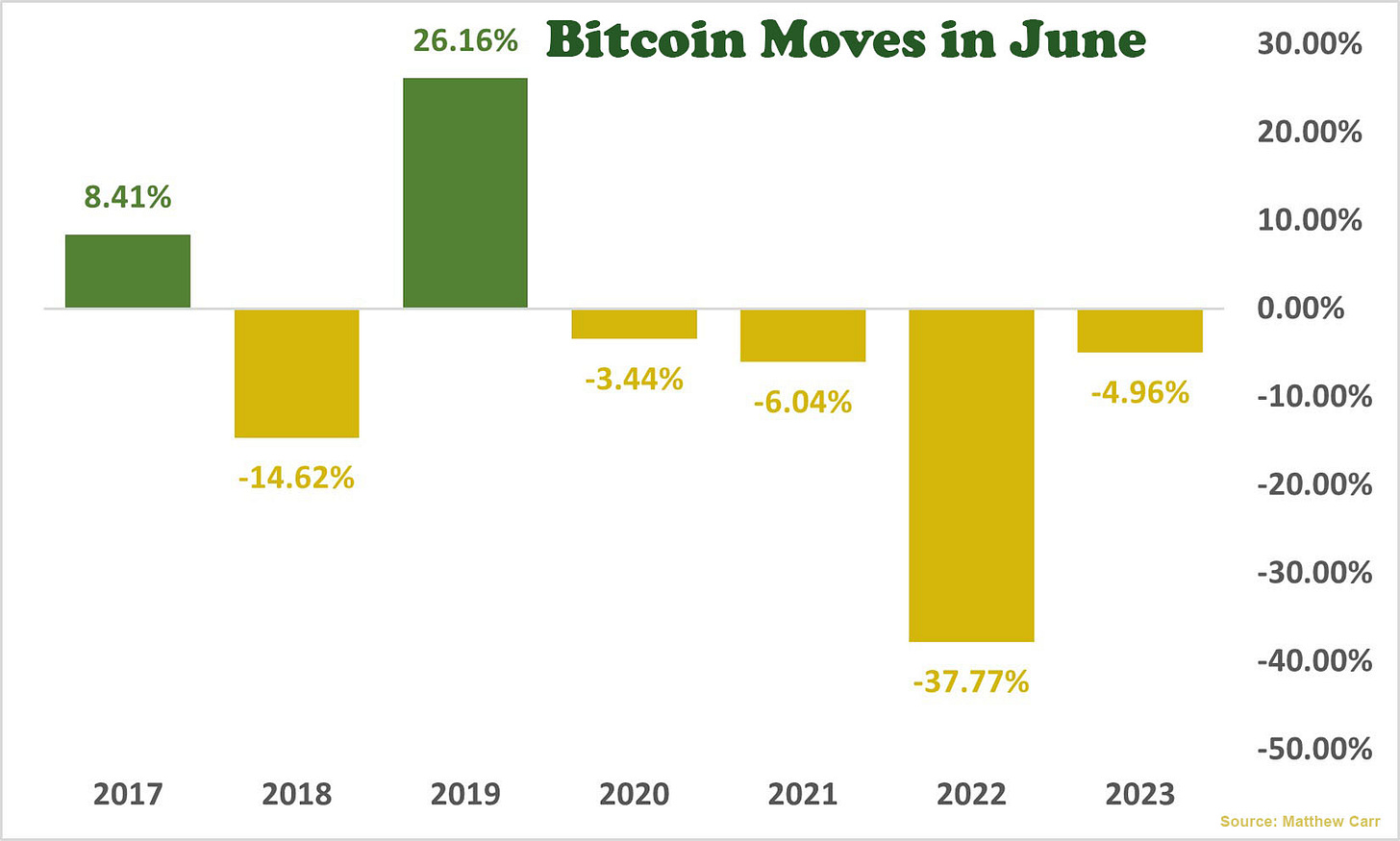

For instance, after rallying in March and April, Bitcoin tumbled in May, slipping 6.87%.

But here’s what few will tell you… that’s a normal May for Bitcoin.

That was the third consecutive year the cryptocurrency has fallen in May. And it’s the fourth year of losses in the month over the last six years.

The move lower shouldn’t have caught any crypto veterans off guard.

But “Oh no!” you say.

Bitcoin is off to a rocky start in June, especially with the SEC suits.

Well, if Bitcoin doesn’t exit June any higher from here, that’ll mark four consecutive years the crypto has fallen in the month… as well as five of the last six.

There’s almost always something in June.

In 2022, it was fears over inflation… in 2021, it was China cracking down on cryptos… in 2020, we had a surge in crypto thefts and derivatives trading…

It’s a terrible month for Bitcoin.

