Well, it’s finally here…

Tonight, we have the first debate of this U.S. presidential election cycle. And it marks an important milestone.

There are only a scant 130 days until Election Day.

At the same time, it provides an opportunity to discuss an asset we don’t often discuss here. But sees a surge during the summer months… particularly in years when Americans are heading to the polls.

Summer’s Rollercoaster Feast

There’s a rule most retail investors forget… but it’s one I live by.

All assets move in waves.

There are peaks and troughs… times of high demand and little interest…

Even for those assets investors struggle to consider tangible.

Such as volatility.

You can cup an angry wasp between your hands. Do so, and you’ll likely get stung.

But you can’t grab market volatility and try to wrangle it under control. Even though you’ll feel its sting in your portfolio each time it swarms.

Yet, we can trade volatility.

We can buy and sell it… Go long or short...

We’ve made the speed of change in share prices an asset class.

Now, here’s what most investors will never realize – but should be your No. 1 take from this essay today: Volatility moves waves.

Not just intraday.

Not from candle to candle or week to week.

But throughout the entire year.

And these waves strike against the shore in the same repeating pattern again and again and again.

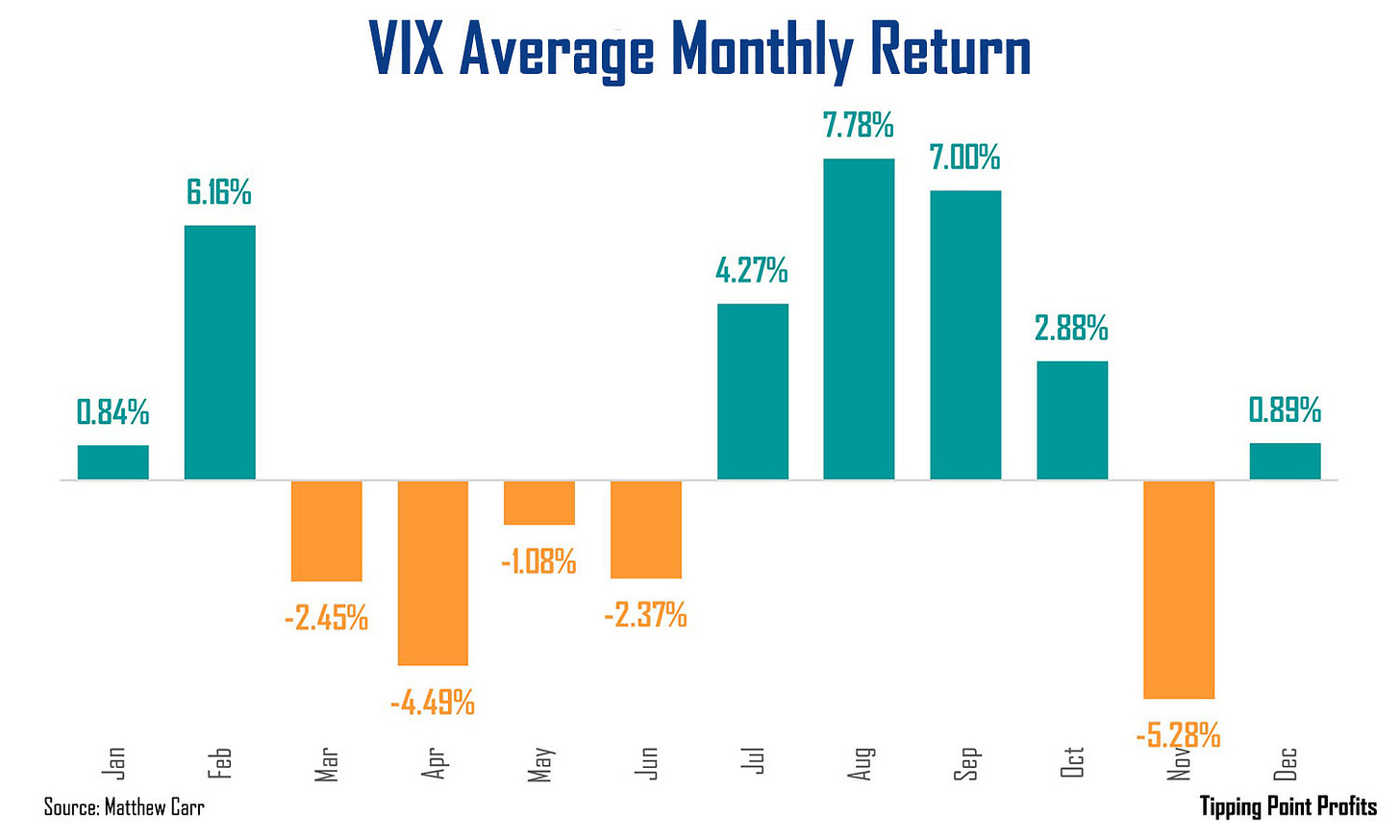

I’ve compiled every trading day for the CBOE Volatility Index (VIX) in my never-ending hunt for cycles and trends. And by breaking down the VIX by its average monthly moves, we spy a clear pattern…

We see there are stretches when volatility soars and periods when it declines. And the changes happen in the same months each and every year.

This allows savvy investors like you to harvest volatility during its best seasons… as well as to short it during its worst.

Now, what you’ll notice from the chart is that – historically, from March through June – the VIX tends to fall. If you’ve been paying attention to any of my previous research notes, you’ll recognize these are traditionally some of the best months for stocks.

Already this year, since peaking on April 19 at 21.36, the VIX then tumbled 46%, setting new 52-week lows in May.

Today, we’re currently hovering around $13.

But look ahead to what happens in July.

That’s the moment we need to start preparing for now.

Buy Low, Sell High… Repeat!

I only want to buy assets at their lows – not their peaks – just before their wave moves higher.

This is how you score consistent gains.

We know volatility is about to surge during its best four-month stretch of the year – from July through to the start of November.

That means we want to get in at the lowest point possible before the upswing.

Well, this is where history can be our guide. Over the past 15 years, the average July low on the VIX is 14.97.

That’s actually higher than where the volatility index currently is.

But in eight of the last 11 years, the VIX hit bottom in July at 12.74 or lower.

Here’s the deal… Most investors get lulled into a sense of security with the VIX at such a low level, never realizing the maelstrom about to unfold.

So, that’s where we have to understand that a true moneymaking trend is lurking.

Throughout the VIX’s history, it surged from that July low to November 1 – an average of 42.36% with a success rate of 89.3%. Over the last five and 10 years, the average return has been 30% or more… but the success rate was 100%.

And during election years, the average return on the VIX during that stretch jumps to 55.9%!

This means volatility is low now. And – if history is our guide – may head lower in the early days of July. But then surges on to November.

Remember, I live by a simple philosophy: The markets shouldn’t be the most stressful part of your day.

If you wake up each morning and your mood is determined by how the Dow Jones Industrial Average, Nasdaq, or S&P 500 are moving, you’re doing something wrong. It’s that simple.

You’re overleveraged… you’re underleveraged… you’re holding too much in risky assets… you’re not diversified… there’s a laundry list of mistakes you could be making.

Investing is about building for the future… about financial independence.

We know volatility is about to spike. Decades of data reveal this pattern.

We can see the countdown clock ticking away. It’s only a matter of time.

It’s best to start preparing now for the next 130 days, and open small stake in the one asset we know is poised to surge this summer until election day: volatility.

Getting ready for some summer fun,

Matthew

Love your work Matt! This is very helpful . Also, I haven’t had the chance to give you thumbs up on your article on NVDA which was also very helpful.

Keep up the good work.