Winter has officially pushed its way into our little world on the farm.

The mornings are bitter. The temperatures are at or below freezing.

The dogs have donned their sweaters (they’re bully mixes, the only thing they hate more than water is cold).

And the last of the acorns I have drying are under assault by squirrels desperate to get their hands on every morsel for their winter stores.

But it’s all part of the changing of the seasons.

In fact, here on the homestead, all is right with the world.

And as expected, November isn’t winding to a close with despair… but celebration.

The Invesco QQQ ETF (QQQ) – the proxy for the Nasdaq 100 – will exit the month with a double-digit gain after setting a new 52-week high. Not only that, the tech heavyweights will end November with a gain for the eleventh time in the last 12 years.

But now, we dive into arguably the most important month for the markets of the year – December.

And for investors, will it be another holiday gift? Or will it be a lump of coal in their stockings?

November Rises on Turkey Legs

Let’s be honest, there’s only one focus this time of year… the winter holidays.

Whether you celebrate Christmas, Hanukah, Kwanzaa, Three Kings Day, or any of the other festivities, we’re in one of the most pivotal stretches for families and corporate balance sheets.

And because of that, December can be a tricky month for the markets.

I tend to think of it as a moody, delicate month.

With holiday spending a vital catalyst – a make-or-break moment for many a retailer – there are typically headlines as we race toward the big days that holiday spending will fall short.

Though, we already know that it’s off to a record-breaking start.

Americans dropped a record $9.8 billion on Black Friday. That was an increase of 7.5% from 2022.

But the spending spree didn’t end there.

On Cyber Monday, consumers shoveled out a record $12.4 billion. And during the stretch from 10:00 AM to 11:00 AM EST rang the digital register at $15.7 million per minute.

When all was said and done, for Cyber Week, Americans spent $38 billion, up 7.8% from a year ago. And one of the most important takeaways was foot traffic in stores increased a mere 2%... Meanwhile, smartphones accounted for 51.8% of all sales.

That’s encouraging in an environment where inflation is the topic du jour.

And despite the handwringing and concerns of the ever-looming threat of recession, retail is flying high.

Shares of Abercrombie & Fitch (ANF), Amazon (AMZN), American Eagle Outfitters (AEO), Costco (COST), The Gap (GPS), Ross Stores (ROST), Shopify (SHOP) and Urban Outfitters (Nasdaq: URBN) are just a few of the names in the sector trading at or near 52-week highs.

But is this the peak before the next slide lower?

Well, this is where our tale offers two different paths.

