Are There Enough Heroes to Save This Company?

“Where have all the good men gone

And where all the gods?”

- Bonnie Tyler, “Holding Out for a Hero”

On May 2, 2008, the Marvel Cinematic Universe (MCU) began.

Robert Downey, Jr. was introduced as Iron Man.

In 2009, The Walt Disney (DIS) snapped up Marvel Studios for $4 billion.

And I would hail this as one of the greatest acquisitions ever. Though I remember when I told this to a small crowd a decade ago that there were some doubters.

“Aren’t superheroes going to get old?”

Well, we both were right.

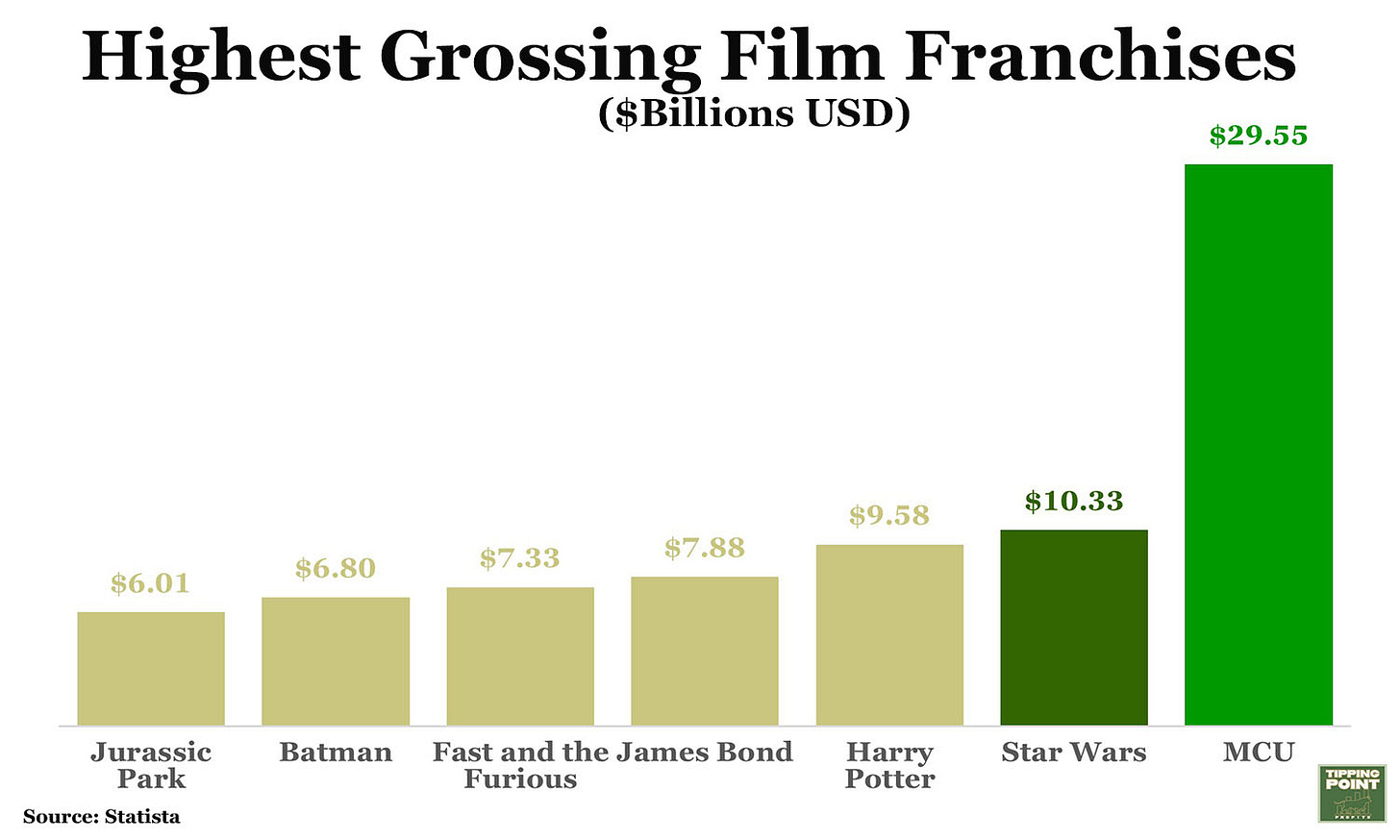

In the years since, Marvel Studios has gone on to release 32 MCU movies which have grossed $29.6 billion at the box office. No other movie franchise comes close…

And of the top 10 highest-grossing films of all-time, four are from the MCU, including Avengers: Endgame, which raked in $2.8 billion.

This success catapulted unknown actors into global mega-stars. And made Stan Lee a household name.

While for Disney, it’s been a profitable endeavor. Marvel Studios has plunked down somewhere in the ballpark of only $6.5 billion to produce these 32 films.

And there’s another 11 in various stages of production.

So, if you’re already behind… you may never catch up.

It’s also worth noting that the second-highest grossing film franchise ever is Star Wars. In 2012, Disney gobbled up Lucasfilm for $4.05 billion.

