“I can’t stop the rain, here it comes again. Lightning strikes across the sky…” – Peter Criss

April waved goodbye.

And as it did so, it split open the sky releasing sheets of tears.

With May now at our door, the flowers are starting to appear. The paddock is a field of yellow, conquered by buttercups on the march. The irises are starting to peek out of their beds. And all around the countryside is wearing a spring coat of lush green.

But, besides the deluge, April left us with gains. The Dow Jones Industrial Average closed out the month with a 2.56% surge, slightly better than it’s 2.46% average for April.

Though, now we’re confronted with the most infamous month of the year for stocks… May.

For those in dire need of an excuse to be bearish – and there are plenty right now - the month has long been an investor favorite to avoid.

“Sell in May and go away, don’t come back til Labor Day” the saying goes. The ye olde English version is “don’t come back til St. Leger’s Day.”

Regardless of if you’re a fan of the U.S. or U.K. release, neither the Beatles nor Eminem have a rhyme that will live on as long as that one. In fact, the saying predates the Buttonwood Traders on Wall Street.

But is there truth to this idea? Or is it one of the market’s most misunderstood myths and pearls of wisdom?

Sell in May and Go Away?

There’s Star Wars Day (May 4th).

There’s Cinco de Mayo… Mother’s Day… Memorial Day, which is the official start of one of my favorite seasonal investing trends, beer drinking season as well as summer driving season.

None of those holidays are as lucrative as Easter, Thanksgiving or Christmas, but neither are they disastrous.

So, why do investors have a deep-seated hatred for the arrival of May?

Summer vacations.

The “Sell in May” concept originated in England, when aristocrats, bankers and other wealthy elites would flee the suffocating heat of London to summer in the countryside. And they wouldn’t return until after the St. Leger Stakes – the final race in the British Triple Crown – on September 15.

But such a potent quotable knows no borders. It carried over to the U.S. where most people take vacations between May and September.

The idea is investors pare their exposure to the markets in these months by having their money take a vacation as well.

That means a summer lull as volume sputters to a trickle. And it wouldn’t normalize again until after the summer ended and children went back to school, around Labor Day.

For decades, the theory seemed efficient enough. From 1950 to 2020, the Dow Jones Industrial Average averaged a meager 0.3% return from May to October. Meanwhile, the blue chips went on a charge from November to April, gaining an average of 7.5%.

