After a day of traffic and meetings, I arrived home to the smell of cinnamon and cloves.

My wife had gathered some apples from our trees and made apple sauce and pie filling.

And timing couldn’t have been more perfect.

You see, this week I planned to introduce a new feature…

Vertical Earnings Analysis – or VertEA.

It’s an approach I’ve been pioneering for almost two decades that does away with the linear thinking that plagues Wall Street… and ends up comparing apples-to-apples.

Too often, the mainstream financial news media will tout, “Over the last six earnings reports, Company XYZ has beat (or missed) four times.”

That tells you a linear trend. But nothing more.

The reality is most businesses are subject to seasonal pushes and pulls throughout the year. If you own and operate a company of your own, you’re probably well aware of this. There’s inventory to manage, products to build and ship, input costs and consumer demand to wrestle with, among a host of other impacts.

And they’re not uniform.

They don’t move in a straight line.

They move in waves.

And these waves impact revenue, earnings per share (EPS), profit margins and forward guidance.

So, one of the secrets I’ve relied on for decades is VertEA.

Essentially, I look at how a company performs every first quarter, every second quarter, third quarter and fourth. Once you adopt this approach, these very clear signals and trends begin to appear. And it allows you to exploit opportunities most investors have no idea are there.

Well, sticking with our apple theme, there’s none bigger than the Apple (AAPL) set to report earnings tomorrow… So, let’s introduce VertEA with what it has to say on $3 trillion behemoth…

The Only Time People Don’t Want an iPhone

The summer months are a cool stretch for Apple.

Most consumers are busy blowing their birthday money and paychecks on trips to the amusement park, the beach, the lake or Europe… where they’re busy defacing wonders from the ancient world.

They’re indulging on food, drink and hefty criminal penalties… not on the latest tech.

For tech consumer gadget giants, like Apple, that translates into softer sales.

Expectations are for Apple’s fiscal year third quarter revenue to come in at $74.24 billion, a drop of more than 10% from the $84 billion it reported a year ago.

