July is closing with a fury.

Two summer storms rattled our small farm. The winds kicked down an ancient tree across our road. Then they came back hours later and shoved over three more that were weary from the fight the day before.

Fortunately for us – despite some blisters on my hands from hacking away at the fallen timber with my axe and chainsaw – the damage was slight. The only real casualties (beside the trees) a couple of cross boards in the paddock fence took the brunt. And those were on my “honey-do” list to replace anyway… though minus the old hickory.

The markets are enjoying some fury of their own in the closing days of July.

But the damage being done is to shorts.

The question now, will it continue?

Tech’s Best Month

At the start of July, I penned an essay Why I’m Buying the Dip in Tech.

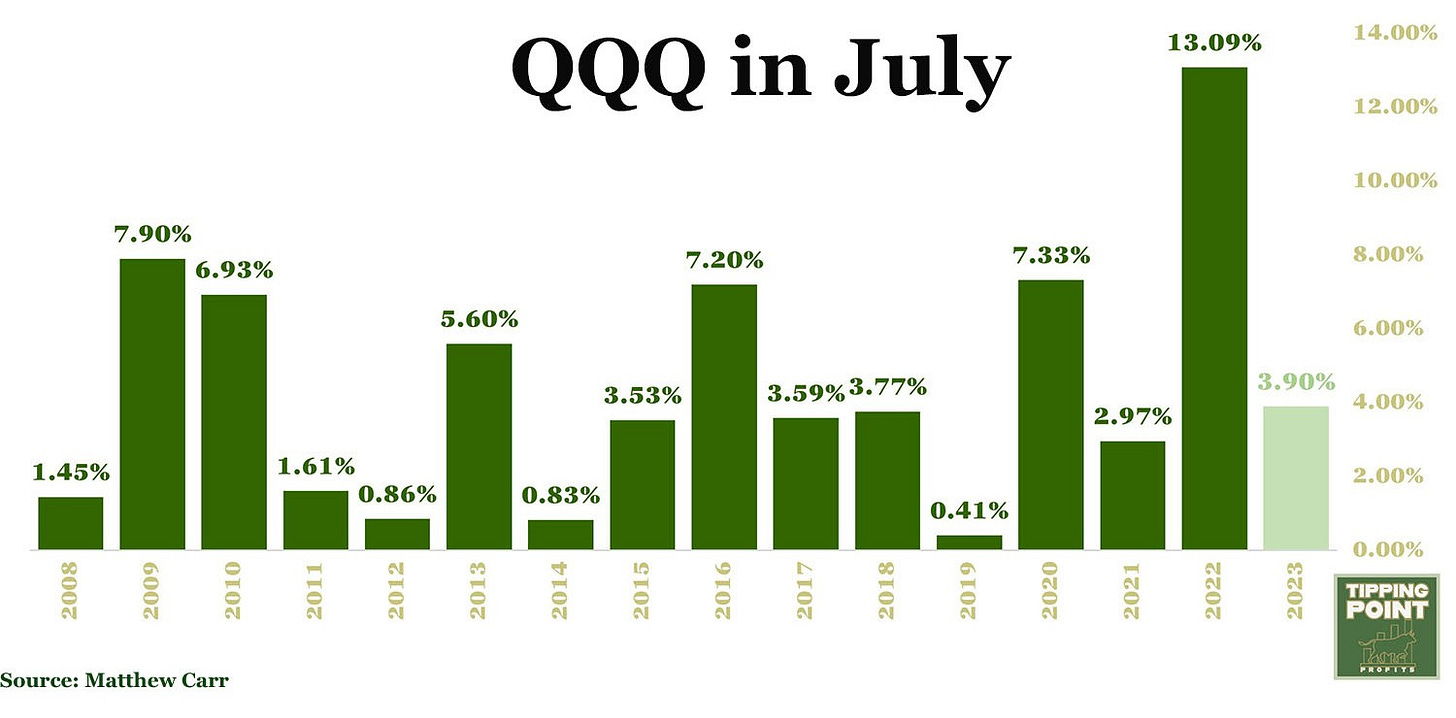

In it, I outlined how the Invesco QQQ ETF (QQQ) was down 1.37% at the time. But that July is home to one of the friendliest trends for the sector…

It was an easy wager to make.

We can see that for 15 consecutive years, the Qs have leapt higher in the month. And in 2023, unless something epically bad takes place between now and the close, it’ll mark 16 straight years of green.

Tech stocks don’t end July in the red.

There are fewer statements to bet the farm on in investing. And our long-term trend – remember, the trend is our friend – has yet to be broken here.

So, what’s next for tech?

60% Chance of Success

I’ve pounded the table that there’s no “summer lull” for tech stocks.

That each year, the QQQ begins a run in March, and it often doesn’t slow until September.

Well, in 2023, the last down month for the Nasdaq 100 was February – when I pushed it was Time to Double Down on These “Dogs” and it was a Perfect Day to LEAP(S) Ahead to 2024.

We’ve enjoyed five consecutive months of gains.

And that’s despite all the negative headlines over a regional banking crisis, continued calls for a looming recession, and an ongoing earnings recession for the S&P 500. Not to mention the war in Ukraine, deadly heatwaves gripping the U.S., and the initial rumblings of the 2024 presidential campaign season.

Through it all, the American economy has remained resilient.

The good news, historically, August tends to be another solid month for the Qs. Though the trend is nowhere as clean as what we see in July…

Over the past 20 years, the proxy for the Nasdaq 100 is averaging a 0.86% gain in the month. That earns it the title of the sixth best month for tech.

And we can see from the chart above, the Qs have only ended August in the red 8 times during that 20-year span. That translates to a 60% success rate.

So, it’s not a shoo-in gains like July.

But traditionally, with second quarter earnings numbers continuing to roll in, we have some winds in our sails through August.

Optimistic with a Dash of Caution

In July, the Federal Reserve once again returned to raising rates. They’re now at the highest level in more than two decades.

But the 25-basis point tick higher was no surprise.

During the pause in June, it was well telegraphed a July hike was in the cards. And as I’ve been stressing the last few months, the market’s response to Fed meetings has become increasingly positive. Investors know we’re nearing the end of this rate hike cycle… if we’re not already there.

No, there is no “official” Fed meeting in August.

That’s the upshot.

Though, the annual Jackson Hole Economic Policy Symposium, put on by the Federal Reserve Bank of Kansas City, serves as an unofficial “Fed Day.” The main event is the closing press conference by Fed Chair Jerome Powell – which is a market mover.

At the same, we have some mega-cap second quarter reports in the days ahead, specifically, Apple (AAPL) and Amazon (AMZN). But before then, I’ll outline what history says to expect.

But typically, this isn’t a stretch where the market starts to hit the brakes… at least not yet.

August isn’t a month to go guns a-blazin’ … It is a month to start looking to tighten up stops. On the horizon is September – a notoriously horrendous four-week stretch. In particular, the back half.

July is ending on some high notes.

So, maintain an optimistic view to the upside. But don’t throw caution to the wind. The annual breather from tech’s six-month sprint is ahead. And that’ll give us a nice opportunity to reload, both for Bitcoin and for tech.

Felling trees, not portfolios,

Matthew

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.

I Have followed Mathew for a long time in my eyes he is one of the top analysts in the Business when he was at the Oxford club he was my go to guy great article Thank you Matthew !!

Great and timely article.