In yesterday’s, My Year-End Forecast for the Nasdaq and S&P 500, Part 1 we covered some recent market drivers, as well as the headwinds the indexes were supposed to face.

As we head into the back nine of 2023, Wall Street strategists are more divided than ever before on the future of the markets…

But should you even bother listening?

That’s we take head-on today…

The Highs and Lows and Where We Go from Here

Fundstrat sees the S&P 500 hitting 4,825 by year’s end.

Piper Sandler is projecting equities will tumble to 3,225.

For a point of reference, the S&P closed yesterday at 4,565.72.

That means, the most bullish call on Wall Street is for the index to climb roughly another 6% between now and December 31. Meanwhile, the most bearish of bears sees stocks collapsing 29.3% during the same stretch.

That’s a gap wide enough to pilot a Supermax through.

Now, there are charts paraded about warning of the vast gulf between these various forecasts, and how negative the outlook strategists are for the back half of 2023.

But let’s remember one thing… and it’s an especially important one…

How many of them predicted a rally this year?

How many of them saw a 30%-plus gain from tech?

That number is so low you can almost count them all on one hand. They are few and far between.

So why would they be worth listening to now?

3 Out of 5 Ain’t Bad

Months ago, I presented to a crowd of investors that the Nasdaq would rise at least 32.5% in 2023. And that in fact, historically, in half of the years such as these, tech stocks surged as much as 42% to 78%!

Currently, the Nasdaq is up 33.8% year-to-date.

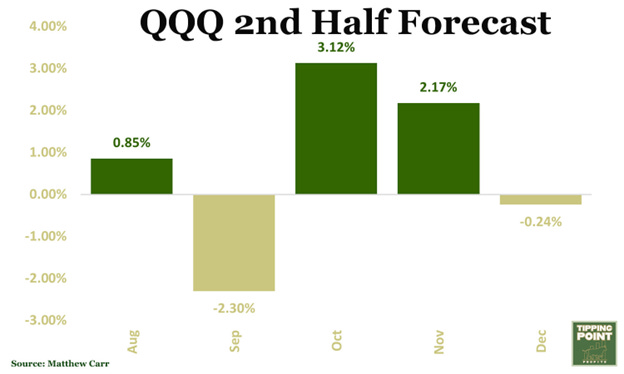

So, with that in mind, here’s what I see for the Invesco QQQ ETF (QQQ) in the months ahead…

Last week, I outlined that the QQQ hasn’t ended July with a loss in 15 years.

Fifteen years!

The last time the Qs closed the month with a decline, George W. Bush was president.

And it looks like that longstanding tradition will remain intact again this year… at least from where we’re currently.

Well, here’s the good news… August, October and November should also be particularly strong months for tech.

Of course, in October and November we’ll not only hear third quarter earnings, but we’ll also be in the thick of the annual holiday spending spree. That adds a nice tailwind each year, particularly for the likes of Apple (AAPL), Amazon (AMZN), Microsoft (MSFT) and Nvidia (NVDA). In fact, Amazon shares have ended November with a gain 79% of the time since 2004!

But it isn’t all easy sailing to close out 2023.

We see from the chart there lurks some stormy seas… namely, September.

But don’t get spooked.

September’s Scary Shift

September is a chance for equities to catch their breath.

That’s all it is.

So, take the opportunity to reload. The best time is usually in the final five days of the month.

You see, over the past two decades, there have only been three years when a tech stock rally continued through July, August, AND September. Those were in 2009, 2012, and 2016.

On top of that, during that same stretch, there’s only been seven years where the directional moves in August and September were the same (up or down).

Often, whatever the Qs do in August, September is petulant and exclaims, “We’re doing the exact opposite!”

So, if we see green in August, there will likely be red in September and vice versa.

And the final piece of data on why to expect a pullback in September is that there’s only been one year during the past two decades where a rally that began in March continued all the way through September without a pause… that was in 2009.

Our rally this year began in earnest in March. And though there are similarities between 2009 and 2023 in terms of bear market rebounds, I don’t expect this run to continue without a breather… September is typically when that happens.

In 2020, 2021, and 2022, the Nasdaq 100 tumbled more than 6% during the month. And the Qs have ended September lower five times out of the last six years.

So… September can be scary.

With all that said and done, I see the QQQ closing September around $373.20. And from there it pushes back higher to my year-end target of $400.29.

For the S&P 500, I see us potentially bottoming out at 4,470 in September before ending 2023 at 4,700.

Now, those forecasts may not be as bullish as Fundstrat. And there nowhere near as bearish as Piper Sandler. But they do consider an extremely high probability we see a significant dip lower on the horizon, with the potential for a 5% correction. Not a world-ender… merely a harvesting of some well-deserved wins before a fresh move higher begins.

The apple trees and raspberry bushes are producing a bounty for us – and the local wildlife – on our small farm in 2023. We even sat watched a fawn nurse yesterday as the doe munched on fruit and leaves. But there’s a bounty to had in the markets as well… investors merely needn’t allow themselves or Wall Street stand in their way.

Always a fan of roller coasters,

Matthew

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.

Thank you, Matt, for sharing your insight with us!

Mathew. Your view from the farm on a tormentuous market helps me find a moment of clensing breath. Thanks.