“No winter lasts forever; no spring skips its turn.” – Hal Borland

If April showers bring May flowers… then May is going to be one petal-filled month.

It rained for days.

The downpours have been so bad that I watched a fox evacuate her den. She carried each of her kits from her washed-out home in the forest on our property to a small stable in our paddock. Four gray, drenched fluff balls rescued, one-by-one.

But the sun is finally breaking through this morning.

The apple trees are dotted with green buds.

Spring is officially here!

It’s the season of new beginnings.

And for those that have followed me for a long time know that April is often one of my top reasons to be bullish each time it comes around!

So, we’re going to dig into one of my favorite months of the year.

The month is home to April Fool’s Day, Tax Day, Earth Day, and my personal favorite holiday, Greek Easter.

But this year’s festivities may be marred by an unwanted trend… which only comes around every four years. And no, I’m not talking about the upcoming Bitcoin reward halving...

Gleaming the Cubes

Awesome April.

That’s what I call it, and you should too.

Of course, we all know the weather is warmer this time of year, flowers are in bloom, and spring is in full swing as March’s notorious “Second Winter” fades in the rearview.

But for investors, April provides even more reason to cheer… And that’s because it’s routinely one of the best months of the year for stocks.

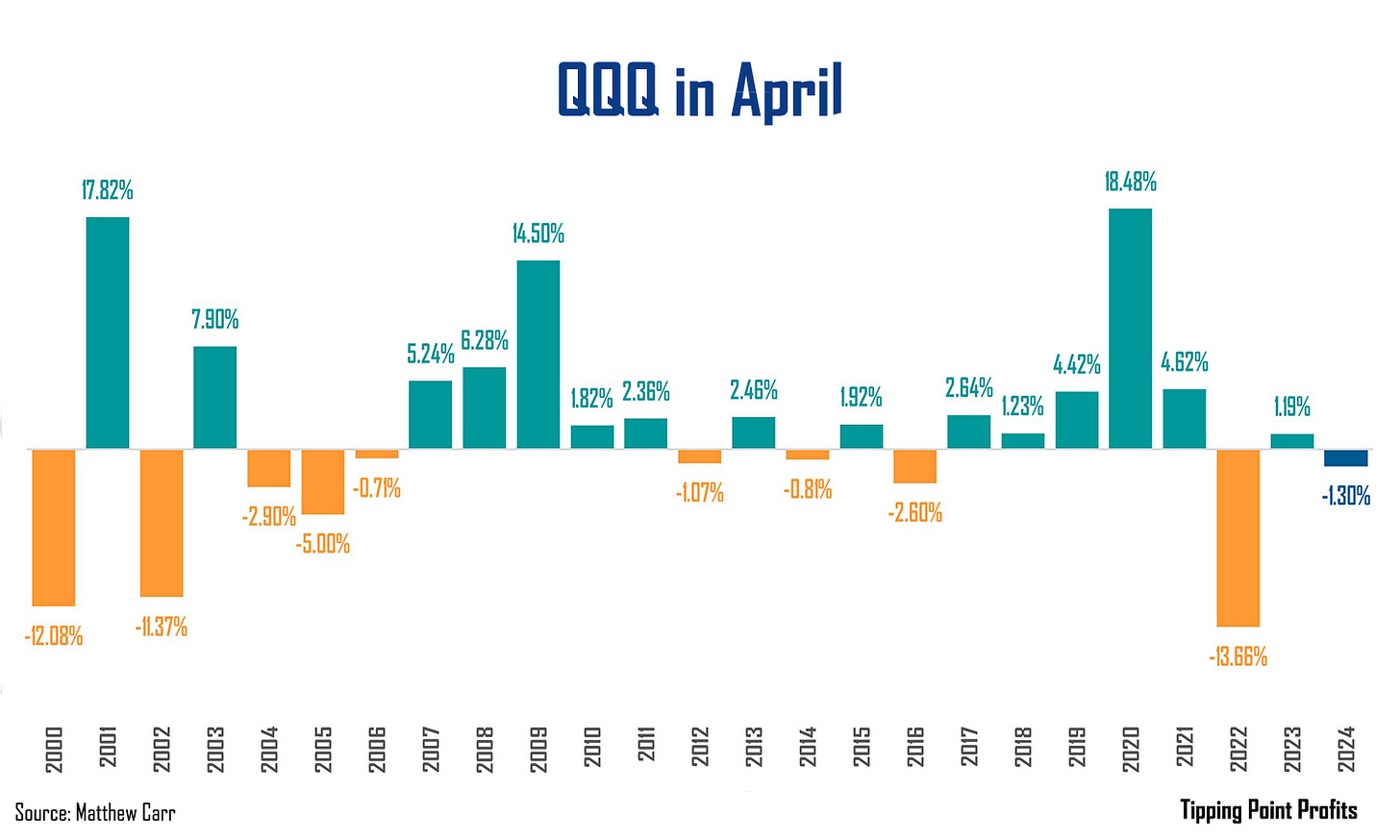

In fact, looking back more than two decades, the Invesco QQQ ETF (QQQ) is averaging a 1.78% gain in the month. That earns it a spot as one of the best months for tech behind October, November, and the gains stronghold, July.

