A single moment can be powerful.

It can be powerful enough to change your life forever.

It happened to me… fortunately for the better.

In my 20s I was working for a financial publishing company in Washington, D.C. Our offices overlooked the White House and the heart of the political capital of the world.

I specialized in crude oil, natural gas, liquefied natural gas (LNG) and a host of other commodities. I built price and trend reports for the trading hubs.

For years, the markets were booming. But they suddenly – and abruptly – took a turn for the worst.

A lot of people were scared.

I was scared.

I asked my boss at the time, “Should we tell our people to sell? Should we move to the sidelines?”

What he said to me next changed the way I thought about markets and about volatility. And it changed my life completely.

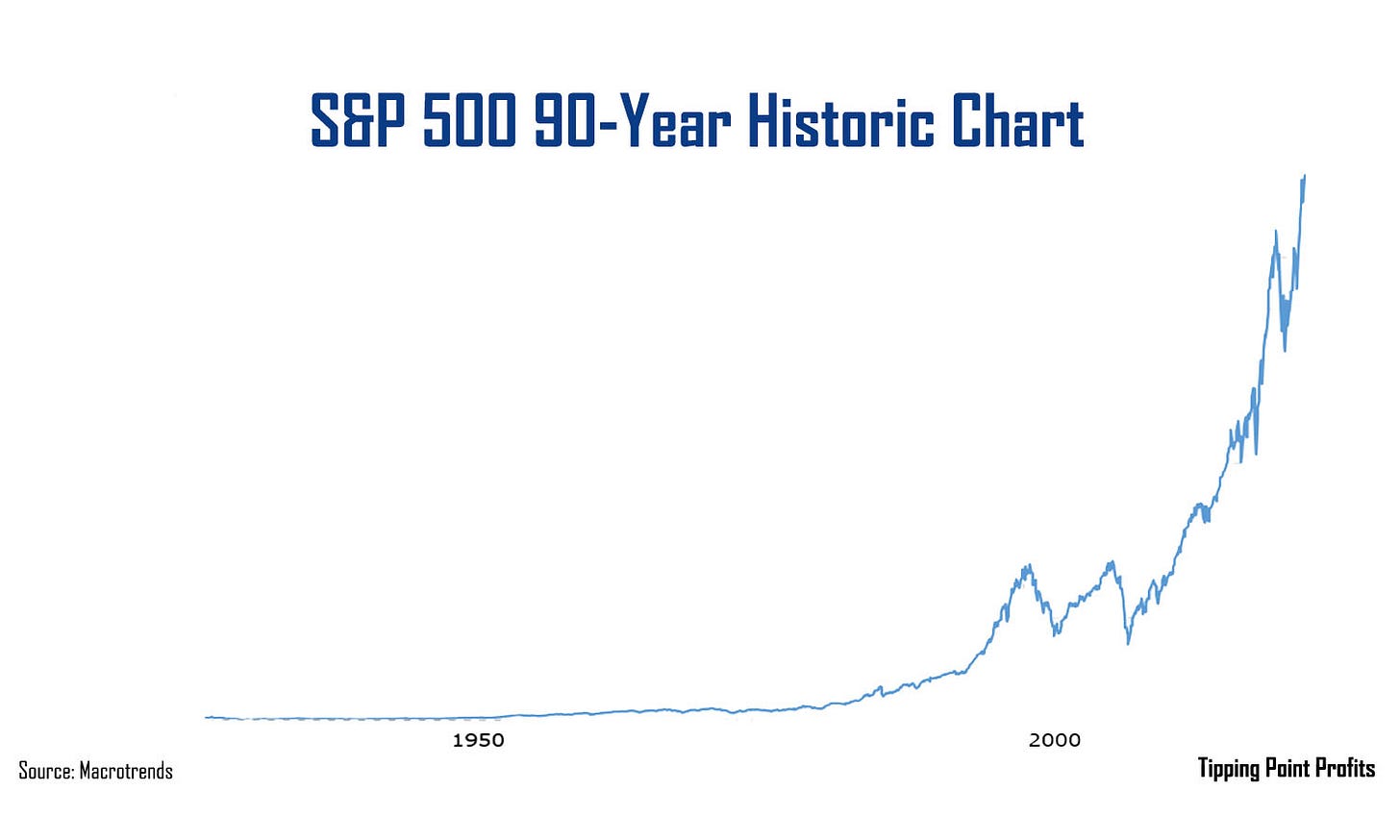

He walked over to my desk and told me, “Pull up an all-time chart of the S&P 500.”

I did.

He told me, “Find the Great Depression…. Find Black Monday… Find Black Tuesday… Find any of the darkest days in the market history. Point to me the 1973 oil crisis... You see, here’s the secret: They’re just blips.”

Of course, it seems obvious now.

It seems undeniable when you look at the multi-decade returns of the index.

But in that moment - when chaos swirled around us, and it felt like the world was ending - I discovered what at the time appeared revolutionary.

Yes, there may be down days, down weeks, down months, and even down years. But ultimately, the market only moves in one direction: Up.

Most importantly, I realized if I remember that when everyone else doesn’t… when everyone else is overwhelmed by panic and indecision… that’s my advantage.

For more than two decades, that’s been my mantra and guiding philosophy.

Don’t panic.

It has made more of an impact on my life than anything else.

It’s brought me calm in even the fiercest of storms.

It guided me during the financial crisis.

During the “flash crash” in 2010 and the U.S. credit downgrade in 2011 it drove my decisions.

It urged me to buy during the U.S.-China tit-for-tat tariffs and the worst Christmas on record.

When the markets imploded from COVID, I had some of my best years ever.

And not even a year ago, in October 2023, I was on stage in front of a crowd of investors telling why it was the perfect time to buy.