A Tale of Two Indexes

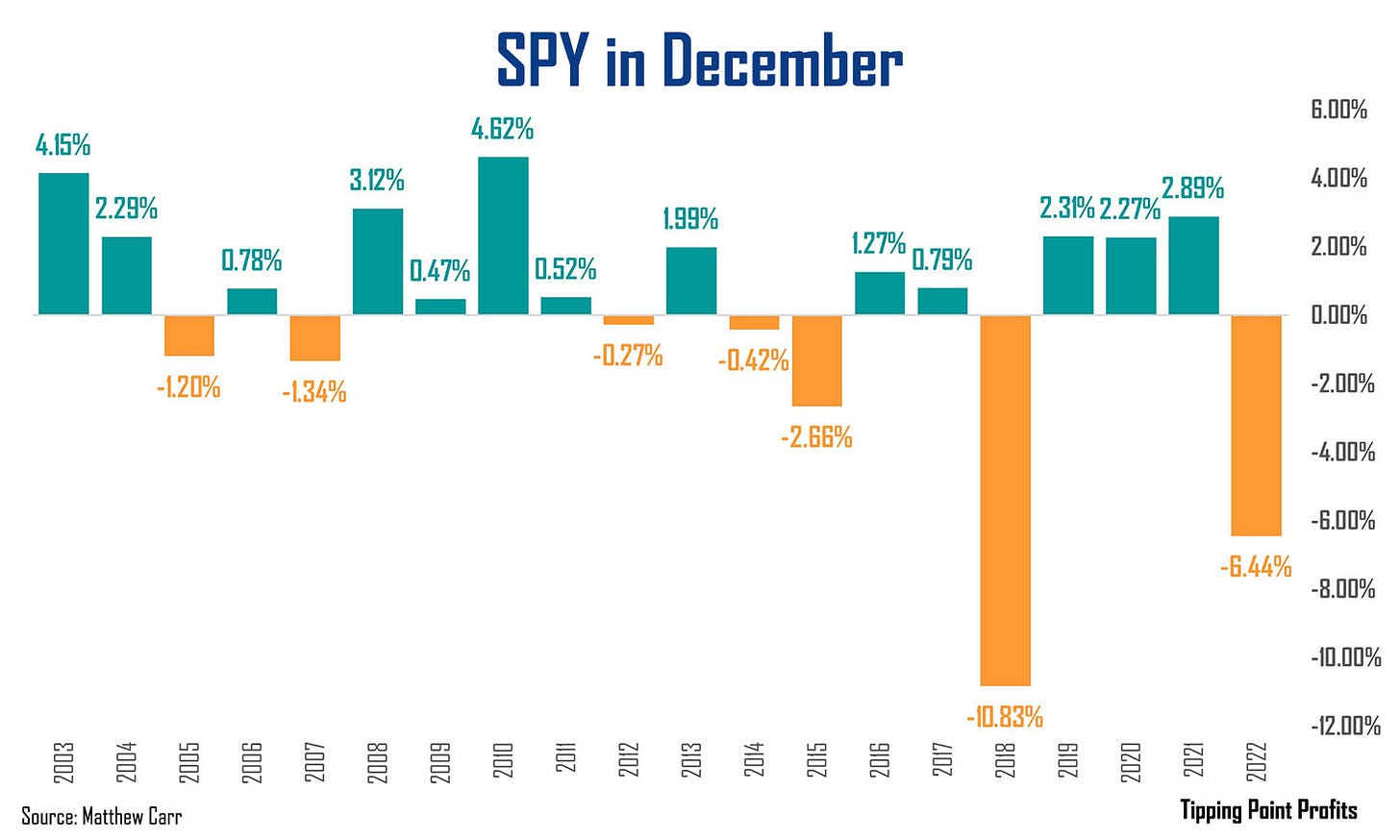

Since 2003, the SPDR S&P 500 ETF (SPY) has averaged a gain of 0.22% in December.

That may not seem like much. But that’s a better performance than January, February, June, August, or September. It ranks as the seventh-best month for blue chips.

Now, the most important aspect of this Christmas Carol is that unnerving swings lower by the S&P during December are rare. And the only real nightmares before Christmas over the last 20 years were the 6.44% drop in 2022 and the notoriously bad 10.83% decline in 2018, which included the worst Christmas Eve session on record.

All-in-all, this equates to a 65% chance of success for the S&P. For comparison, the average chance for a gain for the SPY in any given month during the past 20 years is 64.6%.

So, that’s slightly better than average.

And though inflation is still not yet to the level the Federal Reserve would like, we’re not in the same situation in 2022 or mired in a trade war with China as in 2018.

But here’s the deal… the picture for tech stocks in December isn’t quite as sugar-plum-filled.

The QQQ is averaging a loss of 0.24% in the month over the past two decades. That makes it the second-worst month of the year for the Nasdaq 100, as well as only one of three months where the ETF averages a negative return.

Of course, the bright side is, epic collapses are rare. Merely two in the past 20 years. But the QQQ has notched more losses than the SPY in the month…

The chance of success from tech in December is a less-than-stellar 55%. For comparison, over the past two decades, the average chance for gains for the QQQ in any given month is 59.4%.

I wouldn’t expect a full-fledged Grinch move from the Nasdaq 100 in the month ahead. But a cooling off could be in the cards as the focus shifts to retail.

It’s important to keep in mind that major collapses, like the losses we saw in 2018 and 2020 are far from normal. And more often than not, December has been a profitable gift for investors to close out the year whether you’re in blue chips or tech.

So, don’t expect coal in your stocking this year.

But remember, after the holidays are over, we have what’s traditionally been one of the worst months of the year for equities… though that’s a story for another time.

Stuffed on gains and Thanksgiving treats,

Matthew

Before you go rushing off to do all those things that make you great, do me a favor … Don’t worry, I’m not asking for money. But if you like what you read here, give me a like, comment or share this article with a friend. If you didn’t enjoy what you’ve read, tell me why. I’m not promising you won’t hurt my feelings, but I’m open to suggestions for improving content!

© 2023 Matthew Carr

All rights reserved.

Any reproduction, copying, distribution, in whole or in part, is prohibited without permission.

This market commentary is opinion and for entertainment purposes only. The views and insights shared by the author are based on his many years of experience covering the markets. But they are subject to change without notice and opinions may become outdated. And there is no obligation by the author to update any information if these opinions become outdated. The information provided is obtained from sources believed to be reliable. But the author cannot guarantee its accuracy. Nothing in this email should be considered personalized investment advice. Investments should be made after consulting your financial advisor and after reviewing the financial statements of the company or companies in question.

Happy Thanksgiving a little late. Keep up your good work!

I appreciate your insights on seasonal investing.