Now, the reason for this is major collapses are rare in April…

The Nasdaq 100 has only experienced three bone-rattling drops in the month since the start of the millennium: 2000, 2002, and 2022.

And of course, it’s worth noting, all of those were bear market years.

The rest of the time, the “Cubes” are exiting the month with a gain 62.5% of the time.

So, year after year after year, April is not only a sunny spot for the weather but also the markets.

Though, there is a rain cloud... one we’re currently experiencing.

A Dark Cloud Threatening this Parade?

As I always stress, successful investing is built on probabilities.

If we know the most likely outcome - if we know the trend is with us or against us - we can position ourselves appropriately. And the better chance we have of reaping the rewards of a winning trade.

Or it’s just a good way to keep ourselves sane in an ever-increasingly mad world.

Well, we just learned that for the Qs, few months offer a higher probability of success than April.

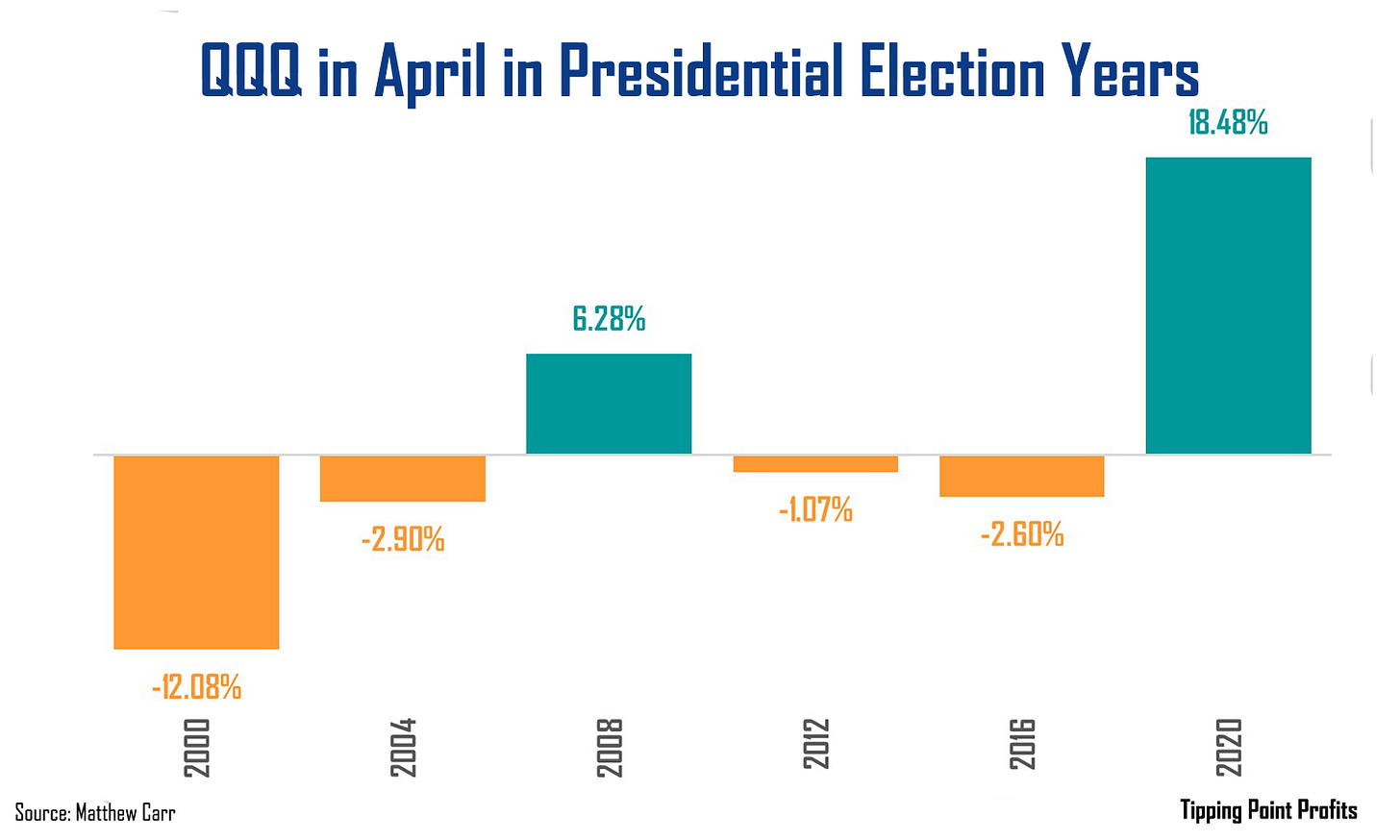

Unfortunately, the potential rain shower on this parade of gains is the U.S. Presidential Election. It’s an interesting trend, but when we look at how the Nasdaq 100 has performed in election years, we uncover a slightly different story…

Tech stocks are still averaging a gain in April during U.S. presidential election years. Though that’s largely due to 2020’s herculean return. Remember, at that time, we were in the midst of the fastest bull market recovery on record.