The darkest days in the market are some of my happiest.

I understand that when the market regains its footing, and its only true direction – Up – I’ll be the one celebrating.

Why Bukowski and Buffett Hate Crowds

It’s never a question of “if.”

But “when.”

This morning, the Nasdaq cratered once again. And is now more than 13% below its all-time high set on July 11.

The CNN Fear and Greed Index has tipped over into “Extreme Fear.”

The S&P 500 has tumbled below its 125-day moving average for the first time since November 8, 2023.

But keep in mind, corrections such as these aren’t rarities.

They’re inevitabilities.

Over the last 44 years, the S&P 500 has experienced pullbacks of at least 10% in 23 of them. That means these corrections occur more than half the time.

Our last one was October 2023.

But here’s the most important statistic to remember in all of this…

In 13 of those 23 years when U.S. equities have fallen at least 10%, the S&P went on to end the year higher an average of 17.5%.

And yes, sentiment has soured. But here’s what most investors go wrong when looking at the American Association of Individual Investors (AAII) Sentiment Survey, the CNN Fear & Greed Index, or any other emotion-driven metric…

These are contrarian indicators.

The American beatnik poet Charles Bukowski famously wrote: “Wherever the crowd goes, run in the other direction. They’re always wrong.”

And this view is shared by Wall Street’s professional traders, stock pickers, managers, and the wealthiest investors of all time.

In fact, billionaire Warren Buffett has his own immortal twist on Bukowski’s view: “Be fearful when others are greedy, and greedy when others are fearful.”

Pullbacks and corrections aren’t a signal to run for the hills.

They aren’t moments to panic and desperately scamper to the sidelines.

They are opportunities for us to buy. A gift many of us wait for each year to unfold. To go picking through the rubble for shares of great companies trading at momentarily, steep discounted prices.

Shopping, not sitting on the sidelines,

Matthew

Wisest words I have read all day. Good thinking!

Matt, thanks for the calming words. Other than 2 positions I was stopped out of Im not selling. In fact i bought some today on the weakness.