Well, today’s the day.

Cue the synthesizer intro from “The Final Countdown” by Europe.

Celebrate it or shirk it, Fed Day is here!

At 2:30 PM ET, Federal Reserve Chairman Jerome Powell will stand before a wall of cameras and a bramble of microphones to lay out the U.S. central bank’s latest rate-hike decision.

Though, we all know what it will be… a rate cut.

The first in four years.

For the last 24 months, Powell’s presser could make or break an investor’s week.

And during this time, it’s blossomed into one of my favorite monthly catalysts to cover and trade. Because Fed Day has consistently delivered one thing: earth-rattling moves.

But have investors set themselves up for a day of disappointment?

Insane Day for Probabilities

The next Powerball drawing is tonight.

And the current jackpot stands at $176 million. Not a $1 billion, but still a hefty sum.

Now, part of the money states collect from lottery ticket sales is funneled into education. Fortunately for lottery operators, no one bothers to teach statistics or probability in school anymore.

Isn’t that handy?

So, let’s touch on probabilities for today…

The biggest headline for Americans and investors worldwide last week was the release of the Consumer Price Index (CPI). This is the Federal Reserve’s preferred measure of inflation. Expectations were for a 2.6% year-over-year increase, which would be a cooling from July’s 2.9% reading.

Well, August’s CPI came in at 2.5%, slightly below expectations.

That lower CPI reading all but cemented a rate cut from the Fed this week. But here’s we things get screwy…