In my opinion, the duo of acquisitions was $8 billion well spent.

Well, this evening, Disney is scheduled to release its third quarter results. In a world of high prices and elevated political tensions, there’s plenty of questions swirling around what to expect… But there may be one direction shares could take.

An Unwanted Streak Broken?

For The House the Mouse Built, its studios, ESPN, and streaming service, Disney+, bring in revenue. But the major source of income cheddar is the company’s iconic theme parks.

These are go-to destinations for summer vacations. And not just for Americans.

Even better, the margins for Disney theme parks and experiences are far fatter than media.

For example, in the company’s second quarter, reported back in May, revenue grew 13% to $21.82 billion as earnings per share (EPS) rocketed 165.4% to $0.69. Now, $14 billion of the revenue came from Disney studios and media. But 66% of operating income came from parks and entertainment, such as Disney Cruise Lines.

Well, for the third quarter, released in a couple of hours, Wall Street is looking for the media giant to report $22.5 billion in revenue with EPS of $0.95.

Now, the options market is expecting a move of 4.86% on Disney shares. But with direction is the question.

Traditionally, the move has been lower on third quarter results…

Looking back since 2009, Disney shares have only risen on this release five times… that’s a success rate of a mere 35.7%.

Though, three of those five moves higher have taken place since 2020.

And there’s a key piece of the puzzle to unlock in that trend...

The Something That Gave

I’ve dubbed this year, “The Summer of Revenge, Part II,” because consumers can’t wait to blow through what little pandemic savings they have left.

Starting in the summer of 2022 (“The Summer of Revenge, Part I”), we’ve seen pent up demand for trips, vacations, and any activity that gets Americans outside of their homes. Airlines, concert venues and cruise lines have all jacked up prices as inflation eats away at their margins.

But that hasn’t cooled the buying frenzy of “The Summer of Revenge, Part II.”

Entertainment and theme parks will squeeze every drop of blood from every penny.

So, the question tonight isn’t whether Disney will get a boost from this spending spree… it undoubtedly will. Theme park revenue is projected to top $8 billion.

The question is, will the gains be enough to offset the struggles plaguing its media segment.

And here’s where I think that longer-term reaction to third quarter results comes into play.

Disney launched Disney+ in November 2019. Global subscribers raced higher, quarter-after-quarter, until the end of 2022. Then they started to roll over.

Wall Street loves subscriber growth. It will often eschew everything else as long as subscriptions are moving higher.

Well, consumers want experiences but are battling inflation.

Something must give.

And that’s been streaming service subscriptions.

Last quarter, Disney lost 4 million Disney+ subscribers. Current estimates are they may have lost nearly 8 million in the third quarter.

That would mean its total Disney+ subscribers have fallen from 161.8 million at the end of 2022 to 149.8 million.

In a world where engagement and subscriber numbers are all that matter, that’s the mousetrap poised to snap down on investors this evening.

The best-case scenario would be if Disney somehow stopped the bleeding on Disney+ losses. That would allow the theme park and cruise line gains to push shares higher.

But if those subscriber numbers come in light – even by a handful – it’s back to our historical “Look out below!” And not even good men, like Captain America or Spider-Man, or even the God of Thunder, Thor, would be able to save shares from the drop.

Four movies behind in the MCU,

Matthew

I have some great news: I’m going to be speaking at the MoneyShow/TradersEXPO Orlando this October! And that leads to only one question...

Can we meet and talk markets there – IN PERSON?

I sure hope so...because my friends at the MoneyShow organization have assembled a dynamite lineup of world-class market strategists, economists, professional traders, money managers, and newsletter publishers.

You can see from the just-released preliminary agenda that you’re in for an unparalleled investor education experience at the event, which runs from October 29-31, 2023. In addition to my talk, you’ll have the chance to hear and learn from the likes of...

Charles Payne, Host, Fox's Making Money with Charles Payne

George Gilder, Editor, Gilder's Technology Report

Lindsey Piegza, Chief Economist, Stifel Financial Corp.

Barry Ritholtz, Founder and CIO, Ritholtz Wealth Management

Mark Skousen, Editor, Forecasts & Strategies

John Carter, Author, Mastering the Trade

Howard Tullman, General Managing Partner, G2T3V, LLC

And more than 75+ other experts! They’ll cover everything from stocks, bonds, real estate, energy, and precious metals to alternative investments and elite trading tools and strategies. Plus, the conference is being held at the Omni Orlando Resort at ChampionsGate – one of the nation's premier golf, meeting, and leisure retreats.

AND because you’re one of my valued readers, I CAN SAVE YOU 20% on the purchase of a Standard Pass to the event!

So first, here is my presentation schedule:

How to Prepare for the Death of the Bull in 2024

Or if you prefer, call the MoneyShow team at 1-800-970-4355 and reference my discount code SPKR20.

Then get ready. Because I can’t wait to share my insights, strategies, and forecasts with you – not to mention talk markets IN PERSON – in Orlando!

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.