That great prognosticator, Punxsutawney Phil performed his magic this morning.

He emerged from his stump at Gobbler’s Knob, and it was declared, “No shadow!”

Thousands cheered as the giant rodent forecast an early spring.

Well, don’t tell poor old Phil that since 1887, his success rate is a paltry 39%. Keep in mind, he’s historically very bearish on spring. He sees his shadow 84% of the time, predicting six more weeks of winter.

Today, we’re going to delve into a trend where gains are even rarer than a Punxsutawney Phil prediction. And it might sound bearish, though not without reason…

Tech’s Short Month Hurdle

February is the shortest month on the calendar.

And there’s a lot of things to celebrate during the month…

Groundhog Day… (and the obligatory watching of Groundhog Day with Bill Murray).

Super Bowl Sunday… the second-largest food holiday in the U.S.

Mardi Gras…

Valentine’s Day…

President’s Day…

Leap Day… and if your “30 Rock” fans, a chance to enjoy the Leap Day Williams episode.

And it’s Black History month.

It’s also the worst month for the Nasdaq 100.

But not in terms of average return. As I’ve outlined before, that unwanted distinction belongs to September.

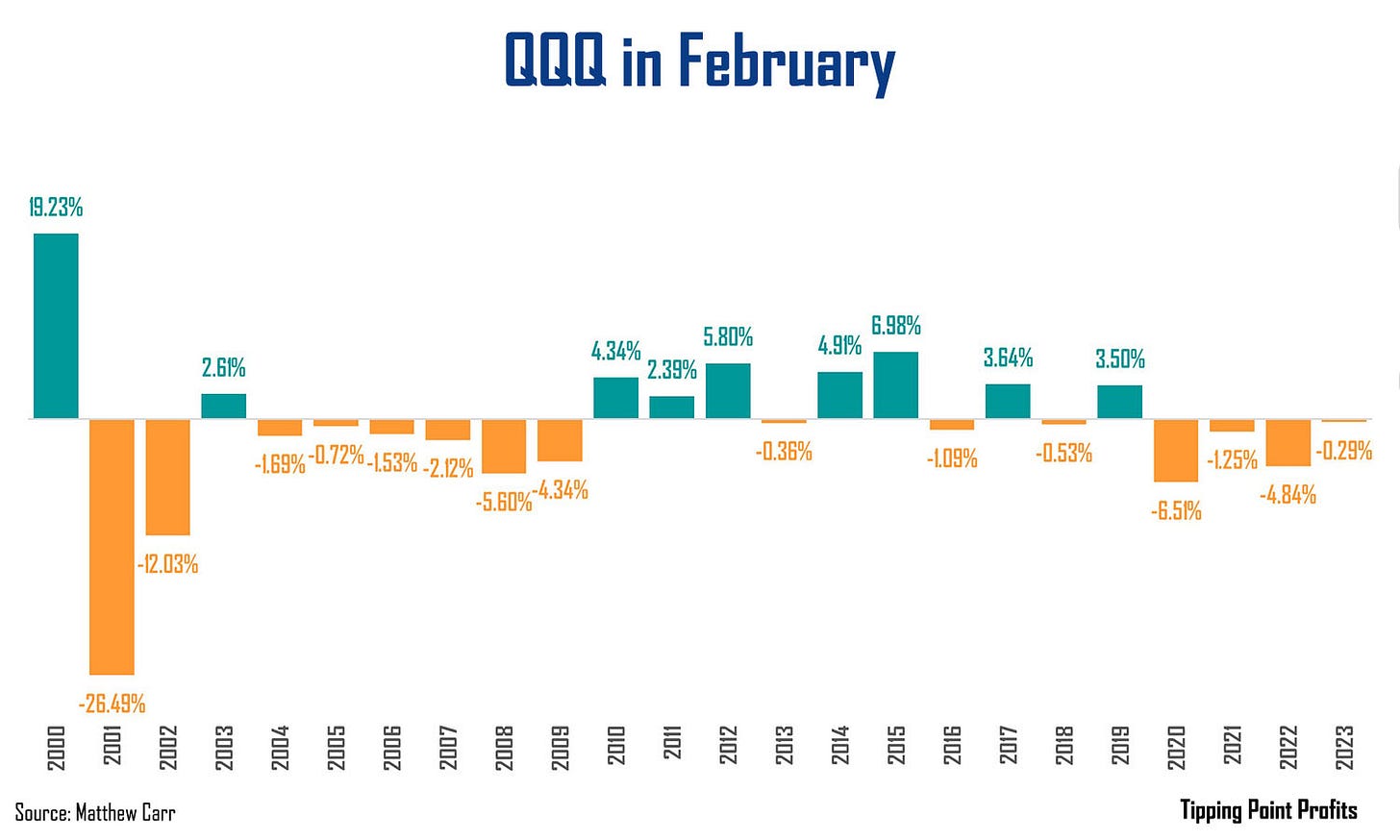

February is the worst month for tech simply for how rare it is for the Invesco QQQ ETF (QQQ) to exit the month with a gain.

Check it out…

The proxy for the Nasdaq 100 only exits the shortest month of the year in the green a mere 37.5% of the time.

For comparison, since 2000, the QQQ has an average probability of 56.42% of exiting any month in positive territory. So, that 37.5% chance of success is well below that average, and even below the 45.83% chance of a positive return we see in September.

It’s a cold month for tech returns.

But is it chance? Or is there something fundamental at play?

Magnificent Headwinds

Well, some of the blame for big tech’s lackluster performance in February falls on fourth quarter or fiscal year first quarter earnings. And the other falls on the historical performance of major components.

For instance, the worst month for Microsoft (MSFT) shares is February. They’ve only ended February with a gain seven times since 2003. That’s a 33.3% success rate.

February is also the worst month for Alphabet (GOOGL) shares. Since going public in 2004, they’ve only exited the month with a gain nine times… A 47.37% success rate.

Tesla (TSLA) shares have only ended February in positive territory five times… A 38.46% success rate. And I recently covered how terrible the electric vehicle maker’s shares do on fourth quarter earnings.

Shares of Apple (AAPL) are trending lower today. Which is no surprise. That’s the company’s seventh drop on its fiscal first quarter results since 2011.

And even though shares of Meta Platforms (META) are rocketing higher today on an earnings beat and its first dividend announcement, February is historically a terrible month for the stock. In fact, if shares continue their momentum and end the month with a gain, it’ll only mark the fifth time they’ve done so since going public.

Amazon (AMZN) is in a similar situation. Shares are pushing higher on a fourth quarter blowout today. But that’s only the fifth time they’ve risen on this report in the last 13 years.

Of course, due to their hefty weights, Amazon and Meta alone are essentially ensuring the Nasdaq 100 won’t dip into the red today.

Traditionally, high expectations for tech are a drag in February. And many of the Nasdaq 100’s largest components fall short on earnings this month. February is also too short for a Federal Open Market Committee meeting, leaving investors a full month to sit and ponder the U.S. central bank's next rate decision in March.

The QQQ is currently up 2.33% to kick off February. And I’m in no way going to cast aspersions on the artificial intelligence-driven gains so far. No one complains when Punxsutawney Phil forecasts six more weeks of winter and spring arrives instead.

But I also understand, that if we do see a pullback in the remaining days of the month, that’s not unusual… It’s not a sign of the apocalypse or a reason to panic. It’s merely on brand for February.

Glad for the early spring… and green,

Matthew Carr

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment, or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.

Where do you work now, I am been looking for you because you are the best

Another great seasonal perspective Matthew!

I can’t remember where I saw this, but there might be 1st half of February is usually strong, followed by a weak second half of February(?).