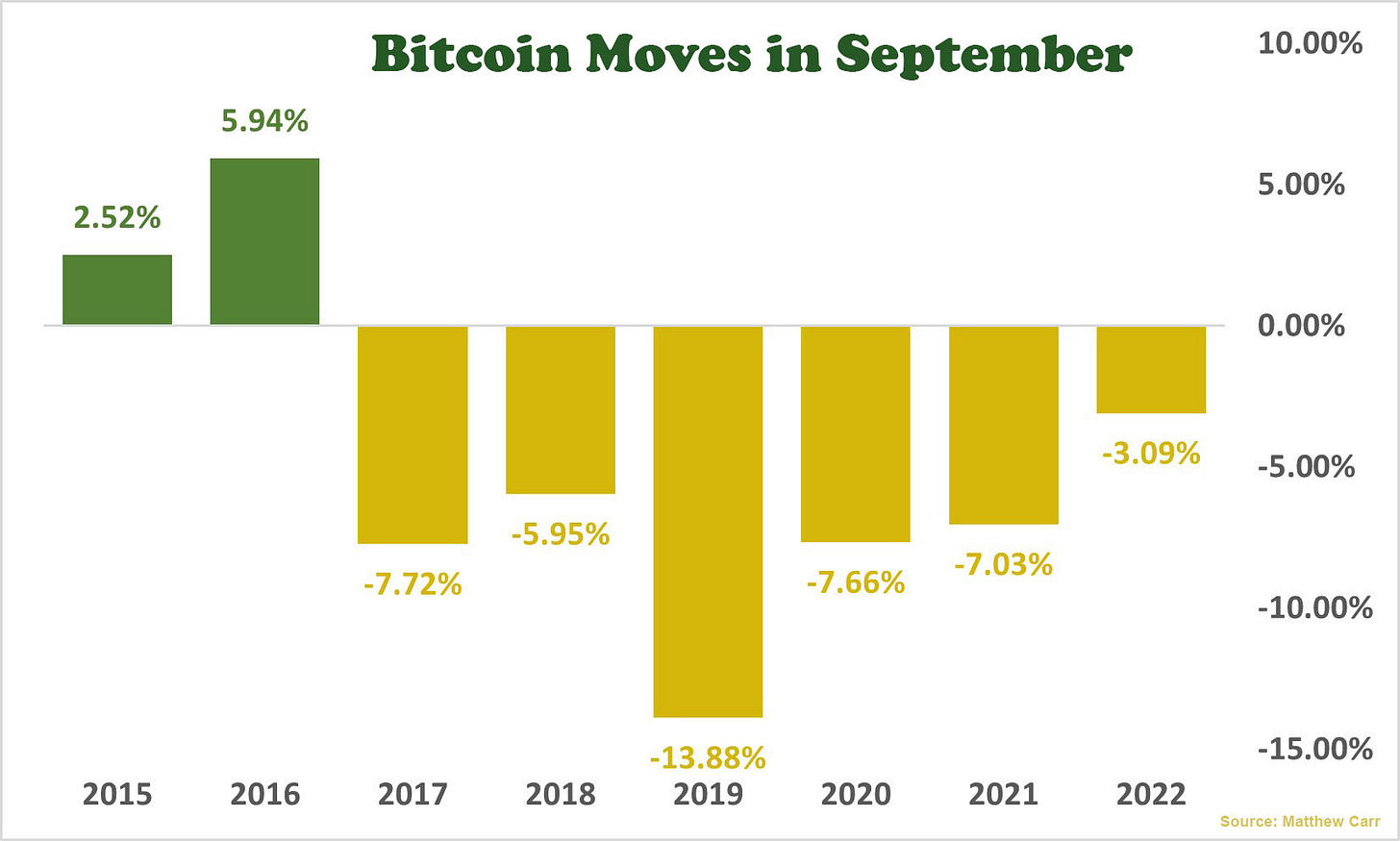

Though, far from the worst… Just look at September…

Bitcoin has declined in September for six consecutive years.

Keep in mind… Predictability is a powerful thing when it comes to investing.

And right now, we know that over the next several months many of these are the most difficult for Bitcoin – June, August, September, and even November.

