The markets shouldn’t be the most stressful part of your day.

If you wake up each morning and your mood is determined by how the Dow Jones Industrial Average, Nasdaq or S&P 500 are moving, you’re doing something wrong.

It’s that simple.

You’re overleveraged… you’re underleveraged… you’re holding too much in risky assets… you’re not diversified… There’s a laundry list of mistakes you could be making.

Remember, investing is about building for the future.

About financial independence.

It’s about the freedom to live the life you want.

And one of the easiest ways to accomplish this is by recognizing there’s a method to the market’s madness… even when it comes to the market’s favorite gauges.

Waves Beyond Goodbye

Yesterday’s sell-off triggered some anxiety.

But I adhere to a strict philosophy here…

All assets move in waves.

Even those that are intangible.

Corn, crude, gold, and platinum you can hold and consume (though three of those four would give you a stomachache…).

Buying shares in a company allows you to own a fractional piece of an enterprise. One that spans the globe and sells products to customers.

Volatility on the other hand is the speed of change in share prices.

Yet, we can trade volatility. We can buy and sell it… Go long or short...

But here’s what most investors will never realize – though it should be your No. 1 takeaway from this essay today: Volatility moves waves.

Not just intraday. Not from candle-to-candle or week-to-week. But throughout the entire year.

And these waves strike against the shore in the same pattern over and over again.

Savvy investors can exploit this for gains, or merely understand the tides to keep themselves sane…

Fear’s Summertime 42% Surge

At the end of May, when the CBOE Volatility Index (VIX) was trading above 20, I made a bold claim...

I laid out that by the time July rolled around, the market's fear gauge would tumble to around 12.

At the time, that represented a decline of roughly 40%.

But, I added, we’d see it surge from there to the start of November.

Well, this unfolded to the “T” as I told investors to expect. As Americans were gearing up for the Fourth of July holiday week, the market’s fear gauge fell to its lowest level in a year… 12.73.

That was a drop of 40.3% from its peak in May.

At the time, equities were flying high. In fact, the Nasdaq closed out the first six months of the year with its best performance since 1983.

But those low volatility days of June and July are in the rearview. And unease is back in force. We can see this as the VIX chugs higher.