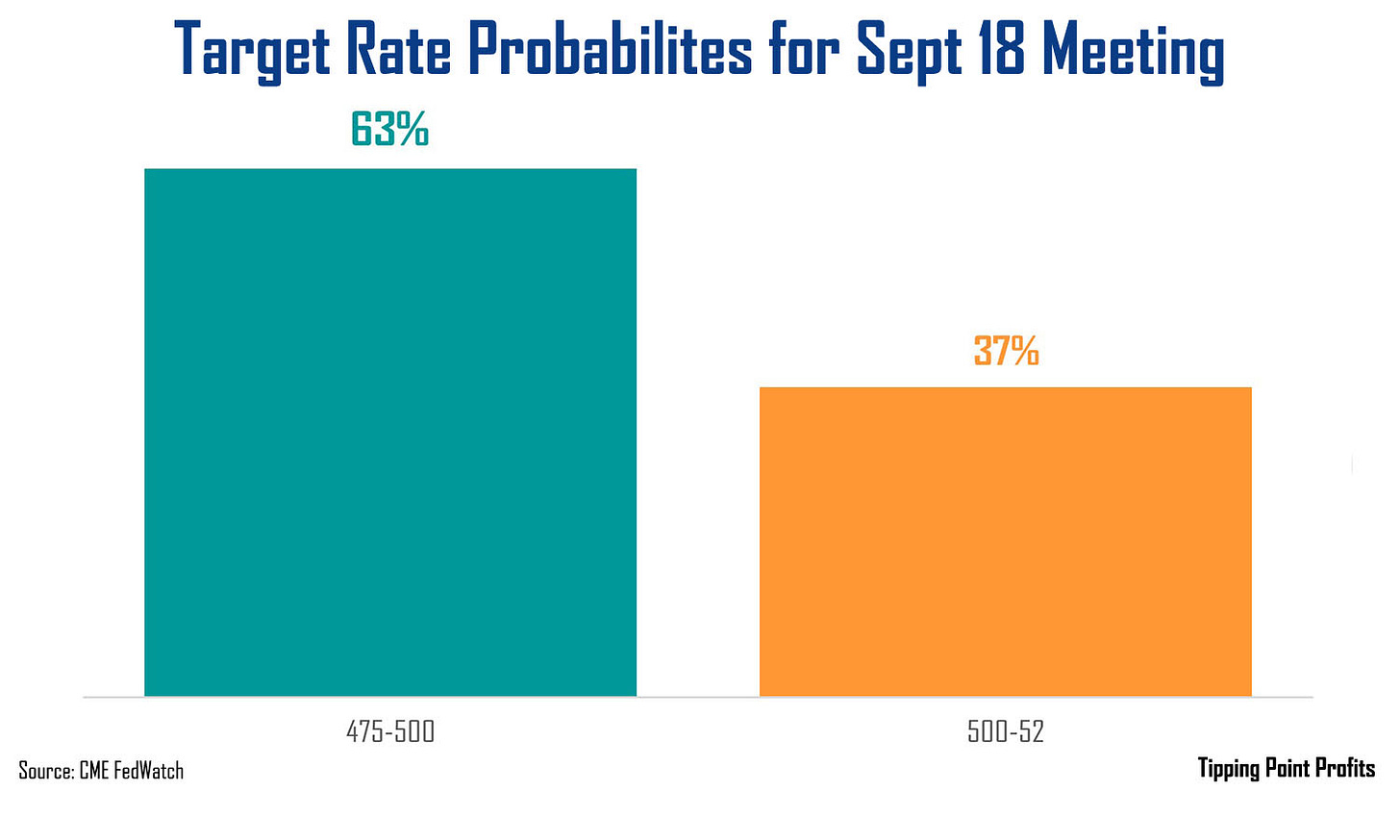

As it stands now, there is a 63% chance that the Fed will announce a 50-basis point (bps) cut. And only a 37% chance that the Fed will announce a 25 bps one.

To me, this is insane.

It signals to me the markets have divorced themselves from reality.

This is the first rate cut of the cycle, and the markets believe the Fed is going to come out throwing haymakers?

I don’t get it.

Now, I will say, it’s a more measured view than the 87% probability of a 50-bps cut a few days ago. But that’s also up astronomically from the 14% probability last week.

All of this also signals to me that investors and traders should be prepared to embrace for a return to 2022.

Here’s what I mean by that…

Setup for Letdown?

Below is how the Invesco QQQ ETF (QQQ) – the proxy for the Nasdaq 100 – has performed on official and “unofficial” Fed Days.

The unofficial days are highlighted in the yellowish-orange. Remember, there is no Federal Open Market Committee (FOMC) meeting in August. Though, that doesn’t mean we get a month of being Fed free. That’s when we get the Kansas City Fed’s Jackson Hole Economic Symposium. And the headliner of the event isn’t Bruce Springsteen, Taylor Swift, Eagles or Bad Bunny… it’s the Fed Chairman’s closing speech.

This presentation serves as an “unofficial” Fed Day and is historically a market mover (which is why I always include it) ...

But what we see from this chart is a lot of big moves.

And we can see we have 11 losses out of 24 Fed Days since the start of 2022.

I would point out, 9 of those 11 losses took place in 2022 and early 2023.

That’s when the U.S. central bank was raising rates at the fastest pace in decades.

But since November 2023 there’s been a shift in tone. Six gains to just two down days. And that’s because the markets knew we were getting closer to the moment we have this week… a rate cut.

Normally, I would be certain the market would be poised to bounce higher today, sticking with the trend we’ve seen.

But that strong belief for a 50-bps cut has me cautious.

This is the classic setup for a broad market letdown.

And we could even be in store from one of JPow’s famous admonishing speeches about markets getting too ahead of themselves. Think Jackson Hole in August 2022 where he reiterated “two means two,” as well as his press conference from November that same year.

Tech stocks tanked on both of these speeches.

Investors are expecting the Fed to be aggressive.

To me, the rest of the data doesn’t demonstrate the need for such aggressiveness, particularly as inflation is still above the 2% target mandated by Fed policy. That 2% target isn’t arbitrary. It has been established policy of the U.S. central bank since 2012 after decades of debate.

We’re already getting a cut early… some would even argue too early.

And a 50-bps cut feels like too much of a stretch.

Of course, the Fed could deliver on that, and investors would cheer.

We’ll see how markets react in the next few hours. But with the rate cut probabilities out of whack, I’d be more cautious than optimistic. And I think we may be in store for a move similar to those we saw in 2022 than we’ve seen in 2024.

Danger on the Track,

Matthew