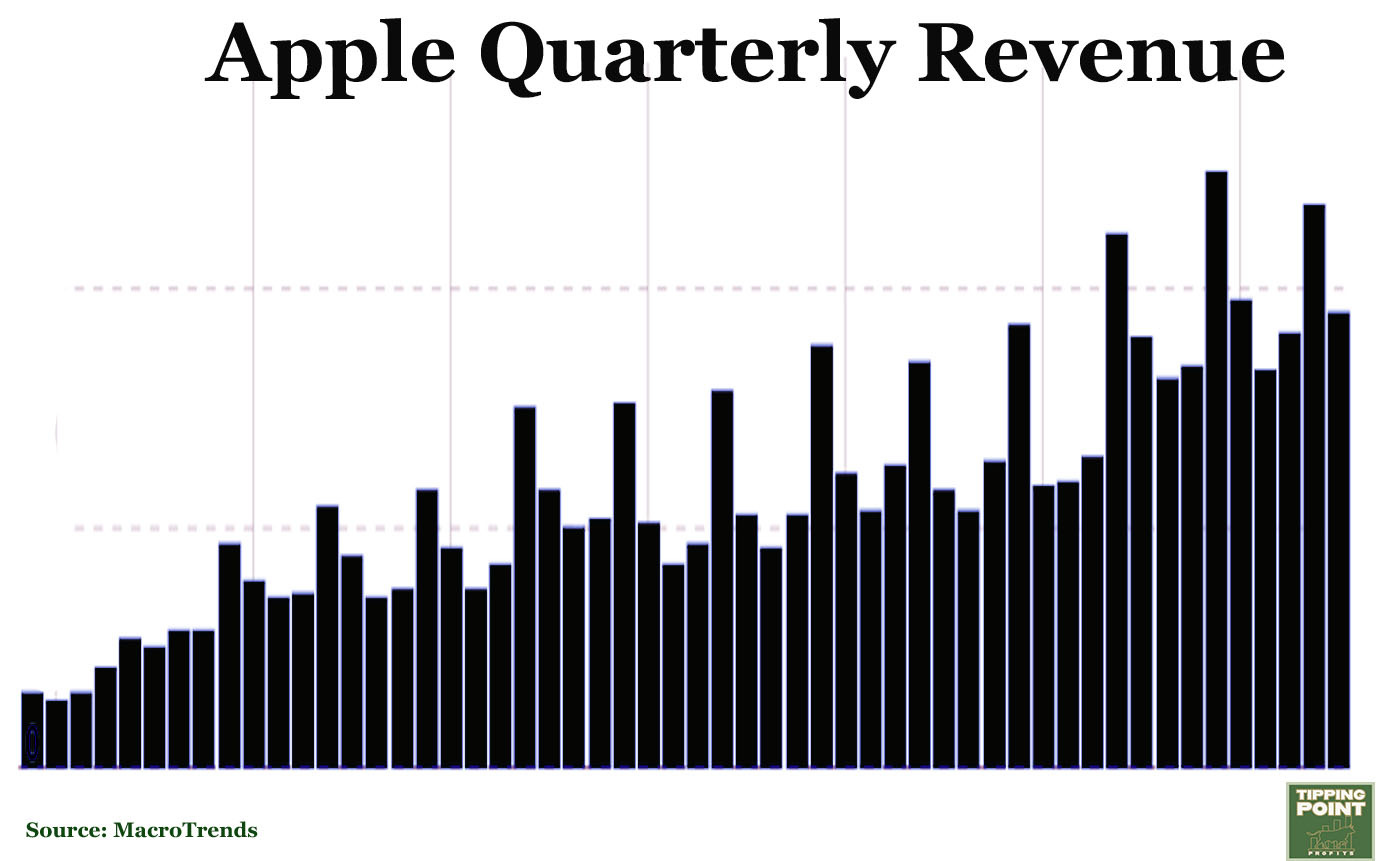

But most important for VertEA is that the projected $74.24 billion in revenue is a steep decline from the $94.8 billion it reported in the company’s second quarter in April.

This is the type of trend we look for.

Though, it isn’t something to get worked up about. It’s merely the “sawtooth” pattern we see in the company’s quarterly sales…

Apple’s first quarter – which spans the holiday shopping season – is by far its largest of the year. Those are the towering columns/teeth in our chart above.

And in the first quarter of fiscal year 2023, the iPhone and MacBook maker brought in $117 billion in revenue.

So, there are some strategists and so-called “experts” that are going to focus on these quarter-to-quarter declines. But rest assured, they’re merely par for the course. That’s the unevenness – the waves – I talked about above.

In fact, as we can see from the chart, Apple’s third quarter is always its worst quarter for sales every year.

Consumers are out buying ice cream cones, baking in sun at the baseball park or plopping down $2,071 per person to see The Weeknd in concert.

But here’s the deal… this low point tends to be an advantage for traders. Not a reason to run.

This Apple Cart Won’t Tip

Despite a summer slump in sales, Apple actually enjoys some very positive trends this time of year.

And these are worth remembering!

I’ve already highlighted that tech stocks don’t experience a “summer lull.” And the Nasdaq 100 has ended July with a gain for 16 consecutive years!

Well, it’s important to keep in mind that Apple is the largest component of the Nasdaq 100… even after the recent special rebalancing that had some investors whipped into a frenzy.

And since 2003, the iPhone maker’s shares have only ended July with a loss twice – 2008 and 2015.