But overall, the QQQ has fallen in April four of the last six U.S. presidential election years… or 66.7% of the time. And election years represent almost half of the losses big tech has suffered in April since 2000.

In my opinion, 2020 was more of an exception than the “Awesome April” rule.

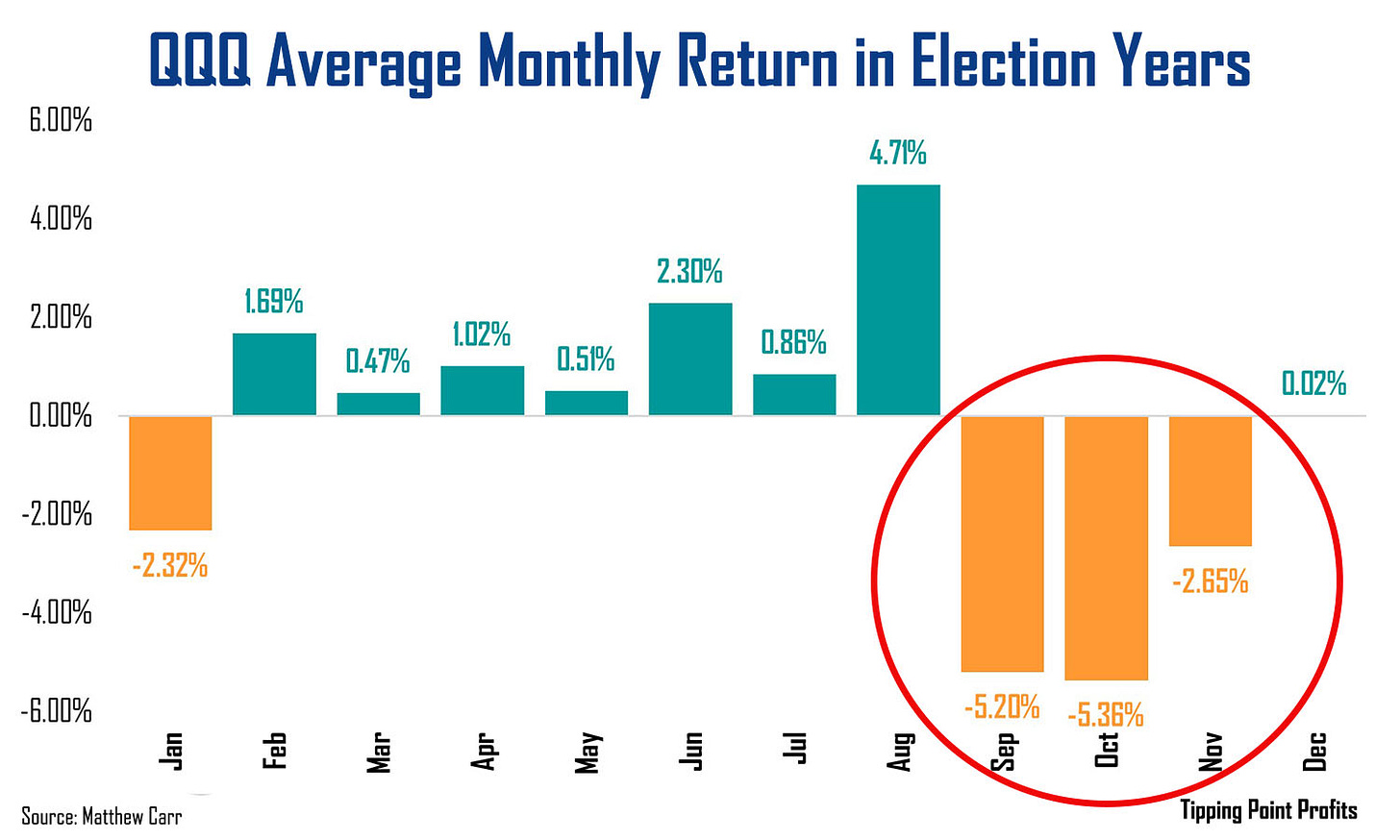

Also, keep in mind, the real pain in election years for tech stocks unfolds from September into November…

The biggest mistake most investors make is not understanding that stocks - just like seasons – tend to follow predictable trends.

And most years, Awesome April is very much your friend. Heck, it’s one of the friendliest months around. It’s a time of new beginnings. And it tends to be one of strongest months of the year for stocks.

But it’s wise to tread carefully in the month during U.S. presidential election years. This is when Awesome April can really rain on the market’s parade… as we’ve already seen.

Keeping my umbrella handy,

Matthew

thanks for sharing. that seems to be in alignment with my latest cycle analysis on nvidia and the sp500. expecting a top between now and nov