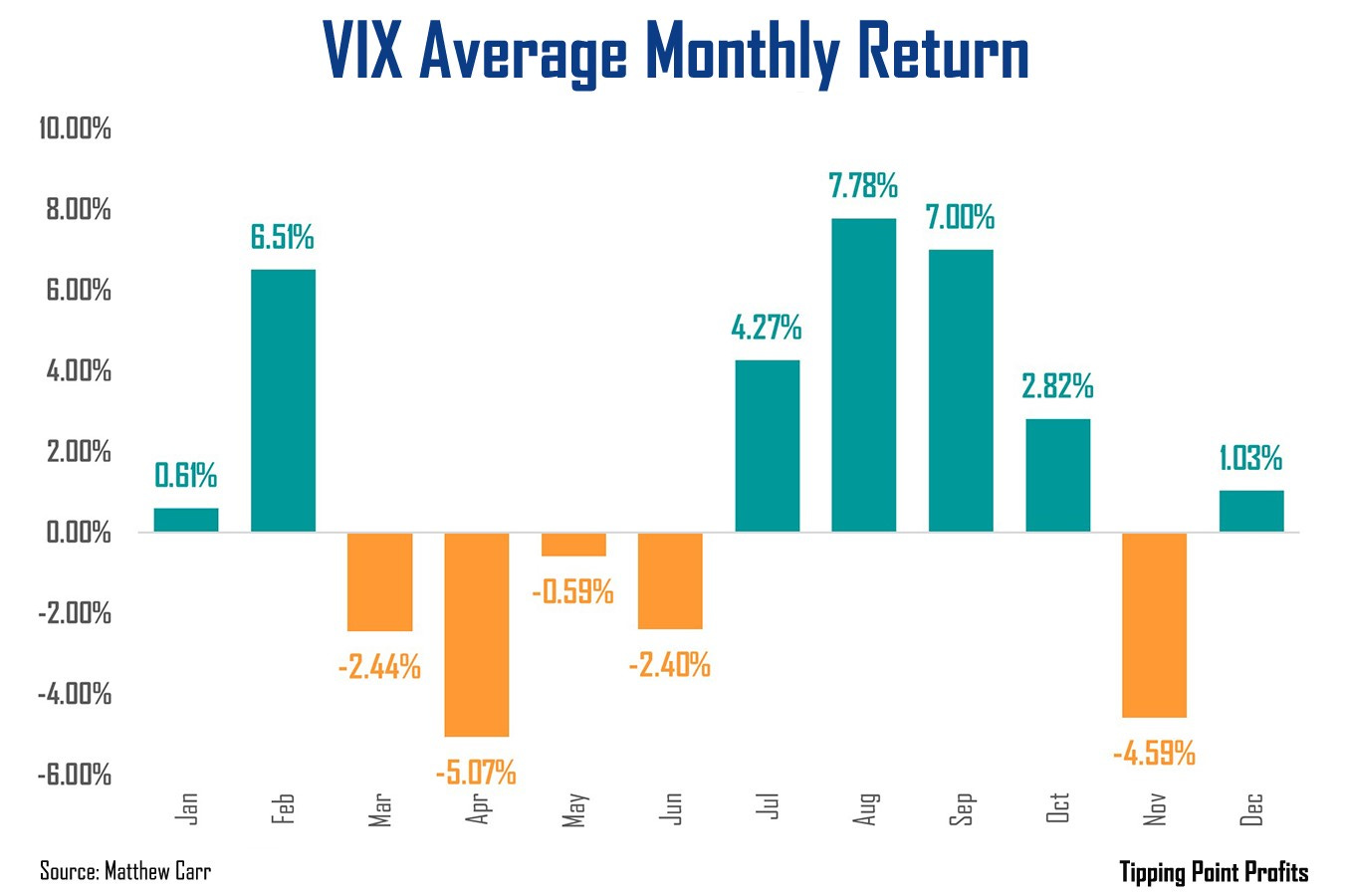

Here’s the takeaway… that’s precisely the pattern we witness every year from volatility. It trades in a predictable wave…

In August, as tech stocks lost some of their shine, the VIX returned to life. At one point surging 35% in under three weeks.

In September, as stocks buckled (which we covered investors should prepare for here), the market’s fear gauge closed the month 29.2% higher. That’s the fourth consecutive year the VIX has gained in September, and the third straight year where it rocketed at least 17.6% in the month.

And this morning, the volatility index hit 20.88… it’s highest level since May.

Plus, it marked a 64% surge off those lows hit at the end of June/early July.

I know there’s a tsunami of headlines to wade through… A possible looming recession… An economic slowdown… High inflation… And the Federal Reserve cranking up rates to higher levels for longer.

Of course, that doesn’t include the upcoming U.S. presidential election with everyone already citing polls.

But the reality is, the move we’ve seen in the VIX isn’t a fluke. Despite all the headlines intended to stoke fear, this year is far from anything but the norm.

What we’ve witnessed is a continuation of a long-term, established trend I’ve worked to make sure investors are prepared for. So, that they can find sanity and solace beyond the talking heads and news stories designed to invoke outrage.

And the thing is, if you recognize and position yourself for trends like these, while the rest of Wall Street is scratching their heads or getting bummed out by portfolio balances, you’re able to live carefree…

Living the Good Life Buying Low

I only want to buy assets at their lows – not their peaks.

And I only want to enter a position right before their wave moves higher.

This is how you score consistent gains.

Most investors get lulled into a sense of security when the VIX gets comfortable nestled at low levels. They never realize the mayhem about to unfold… even when it’s easy to predict.

So, here’s the true money-making trend to remember. Put this in your back pocket for next summer…

Throughout the VIX’s history, it’s surged from its July low to November 1 an average of 42.4% with a success rate of 89%. Over the last five and 10 years, the average return has been 33% or more, but the success rate is 100%.

The VIX is currently up 53% from its low in recent months.

Now, we just exited September, which is historically the worst month for equities. And it was by far the worst month for tech stocks in 2023.

October tends to be a very strong month for equities and can be a wild one for volatility. There have been 11 double-digit returns for the VIX in October over the last 12 years. Though, seven of those were declines.

Something to keep in mind with the VIX around 20 today.

How I enjoy a worry-free life, without fears over the latest headlines or the current crisis, is by planning. By recognizing trends and cycles, understanding that all assets move in waves – including volatility – and preparing accordingly.

And every trader and investor I know who does the same, spends their days focusing on what really matters… not the next candle on the S&P.

Not running shirtless, but smiling anyway,

Matthew

This is a very good article Matt.

Next article should tell us how to play the market when the VIX goes up in those months without shorting stocks ie ETF funds etc.

Thanks again!