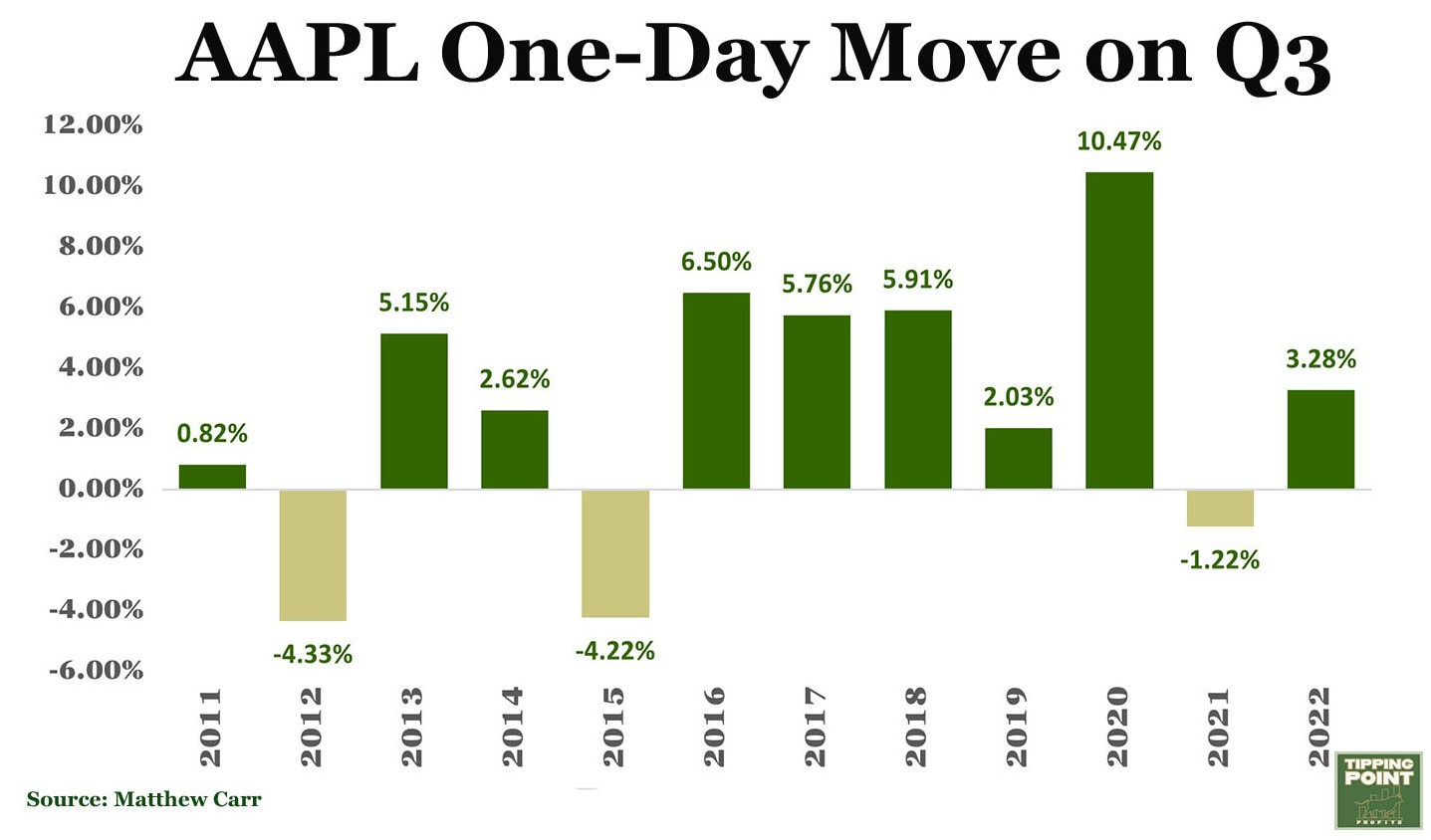

Now, that optimism is in part propelled by the reaction to the company’s third quarter results. We can see that since 2011, shares have only fallen on this report three times…

And one of those was 2015.

But our average one-day move on Apple’s shares on third quarter results over this stretch is 2.73%. And we’ve had five moves of 5% or more.

The reason for this is easy enough to explain: Even though Apple’s sales and earnings hit their lowest level of the year in the company’s third quarter (which it’ll be reporting tomorrow), forward guidance is always strong.

Apple often merely needs to be in hand grenade or horseshoe distance for the current quarter. And the outlook – with the annual September iPhone release weeks away – tends to do the heavy lifting.

For example, analysts are projecting fourth quarter revenue of $81.98 billion with EPS of $1.23. Both of those are steps higher from third quarter estimates.

Of course, we also know the iPhone maker’s best quarter is on the horizon after that, where sales should easily top $100 billion. The iPhone 15 series unveiling in September will lead to that annual upgrade cycle and buying spree.

Now, the markets are in a rotten mood today, thanks to the downgrade to US debt and ADP jobs numbers coming in way better than expected. But think there’s real potential for a sweet lift from Apple tomorrow night. And shares of the company have only ended August with a loss five times in the last 20 years.

Those are sweet trends sure to keep your cardiologist at bay.

Eating an apple a day,

Matthew

I have some great news: I’m going to be speaking at the MoneyShow/TradersEXPO Orlando this October! And that leads to only one question...

Can we meet and talk markets there – IN PERSON?

I sure hope so...because my friends at the MoneyShow organization have assembled a dynamite lineup of world-class market strategists, economists, professional traders, money managers, and newsletter publishers.

You can see from the just-released preliminary agenda that you’re in for an unparalleled investor education experience at the event, which runs from October 29-31, 2023. In addition to my talk, you’ll have the chance to hear and learn from the likes of...

Charles Payne, Host, Fox's Making Money with Charles Payne

George Gilder, Editor, Gilder's Technology Report

Lindsey Piegza, Chief Economist, Stifel Financial Corp.

Barry Ritholtz, Founder and CIO, Ritholtz Wealth Management

Mark Skousen, Editor, Forecasts & Strategies

John Carter, Author, Mastering the Trade

Howard Tullman, General Managing Partner, G2T3V, LLC

And more than 75+ other experts! They’ll cover everything from stocks, bonds, real estate, energy, and precious metals to alternative investments and elite trading tools and strategies. Plus, the conference is being held at the Omni Orlando Resort at ChampionsGate – one of the nation's premier golf, meeting, and leisure retreats.

AND because you’re one of my valued readers, I CAN SAVE YOU 20% on the purchase of a Standard Pass to the event!

So first, here is my presentation schedule:

How to Prepare for the Death of the Bull in 2024

Or if you prefer, call the MoneyShow team at 1-800-970-4355 and reference my discount code SPKR20.

Then get ready. Because I can’t wait to share my insights, strategies, and forecasts with you – not to mention talk markets IN PERSON – in Orlando!

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.