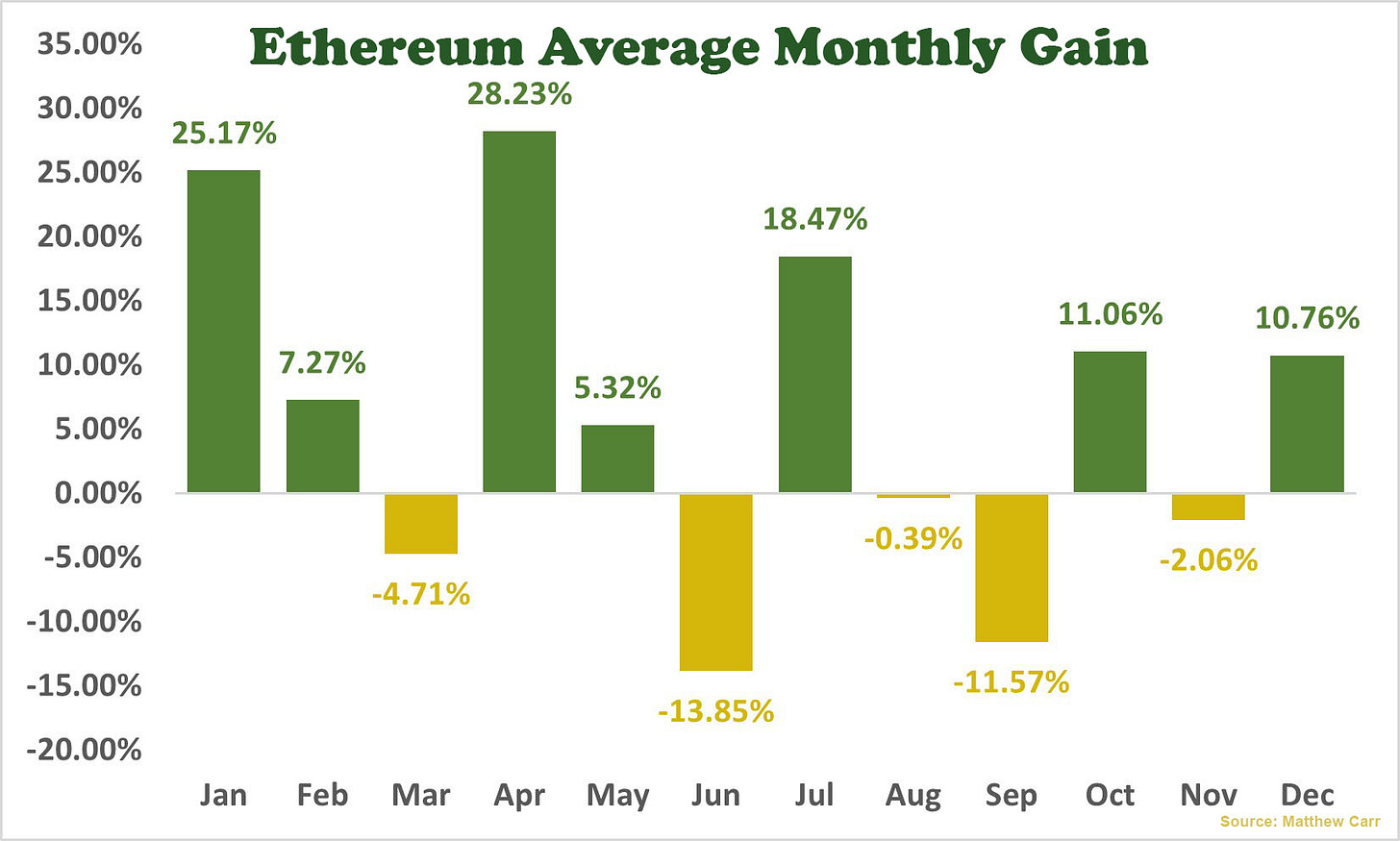

And wouldn’t you know it, Ethereum sees a very similar seasonal pattern.

We know haters are gonna hate.

The Warren Buffetts, Charlie Mungers, Elizabeth Warrens, and the ever-raucous crowd of “I Told You So’s!” are going to see these declines as proof of a faulty system.

They’re going to see it as inevitable even.

But what they and many others won’t recognize is that these declines are predictable.

Though not in the way they realize.

What we see in cryptocurrencies like Bitcoin and Ethereum are seasonal moves like we see in the shares of Boston Beer (SAM), Macy’s (M), Tesla (TSLA), the Invesco QQQ ETF (QQQ) and hundreds of other stocks.

That’s an opportunity.

It’s one we must recognize… particularly with what is going to unfold in 2024.

Buy Low. Sell High. Repeat

Successful investing is a very simple equation: Buy low. Sell high.

The next several months offer us some excellent entry points to prepare for the year ahead.

We can start nibbling around $25,000 or lower in June.

Then we can look to add some more in September… Maybe again in November.

Build our position. Work slowly to create a nice little stockpile.

Invest in crypto the correct way!

We know what’s coming.

We should be off to the races in mid-2024. And that rally should stretch into 2025 thanks to the reward halving.

On top of that, as we see from Bitcoin’s average monthly gain above, the first half of the year for the crypto is traditionally very strong. In fact, it’s only ended the month of February with a loss once since 2015.

So, if history is our guide, this momentum should easily send Bitcoin back above $60,000 and maybe even beyond. The reward halving is a trigger event every four years. And our next one is in April 2024.

This is the pattern we see with Bitcoin again and again and again.

We don’t have to imagine… We know with a fair amount of certainty that an investment has the potential not to merely double… but triple… maybe even quadruple.

Maybe you ignored 2012… 2016… and 2020.

Do you want to ignore 2024?

With these predictable patterns… with these two powerful forces at work… do you want to let that opportunity pass you by one more time?

Preparing for the next climb,

Matthew

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.

[MC1]https://matthewcarr.substack.com/p/the-panic-arrived-on-time-episode

[MC2]https://www.cnbc.com/2023/04/20/taylor-swift-avoided-ftx-lawsuit-by-asking-a-simple-question.html

[MC3]https://matthewcarr.substack.com/p/if-you-hate-bitcoin-youll-hate-this

Great article.You were right on Croc as well !Keep these articles coming !