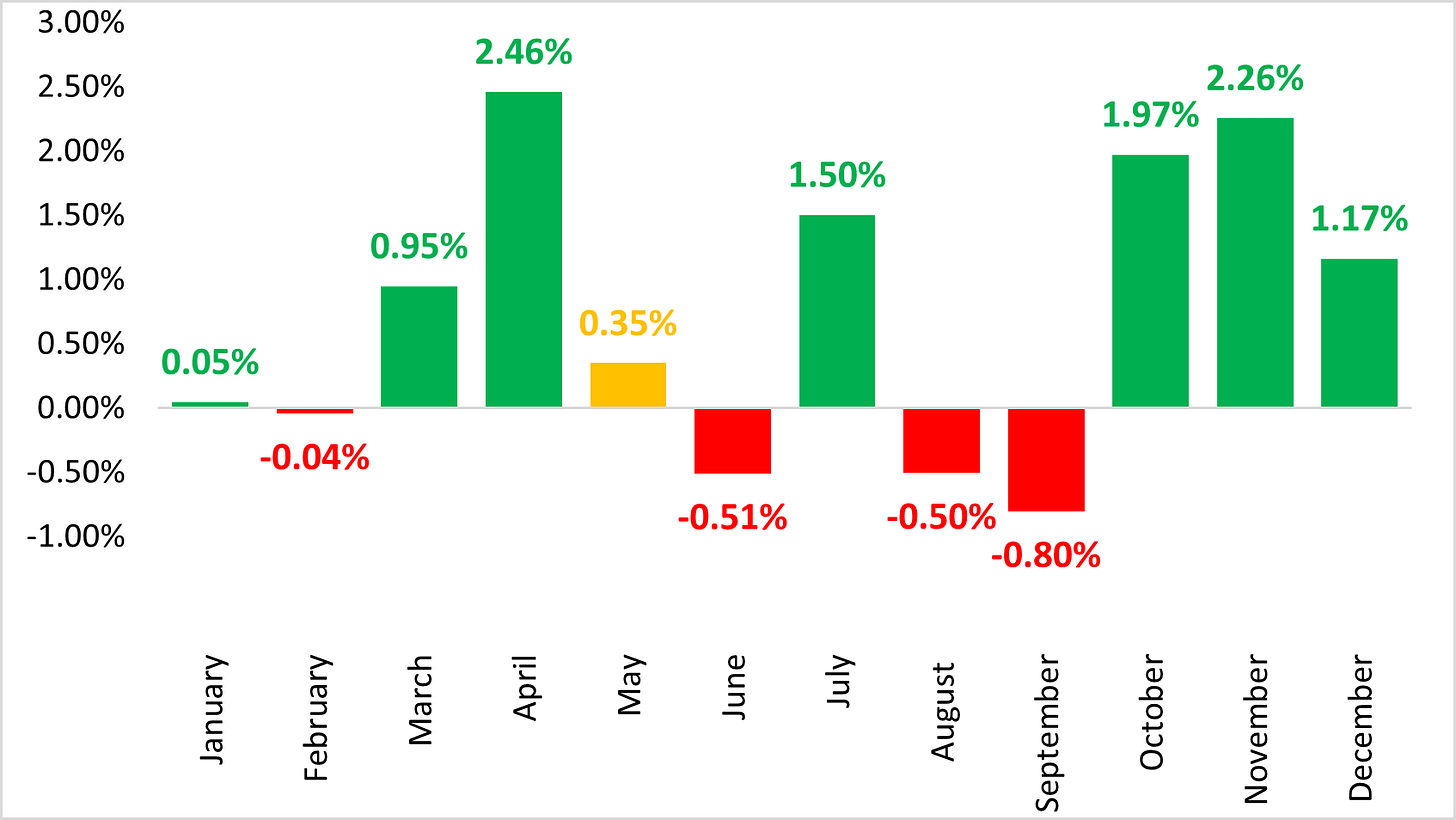

And when we look at the stretch of average monthly gains for the Dow since 1993, the period from May through September doesn’t look very promising.

Three of the four worst months of the year for stocks occur in that five-month span.

But a lot of the damage is weighted to the years between 1998 and 2011. Nearer term the story is a lot different.

In fact, since 2013, the average return of the SPDR S&P 500 ETF (NYSE: SPY) from May through October is 5.4%. That’s actually better than the average 4.96% return from November through April during the same span.

Everyone is now connected to the markets 24/7, 365. Even on vacation – whether it’s in May or in November - investors can place trades.

Despite this, the month can be prone to some notorious swings.

Mayhem in May

May can be as volatile as the starship fuel rhydonium.

The looming phantom of “Sell in May” hangs over the month.

We also have first quarter earnings winding down to a close during the month. That means we enter a quiet period on the company level until second quarter earnings pick up again in late June.

So, it’s no surprise May is home to some exceptionally steep drops.

But the reality is, the Dow has only ended May with a loss 11 times since 1993.

That means blue chips have ended the month with a gain 63.3% of the time over the last 30 years.

The fact of the matter is January, February, June, July, August, and September are far worse months for stocks than May. And since 2013, the Dow has only ended May with a loss once.

With that being said, we can see that when stocks do fall in the month, they tend to fall hard… particularly since 2010. We have three losses over 6% during that decade and change.

Historically, May marks the beginning of a difficult stretch for the Dow and the S&P 500.

But a lot of that has to do with the cyclical nature of industries like retail and shipping, as well as the impact of money managers, Wall Street execs and average Americans heading off to summer vacations.

Fortunately, those industries aren’t very large components of the major U.S. indexes anymore. And since smartphone adoption crossed 50% in 2013, summer vacations no longer weigh on markets as they once did.

“Sell in May and go away” is just another in a growing list of debunked market myths.

Since 2003, the SPY has only exited May with a loss five times. That’s a 75% success rate, though the ETF is averaging a mere 0.64% gain during the month in that span.

The Invesco QQQ Trust (Nasdaq: QQQ) is averaging a gain of 1.53% in the month over the past 20 years, with a 65% success rate.

And the iShares Russell 2000 ETF (NYSE: IWM) is averaging a 1.06% gain in May since 2003 with a 65% success rate.

So, it’s not the greatest month of the year for stocks. But it’s far from the worst. It’s like the Star Wars: Episode III – Revenge of the Sith for equities. It’s no Empire Strikes Back but it’s also more palatable than Phantom Menace.

Holding the high ground,

Matthew

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.